Cannabis Trends 2020: Critical Growth Amid a Devastating Pandemic

In a year marked by uncertainty, the overall cannabis market continued at a hesitant pace while the US offered a new vision for the sector.

Click here to read the latest cannabis trends article.

In a year packed with turmoil, the cannabis investment proposition took some immediate hits in 2020, while setting the groundwork for critical forward movement.

Experts view 2020 as a period of growth and reassessment for cannabis operators. Indeed, the industry was already on a path of evaluation following years of hype and unrealistic expectations, even before the effects of the novel coronavirus took hold.

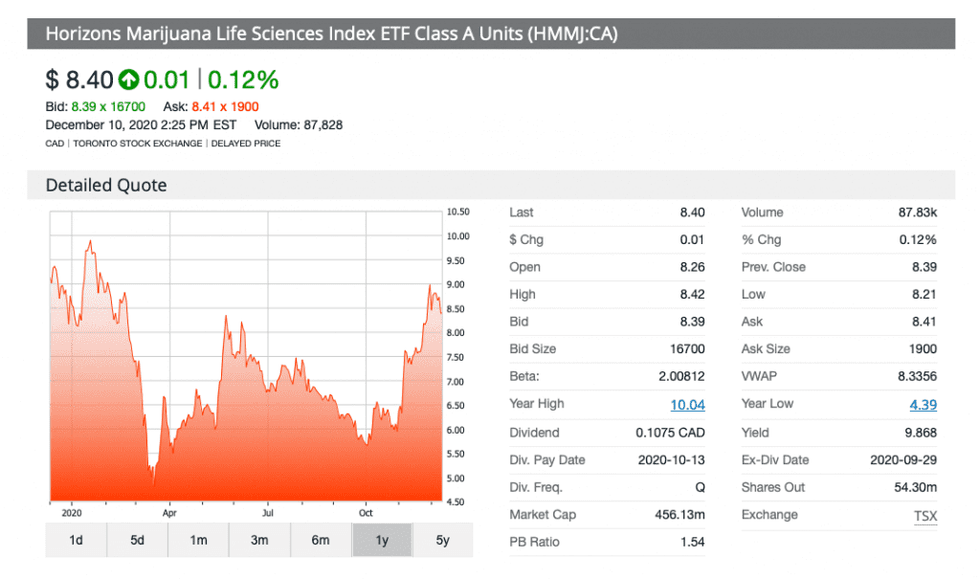

Blanket indicators for the entire cannabis segment, such as the Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ), show an industry with peaks and runs for the year.

2020 performance of the Horizons Marijuana Life Sciences Index ETF.

Here the Investing News Network (INN) outlines the key trends seen throughout 2020 by experts, insiders and industry members of the cannabis investment market.

Cannabis trends: Pandemic brings changes for sector

The effects of COVID-19 have been seen throughout the world in diverse sectors, and cannabis was no exception. Ashley Chiu, cannabis strategy advisor with EY Canada, told INN that cannabis companies were forced to reevaluate their strategies during the pandemic given the lack of capital available.

“There has been increased pressure on where companies should focus their efforts and the pace at which they should be making investments in areas like research and development, market entry, partnerships and distribution channels,” Chiu said.

Despite the uncertainty brought forth by the pandemic, one investment executive told INN he views the spotty access to capital for cannabis operations as a significant detriment to the industry.

“The lack of sufficient capital to fuel the growth plans for the industry continues to be the biggest challenge,” said Anthony Coniglio, CEO of NewLake Capital, an investment operation targeting real estate assets for a portfolio based on industrial and retail properties in the cannabis industry. “Not having sufficient access to capital holds back the industry for achieving its full potential.”

While part of the pandemic’s immediate impact was a downturn in the already sluggish cannabis stock market, several of the people INN spoke with for this story expressed delight that cannabis businesses were given essential status, a critical victory during the pandemic.

Charles Taerk, president and CEO of Faircourt Asset Management, told INN that one of his biggest surprises of the year was the recognition of the cannabis industry as essential during the pandemic.

This meant many cannabis stores in Canada and the US were allowed to continue operating in some form during the severe periods of lockdown seen in the new COVID-19 reality.

“In the course of a year, cannabis went from being something seen as largely prohibited to largely essential,” said Kris Krane, president at 4Front Ventures (CSE:FFNT,OTCQX:FFNTF).

Being granted essential status didn’t just allow cannabis companies to continue operating and see revenues — Taerk, who co-manages the Ninepoint Alternative Health Fund, said the recognition also pushed the entire sector forward.

Chiu echoed Taerk’s comments, saying an unexpected effect of the pandemic was a snapshot of an evolved domestic market thanks to increased accessibility.

“Sales have boomed throughout the COVID-19 pandemic, and have helped buoy the industry during a period in which so many businesses are suffering,” said Mark Noble, executive vice president of ETF strategy at Horizons ETFs (Canada), which provides the Horizons Marijuana Life Sciences Index ETF and the Horizons US Marijuana Index ETF (NEO:HMUS).

From the perspective of operating companies, Jesse McConnell, co-founder and CEO of Rubicon Organics (TSXV:ROMJ,OTCQX:ROMJF), said that ensuring employee safety proved to be an unexpected challenge, but one he feels his firm rose to answer adequately.

“It caused all companies to reassess how they do business, from cultivation to production to retail, in order to keep their employees and customers safe, and to comply with new COVID-related regulatory restrictions,” Krane explained to INN.

Fellow US cannabis operator executive Chris Driessen, president and CEO of SLANG Worldwide (CSE:SLNG,OTCQB:SLGWF), added that the shutdowns caused by the pandemic forced entities to “be responsive and flexible to keep their supply chains moving.”

Domestic cannabis businesses weren’t the only ones affected by the pandemic, according to one cannabis executive. David Gordon, chief corporate officer at PharmaCielo (TSXV:PCLO,OTCQX:PCLOF), said international exports were disrupted with either the slowdown of shipments or the inability to have buyers and inspectors examine potential partner sites.

Speaking on the larger international challenge, Jordan Lewis, CEO of private Uruguay-based cannabis producer Fotmer Life Sciences, which has sent shipments to Europe and holds a leading position in terms of product exported from Uruguay, said standardizing cannabis trade is complicated.

“There are many challenges in aligning regulatory frameworks, certification standards as well as permitting requirements,” Lewis said.

Cannabis trends: Divide grows between Canada and the US

A continued trend in the cannabis investment marketplace in 2020 was that of American firms surpassing Canadian names based on better performance and results. While the Canadian market has seen struggles that have affected the performance of producers and operators, the US space continues to flourish, with only expansion in its future.

Noble said that as it stands, Canadian companies still have larger market caps thanks to their listings on senior US stock exchanges, which allow them to access a deeper pool of capital. However, they are losing ground in terms of “highlighting the cannabis opportunity.”

This difference in standing frustrates Dan Ahrens, managing director and chief operating officer at AdvisorShares, who told INN the biggest challenge in 2020 was the continued misunderstanding of the difference in opportunity between American and Canadian cannabis stocks.

As the manager of the AdvisorShares Pure US Cannabis ETF (ARCA:MSOS) and the AdvisorShares Pure Cannabis ETF (ARCA:YOLO), Ahrens has been a big proponent of the US market as the superior investment area for cannabis.

Nawan Butt, portfolio manager at Purpose Investments and co-manager of the Purpose Marijuana Opportunities Fund (NEO:MJJ), told INN that coming into the year he expected bankruptcies and consolidation of the industry to dictate the conversation for Canadian cannabis.

According to Butt, this year allowed the big-name Canadian licensed producers (LPs) to find the capital needed to survive — although as other experts have pointed out, that capital is shrinking.

“Larger Canadian LPs have continued to tap capital markets for funding, which we thought would be scarce at best, and have bought themselves another 12 months to achieve profitability and consolidate scale,” Butt commented to INN.

Cannabis trends: US election hints policy changes

One future indicator for US operators is the growth in state markets available to them. On top of that, many experts view the presidential election victory of Joe Biden as a sign for a friendlier view of cannabis policy compared to Trump.

In addition to the Biden win, five new cannabis markets were approved by voters, indicating a significant wave of support for the legalization of cannabis in the US.

“As far as an election year, 2020 is the most consequential election that we’ve seen for cannabis,” Kacey Morrissey, New Frontier Data’s senior director, industry analytics, told INN.

Besides expansion, the electoral wins for cannabis alongside a Democratic leader could signal the arrival of much-needed policy adjustments to support the industry at large.

“Going forward, with the Democrats having better ability to put forward their agenda, the SAFE and STATES acts could significantly bring down the cost of capital even further,” Butt told INN.

Meanwhile, Taerk expects Biden to provide a more welcoming dialogue with the needs of the industry.

While he doesn’t anticipate sweeping federal legalization anytime soon, the basic needs of businesses, like banking and cheaper capital, may enter the picture thanks to the critical Biden win.

Cannabis trends: Investor takeaway

The past year has offered another sobering reality check for investments in cannabis. While the sector isn’t going away any time soon, its readjustment in focus and spending has shown that pitfalls still abound when placing bets in the space.

The road for transition in the cannabis industry, particularly the Canadian space, has left behind thousands of workers in the wake of job cuts, and ambition from cannabis operators in the country has generally been reduced.

As the industry gears up for what’s ahead in 2021, investors will have plenty to remember from 2020, which has been a significant year was for the development of the cannabis industry at-large.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: 4Front Ventures is a client of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.