Crypto Market Recap: Bitcoin Stages Comeback as Tariff Negotiations Continue

The Trump administration has announced a reduction in reciprocal tariffs and a 90 day pause for most countries, leading to a recovery in the crypto market.

Here's a quick recap of the crypto landscape for Wednesday (April 9) as of 9:00 p.m. UTC.

Bitcoin and Ethereum price update

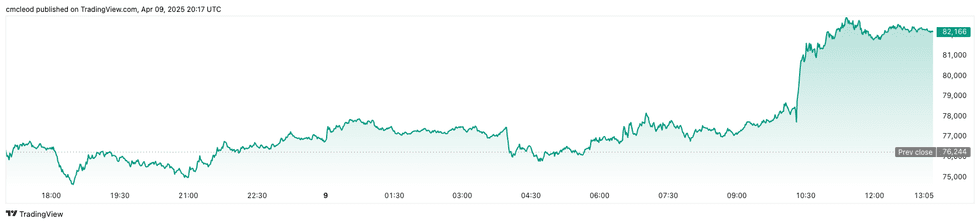

At the time of this writing, Bitcoin (BTC) was priced at US$82,060.13 and up 7.2 percent in 24 hours. The day's range has seen a low of US$76,842.48 and a high of US$82,665.31.

Bitcoin performance, April 9, 2025.

Chart via TradingView.

Bitcoin is back to trading near levels seen earlier in the week following an announcement from the White House that tariffs against most countries will be paused for 90 days, after which reciprocal tariffs will be lowered to 10 percent. China is an exception — tariffs against the country have been boosted immediately to 125 percent.

Ethereum (ETH) is priced at US$1,633.44, an 11.9 percent increase over the past 24 hours. The cryptocurrency reached an intraday low of US$1,459.15 and a high of US$1,661.40.

Altcoin price update

- Solana (SOL) is currently valued at US$118.54, up 14.3 percent over the past 24 hours. SOL experienced a low of US$104.09 and a high of US$119.68 on Wednesday.

- XRP is trading at US$2.03, reflecting an 11.8 percent increase over the past 24 hours. The cryptocurrency recorded an intraday low of US$1.79 and a high of US$2.06.

- Sui (SUI) is priced at US$2.24, showing an increase of 13.9 percent over the past 24 hours. It achieved a daily low of US$1.09 and a high of US$2.26.

- Cardano (ADA) is trading at US$0.6308, reflecting a 12.8 percent increase over the past 24 hours. Its lowest price on Wednesday was US$0.5597, with a high of US$0.64.

Crypto news to know

Trump’s tariff shock wipes US$2 billion from US Bitcoin stash

The US government’s Bitcoin holdings have dropped by nearly US$2 billion in value since April 2 — dubbed “Liberation Day” by President Donald Trump — following a steep market selloff triggered by tariff announcements.

According to Arkham Intelligence, the 198,012 BTC held by federal agencies declined in value from US$17.24 billion to US$15.21 billion in just under a week as Bitcoin slid from over US$87,000 to below US$77,000.

An executive order made by Trump in March established a strategic Bitcoin reserve sourced from seized assets, further tying federal coffers to price swings in the cryptocurrency. The losses come as the administration ramps up global economic pressure, testing the volatility of its newly created digital reserve.

Digital asset regulations under scrutiny at congressional hearing

The Subcommittee on Digital Assets, Financial Technology and Artificial Intelligence (AI) held a hearing on Wednesday to examine why current regulations may not apply to digital asset activities, and to explore which of these activities trigger US securities laws. Members of the subcommittee also discussed how Congress can address challenges through legislative action that reduces legal uncertainty while encouraging innovation.

At the hearing, Rodrigo Seira, special counsel to law firm Cooley, told the subcommittee that current securities laws are not flexible enough to account for digital assets, citing a long list of crypto projects that have tried and failed to register their products with the US Securities and Exchange Commission (SEC).

“It is clear that the current securities regulatory framework is not a viable option to regulate crypto. It fails to achieve its stated policy goals,” Seira said in his opening remarks.

“(T)he idea that crypto projects can come in and register with the SEC is demonstrably false.”

Seira admitted that it is critical to apply federal regulations to crypto promoters; however, “virtually no crypto projects have successfully registered their tokens under federal securities laws and lived to tell the tale.”

Representative Bryan Steil, head of the subcommittee, praised the progress that lawmakers have made, mentioning last week’s passing of the STABLE Act in the House of Representatives, before directing the subcommittee to the next stage of the process, namely comprehensive digital asset market structure legislation.

Pakistan taps Bitcoin mining and AI to solve power woes

Pakistan is turning to Bitcoin mining and AI data centers as a solution for its surplus electricity problem, aiming to repurpose excess power into revenue-generating infrastructure.

Bilal Bin Saqib, head of the country’s Crypto Council, told Reuters that mining sites will be selected based on regional energy overcapacity, with former Binance CEO Changpeng Zhao advising on the initiative.

Despite regulatory ambiguity, Pakistan ranks among the top 10 countries in global crypto adoption and boasts over 15 million users. The move also emphasizes youth blockchain upskilling and fostering innovation in fintech through regulatory sandboxes to boost exports and economic resilience.

Kraken, Mastercard bring crypto spending to 150 million merchants

Crypto exchange Kraken is teaming up with Mastercard (NYSE:MA) to roll out crypto debit cards across the UK and Europe, enabling users to spend digital assets at more than 150 million merchants.

The partnership builds on Kraken Pay, which allows seamless crypto-to-fiat transactions in over 300 currencies.

The new physical and digital cards — set to launch in the coming weeks — are aimed at expanding crypto’s real-world utility and normalizing digital asset payments.

Kraken CEO David Ripley views this as a critical step toward integrating crypto into everyday commerce, while Mastercard has underscored its commitment to innovating in digital finance and supporting blockchain initiatives.

Binance to delist 14 tokens

Binance announced on Tuesday (April 8) its decision to delist 14 tokens — BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT and VIDT — from its platform on April 16.

The decision follows a comprehensive evaluation that included a review of project commitment and trading volume. The outcome also incorporated the results of Binance’s newly introduced "Vote to Delist" mechanism, which allows users to vote on potentially underperforming tokens based on their BNB holdings.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.