Crypto Market Recap: ARK Invest Calls for Bitcoin Price of US$2.4 Million by 2030

Elsewhere in the crypto space, Michael Saylor predicted that BlackRock's Bitcoin ETF will be the world's largest ETF within 10 years.

Here's a quick recap of the crypto landscape for Friday (April 25) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

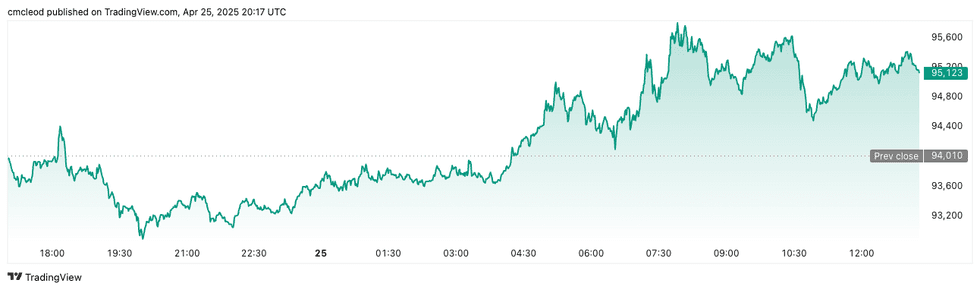

Bitcoin (BTC) was priced at US$95,030.17 as markets closed for the day, up 1.8 percent in 24 hours. The day's range has seen a low of US$94,367.25 and a high of US$95,563.75.

Bitcoin performance, April 25, 2025.

Chart via TradingView.

As the crypto market stages its comeback after weeks below its key resistance level, ARK Invest increased its most optimistic Bitcoin price forecast for 2030 from US$1.5 million to US$2.4 million. The firm attributes this upward revision to growing interest from institutional investors and Bitcoin's expanding role as "digital gold." Cointelegraph’s market analysis cites five technical indicators pointing to valuations above US$100,000 by May.

Ethereum (ETH) ended the day at US$1,796.65, a two percent increase over the past 24 hours. The cryptocurrency reached an intraday low of US$1,772.18 and a high of US$1,819.79.

Altcoin price update

- Solana (SOL) ended the day valued at US$151.24, down 0.1 percent over 24 hours. SOL experienced a low of US$150.90 and peaked at $155.18.

- XRP traded at US$2.19, reflecting a 0.6 percent decrease over 24 hours. The cryptocurrency recorded an intraday low of US$2.19 and reached its highest point at US$2.22.

- Sui (SUI), this week's outperformer, was priced at US$3.60, showing an increase of 8.8 percent over the past 24 hours. It achieved a daily low of US$3.56 and a high of US$3.73. Sui is up by over 67 percent for the week.

- Cardano (ADA) was trading at US$0.7127, down 1.7 percent over the past 24 hours. Its lowest price on Friday was US$0.7099, with a high of US$0.7268.

Today's crypto news to know

ARK Invest sees Bitcoin hitting US$2.4 million by 2030

Cathie Wood’s ARK Invest has revised its already optimistic Bitcoin forecast, projecting on Thursday (April 24) that the asset could reach as high as US$2.4 million by 2030 in its most bullish scenario.

The firm's report outlines three trajectories: a bear case of US$300,000, a base case of US$710,000, and a sky-high scenario that factors in growing institutional allocations and rapid expansion of on-chain financial services.

The US$2.4 million target assumes Bitcoin captures 6.5 percent of the US$200 trillion global investable asset pool, with sustained 60 percent annual growth in BTC-driven financial infrastructure.

National reserves, corporate treasuries, and rising adoption in emerging markets also play critical roles in the model, but ARK identifies institutional capital as the most transformative force.

While skeptics still cite volatility and regulatory uncertainty, ARK argues that BTC’s asymmetric upside — especially amid global monetary shifts — makes it a once-in-a-generation investment thesis.

Saylor predicts BlackRock ETF will eclipse all ETFs within a decade

MicroStrategy Chairman Michael Saylor declared that BlackRock’s iShares Bitcoin Trust (IBIT) will become the largest ETF in the world within 10 years, following a record-breaking week where US Bitcoin ETFs drew US$2.8 billion in net inflows.

IBIT led the pack with US$1.3 billion, lifting its total assets to roughly US$54 billion and driving daily trading volumes above US$1.5 billion. For context, the current largest ETF, Vanguard’s VOO, commands a market cap over US$593 billion — nearly ten times IBIT’s current size.

Bloomberg ETF analyst Eric Balchunas acknowledged Saylor’s claim wasn’t farfetched, but said IBIT would need to consistently attract US$3 billion US$4 billion per day to overtake VOO within a decade.

The bold prediction reflects mounting institutional appetite for BTC exposure, but also underlines the extraordinary capital movement that would be required for such a paradigm shift in ETF rankings.

$TRUMP meme coin rallies after president offers private dinner

Donald Trump’s $TRUMP meme coin surged over 70 percent after the president promised an exclusive gala dinner for the token’s top 220 holders, including a VIP reception at his Washington DC golf club for the top 25.

Launched just before Trump’s January inauguration, the coin has exploded in both market cap — now estimated around US$2.5 billion — and political intrigue, reflecting the former president’s aggressive expansion into crypto.

This latest move aims to blend campaign optics with digital asset hype, positioning Trump not just as a “crypto president,” but as an active participant in speculative retail culture.

Critics have slammed the dinner-for-holders gimmick as a political stunt and potential conflict of interest, while others say it signals a new model of decentralized donor engagement.

Regardless, the announcement caused a major pump and reignited interest across meme coin forums and pro-Trump financial channels.

Swiss central bank rejects Bitcoin in reserves

Swiss National Bank Chairman Martin Schlegel flatly rejected proposals to include Bitcoin in the country’s currency reserves, stating it "cannot currently fulfil the requirements" needed for official holdings.

At the SNB’s annual meeting in Bern, Schlegel cited Bitcoin’s extreme volatility and insufficient liquidity as major concerns, making it unsuitable for maintaining the stability and convertibility of the national reserve portfolio.

This comes as activists behind the "Bitcoin Initiative" mount a constitutional referendum campaign that would legally compel the SNB to hold BTC alongside gold. Luzius Meisser, one of the movement’s leaders, argued Bitcoin could prove invaluable in a future marked by declining trust in government debt.

The SNB’s resistance, however, signals continued institutional reluctance to enshrine Bitcoin as a strategic monetary asset, even in one of the world’s most financially progressive nations.

CME Group to launch XRP futures

The Chicago Mercantile Group (CME) announced plans to launch XRP futures contracts, according to an announcement by the derivatives marketplace on Thursday.

“As innovation in the digital asset landscape continues to evolve, market participants continue to look to regulated derivatives products to manage risks across a wider range of tokens,” said Giovanni Vicioso, Global Head of Cryptocurrency Products at CME Group. “Interest in XRP and its underlying ledger (XRPL) has steadily increased as institutional and retail adoption for the network grows, and we are pleased to launch these new futures contracts to provide a capital-efficient toolset to support clients' investment and hedging strategies.”

Pending regulatory approval, participants will be able to trade micro-sized contracts comprising 2,500 XRP and/or large contracts of 50,000 XRP starting on May 19.

Nasdaq calls for consistent digital asset regulation

In a Friday letter, the Nasdaq calls on the US Securities and Exchange Commission (SEC) to apply the same regulatory standards to digital assets as it does to securities, particularly if these assets function as "stocks by any other name."

The Nasdaq asserts that the SEC needs to develop a more distinct classification system for cryptocurrencies, suggesting that some digital assets should be categorized as "financial securities." The exchange contends that these tokens should continue to be regulated in the same manner as traditional securities, irrespective of their tokenized format.

“Whether it takes the form of a paper share, a digital share, or a token, an instrument’s underlying nature remains the same and it should be traded and regulated in the same ways,” the letter states.

The letter also proposes categorizing some cryptocurrencies as “digital asset investment contracts,” which would still be overseen by the SEC, but subject to “light touch regulation."

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.