Crypto Market Update: Trump Pushes Emergency Power Auction to Shift AI Energy Costs to Big Tech

Trump is pushing to run an emergency power auction to fund up to US$15 billion in new electricity generation to meet rising AI-driven demand.

Here's a quick recap of the crypto landscape for Friday (January 16) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

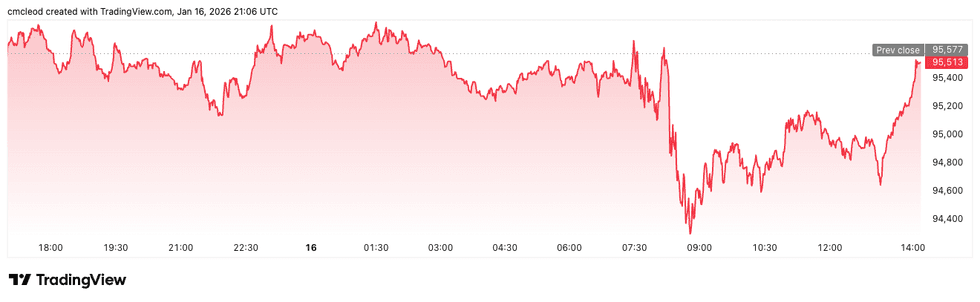

Bitcoin (BTC) was priced at US$95,485.17, up by 0.2 percent over 24 hours.

Bitcoin price performance, January 16, 2026.

Chart via TradingView.

Ether (ETH) was priced at US$3,294.52, trading flat over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$2.08, up by 0.6 percent over 24 hours.

- Solana (SOL) was trading at US$144.78, up by 2.3 percent over 24 hours.

Today's crypto news to know

Trump pushes emergency power auction

According to the Financial Times, US President Donald Trump and several state governors are pressing the operator of the largest US power grid to hold an emergency auction that would force major data center operators to finance new electricity generation needed for artificial intelligence (AI) growth.

The proposal would require tech companies to bid for long-term power contracts, potentially underwriting roughly US$15 billion in new power plants whether or not the electricity is ultimately used.

The push targets PJM Interconnection, which supplies power across the US northeast and midwest and sits at the center of the country’s fastest-growing data center corridor.

The Trump administration is framing the move as a response to rising household electricity bills, which have climbed 13 percent since early 2025 amid surging demand from AI infrastructure.

Riot signs US$311 million AI data center lease with AMD

Riot Platforms (NASDAQ:RIOT) announced the fee simple acquisition of 200 acres at its Rockdale site in Texas for US$96 million. It funded the purchase by selling 1,080 BTC, securing long-term ownership of a 700 megawatt power site.

Under the terms of the deal, Riot has achieved full ownership of the Rockdale site, eliminating the prior ground lease. The site features a 700 megawatt grid interconnection, dedicated water supply and fiber connectivity. It expands the company's portfolio to 1.7 gigawatts of power capacity across its Texas facilities.

The company also signed a 10 year data center lease with Advanced Micro Devices (AMD) (NASDAQ:AMD) for an initial 25 megawatts of critical IT load, expandable to 200 megawatts.

It projects US$311 million in revenue initially, and up to US$1 billion with extensions.

The AMD lease requires retrofit CAPEX of US$89.8 million and is expected to generate US$25 million in annual net operating income, with phased delivery starting in January 2026 and completing in May 2026.

Riot CEO Jason Les described the AMD deal as validation of the company's infrastructure for AI and high-performance computing tenants, marking a pivot from Bitcoin mining to data centers within 12 months.

Ethereum founder says blockchain nearing 2014 vision

Ethereum founder Vitalik Buterin said the network is finally delivering on the original 2014 vision as a series of technical upgrades push the blockchain closer to scalable, decentralized application infrastructure.

"Ethereum is now scaling, it is now cheap, and it is on track to get more scalable and cheaper thanks to the power of ZK-EVMs," Buterin posted on X on Tuesday (January 13).

His comments came as Ether climbed above US$3,300, reflecting renewed market confidence in the network’s long-term roadmap. Buterin also pointed to Ethereum’s shift to proof-of-stake, lower transaction fees and advances in zero-knowledge scaling and sharding as foundational progress.

He acknowledged that competing narratives over the past several years have distracted from the core mission, but argued that the underlying technology has continued to strengthen. Improvements in decentralized messaging and privacy-focused tools were also cited as signs of ecosystem maturity.

Belgium’s KBC becomes first bank to offer Bitcoin, Ether trading under MiCA

Belgium’s KBC Bank is set to let retail customers buy and sell Bitcoin and Ether directly through its Bolero investment platform starting in mid-February, marking a first for the country’s traditional banking sector.

The launch follows the full implementation of the EU’s Markets in Crypto-Assets Regulation (MiCA), which gives banks a clear legal pathway to offer crypto services.

Until now, Belgian investors largely relied on foreign exchanges or fintech apps to access digital assets.

The bank has completed the required crypto asset service provider notification under MiCA, with oversight shared between Belgium’s market and central banking authorities. Under the framework, Bitcoin and Ether fall into a general category of crypto assets rather than stablecoins.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.