Crypto Market Update: Bitcoin Climbs Back to US$113,000 Ahead of US Jobs Report

Elsewhere in the crypto space, crypto exchange Gemini deepened its push into Europe with the launch of new staking and derivatives products.

Here's a quick recap of the crypto landscape for Friday (September 5) as of 9:00 a.m. UTC.

Get the latest insights on Bitcoin, Ethereum and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ethereum price update

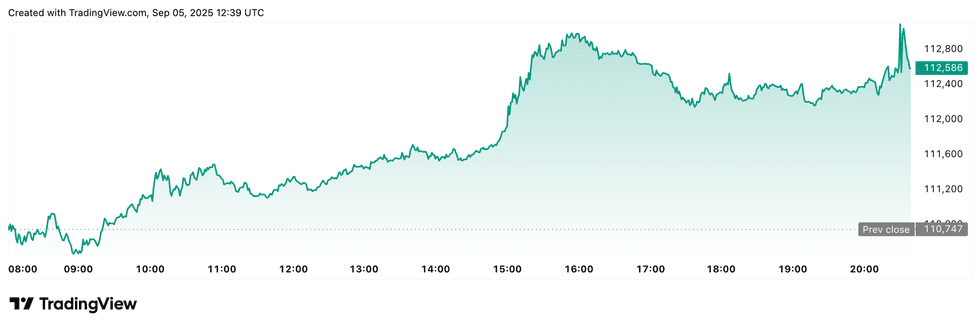

Bitcoin (BTC) was priced at US$112,668, a 1.8 percent increase in 24 hours. Its lowest valuation of the day was US$109,399, and its highest was US$112,965.

Bitcoin price performance, September 5, 2025.

Chart via TradingView.

Ether (ETH) was priced at US$4,432.69, up by 1.2 percent over the past 24 hours. Its lowest valuation on Friday was US$4,269.81 and its highest was US$4,447.28.

Altcoin price update

- Solana (SOL) was priced at US$207.32, trading flat over the last 24 hours. Its lowest valuation on Friday was US$201.33, and its highest level was US$208.25.

- XRP was trading for US$2.86, up by 0.9 percent in the past 24 hours. Its lowest valuation of the day was US$2.78, and its highest price was US$2.87.

- SUI (Sui) was trading for US$3.41, up by 3.2 percent in the past 24 hours, its highest valuation of the day. Its lowest for Friday was US$3.24.

- Cardano (ADA) was priced at US$0.8412, up by 3.3 percent. Its lowest valuation for Friday was US$0.8043, and its highest point was US$0.8426.

Today's crypto news to know

Bitcoin reclaims US$113,000 level ahead of US jobs report

Bitcoin surged to US$113,000 on Friday, its strongest level since late August, ahead of the US jobs report.

The rally pushed Bitcoin dominance to nearly 59 percent, the highest in two weeks, suggesting capital is flowing back into the cryptocurrency after weeks of rotation into Ether. Analysts are pointing to the “max pain” effect as a possible driver, with US$3.28 billion in Bitcoin options expiring around a strike price of US$112,000.

The theory suggests that options sellers, often institutions, steer prices toward the level where most options buyers lose money. On this occasion, Bitcoin’s price movement matches the theory almost exactly, a rare alignment.

Still, traders remain split on whether max pain has predictive power in digital assets. All eyes are now turning to the US jobs report, which could set the tone for Bitcoin's next major move.

Fireblocks launches payments network for stablecoin transactions

Digital asset infrastructure firm Fireblocks has rolled out a new network designed specifically for stablecoin transfers among banks, payment providers and crypto institutions. The Fireblocks Network for Payments supports cross-border treasury flows, corporate payouts, remittances and merchant settlements through a single API.

More than 40 partners, including Circle Internet Group (NYSE:CRCL), Paxos and Swiss bank Sygnum, are already live on the platform. What sets the service apart is its built-in compliance layer, which handles anti-money laundering, sanctions and travel-rule requirements across all transactions.

Fireblocks also has integrated its own verification tools alongside partnerships with firms like Notabene, Elliptic and Chainalysis to ensure adherence to regulatory standards.

Gemini expands EU presence with staking and perpetual futures

Crypto exchange Gemini has broadened its European services with new staking and derivatives products under the region’s MiCA regulatory framework. Customers can now stake Ether and Solana directly through Gemini, with Ether rewards varying and Solana yields offered at up to 6 percent.

In addition, the exchange has launched Gemini Perpetuals, a futures product denominated in USDC that offers up to 100x leverage without expiration. The new services also operate under the firm’s MiFID II license as the exchange seeks further compliance with clearer rules for crypto assets.

Gemini recently moved its European base of operations to Malta to align with MiCA requirements. The company said the expansion reflects Europe’s importance as a growth market for regulated digital asset products.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.