US Election Night a Big Win for Cannabis State Policies

Election night proved to be big for state-level cannabis policies as Americans approved five new legalization programs.

The American cannabis industry enjoyed a decisive election night, as voters in the country confirmed the five cannabis programs up for approval.

Arizona, Mississippi, Montana, New Jersey and South Dakota voters showed up for cannabis on Tuesday (November 3), with all state measures for cannabis-related legalization winning their respective votes.

Mississippi legalized a medical market, while New Jersey, Arizona, Montana opened the doors to recreational use; South Dakota did both.

Thanks to the newly approved measures, a grand total of 15 states have now legalized cannabis for recreational use in the US. Investors curious about the background behind the five states that just voted positively for cannabis can click here to read a breakdown from the Investing News Network (INN)

It was a big night for cannabis legalization advocates like the National Organization for the Reform of Marijuana Laws and Director Erik Altieri, who in a statement emailed to INN said the results show voters want reform instead of prohibition.

“The success of these initiatives proves definitively that marijuana legalization is not exclusively a ‘blue’ state issue, but an issue that is supported by a majority of all Americans — regardless of party politics.”

According to a September report from cannabis data firm New Frontier Data, released in anticipation of the election results, the five new state programs could stand to represent US$3.3 billion in revenue for the overall US cannabis market by 2025.

“With US$9 billion in new revenue from 2022-2025, should all five states ballot measures pass, New Frontier Data estimates that revenues from all legal U.S. markets will reach US$35.1 (billion) in 2025,” New Frontier Data CEO Giadha DeCarcer said in a statement as part of the study.

The report notes that 234 million Americans, equivalent to over 70 percent of the population, will now live under a legal cannabis market. The researchers believe that’s a win for regulated cannabis, as more consumers may be willing to try cannabis if the drug is legal in their state market.

“Legalization confers a legitimacy upon cannabis and provides a subset of consumers with the security and confidence to try cannabis products,” the report states.

Industry observers have latched onto the potential size and growth provided by the Arizona and New Jersey state markets. In a recent video conversation with INN, Nawan Butt, portfolio manager at Purpose Investments and co-manager of the Purpose Marijuana Opportunities Fund (NEO:MJJ), said he is particularly encouraged by the options created by new legalized programs in the two states.

Watch the full cannabis interview with Butt, along with Dan Ahrens of AdvisorShares.

Stocks fall on uncertainty surrounding presidential and Senate results

Despite the big victory for cannabis policy at the state level, all eyes are still on the outcome of the presidential election given the real implications for some kind of federal reform. Democratic candidate Joe Biden’s campaign offered hope of decriminalization for the drug, while President Donald Trump failed to mention what his stance on the issue would be moving forward.

Ballots across the country were still being counted on Wednesday (November 4) morning, preventing voters from knowing the actual result of the presidential race.

Another critical point for cannabis voting in this election cycle was the potential for the Democrats to win control of the Senate. While flipping the Senate is the dream for cannabis insiders, it may still prove possible to work out a new federal framework for the drug if the Senate remains Republican-controlled, as is currently projected by the Associated Press.

“We continue to see outsized growth in most states as operators have worked out how to optimize within the current constraints,” Butt said previously as part of an investment commentary note. “Any reform at the federal level will cause a step function in valuations of these operators, but explosive growth can still continue under current regulations.”

Cannabis stocks took a dive after the markets opened on Wednesday following a lack of certainty on the direction of the country as the president remained up in the air.

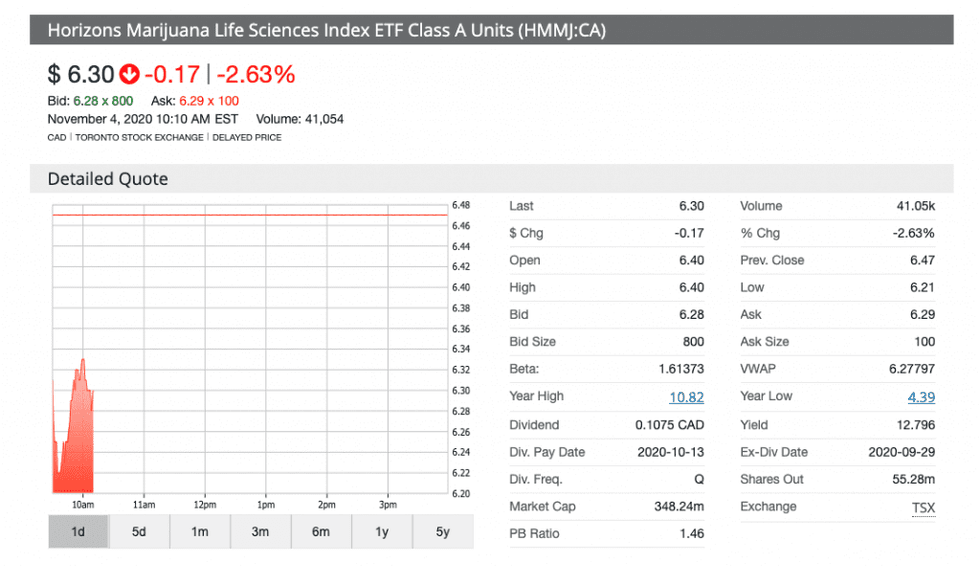

The Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ) opened on Wednesday with an early drop in value. The fund acts as an index for the cannabis sector at large, particularly Canada-based companies.

On the other hand, the AdvisorShares Pure US Cannabis ETF (ARCA:MSOS), which tracks US-based multi-state operators only, had a slightly less significant drop at the start of the trading day. The fund is actively managed, while HMMJ operates as an index.

MSOS tracks the companies most likely to benefit from the state developments in the US cannabis market at the moment, given that Canadian producers still can’t access the medical or recreational markets below the border.

Some of Canada's bigger cannabis licensed producers are trading in the red this morning after the chances of U.S. federally legalizing pot look uncertain following yesterday's election pic.twitter.com/akEW7EfLr9

— David George-Cosh (@itsdgc) November 4, 2020

Don’t forget to follow us @INN_Cannabis for real-time updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.