Copper’s importance to global electrification and energy transition efforts highlights the need for a more stable and secure North American supply chain.

Copper has a huge role to play in both electrification and the global energy transition — and at our current level of production, demand will soon outpace supply.

The current global supply dynamic exacerbates this problem. According to S&P Global, copper production is more concentrated than oil. Chile is currently the world's largest copper producer, producing roughly 5 million metric tons (MT) of the metal in 2023. Peru, the second largest producer, produced only 2.6 million MT, while Australia was in third place with 810,000 MT. Chile and Peru account for 38 percent of world copper production.

This current supply landscape is unsustainable. Diversifying global supply chains for copper production is necessary to meet the increasing demand. North American governments recognized this issue. They implemented policies and incentives to boost domestic supply.

Understanding these measures, as well as copper's supply and demand dynamic, is essential for anyone seeking to invest in this important metal.

Unstable, unsustainable supply chains

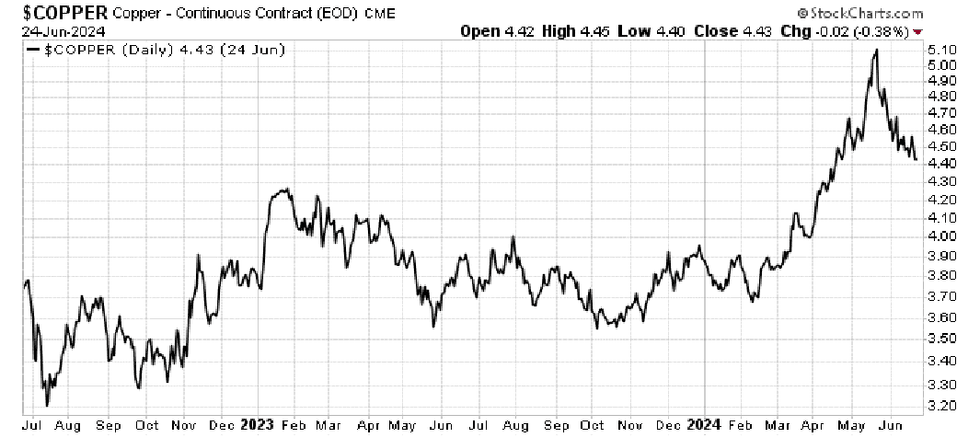

Copper prices rallied significantly over the past year, increasing from US$3.75 per pound in December 2023 to US$5.15 per pound around the beginning of May 2024.

What's more, copper prices on May 20 reached a record high of US$5.20 per pound, effectively freezing out Chinese spot trading for a day before closing at US$5.11. Analyst firm Morningstar has even referred to copper as the new oil.

A complex mixture of supply and demand issues drive the copper price today. There are several critical factors contributing to the dynamic price changes:

- Chinese economic recovery

- Supply chain disruptions (mine closures, poor production, labor issues)

- Inadequate production growth

- Rising demand from electric vehicles and green energy

- Falling demand from housing construction

While these factors can force short-term fluctuations in the copper price, most analysts agree that the long-term trend appears to be upwards.

In a May 23 Financial Times article, veteran hedge fund manager and commodities trader Pierre Arnurand said that what we've witnessed this year is only the beginning. He predicts copper prices could increase by as much as 288 percent over the next few years. This demand, says Arnurand, will be driven both by traditional applications, such as power infrastructure, and emerging ones, such as electric vehicles, wind farms, solar panels and the defense sector.

The digital economy will also play an incredibly important role in driving copper demand, particularly artificial intelligence.

A single server rack in an AI data center, for instance, will draw up to 60 kilowatts of power. In contrast, a traditional data center rack usually tops out at roughly 15 kilowatts. Powering and maintaining these facilities will require a massive volume of copper, increasing demand by up to 1.5 percent in the US alone.

Electric vehicles are even more copper hungry, with the International Energy Forum projecting that full electrification will require that copper production increase by as much as 55 percent.

According to the Energy Information Administration, sources of renewable energy like wind and solar use between 2.5 and seven times more copper per unit of power — copper demand from these two sources alone is projected to reach 600,000 MT by 2040.

Giant bank BMO Capital Markets projects copper demand could reach 40.4 million metric tons per year by 2030, with a compound annual growth of 3 percent.

In addition to falling short of projected demand, the current copper supply is heavily impacted by permitting issues, political risks, environmental impacts and development challenges, effectively slowing the pace at which new mines come online. These issues are also heavily impacting supply chains. Moreover, the increasing instability of supply from South America is already causing a shortage, one which analysts predict could last until at least 2030.

"In early 2024, data from underperforming copper mines from 2023 and the Panamanian government shutdown of the Cobre Panama Mine brought the ongoing copper supply issue front and center," explains Matthew Badiali, CEO of Quetzal Copper (TSXV:Q). "And while we saw a rapid rise in the copper price, it was hardly unprecedented in the commodity space. Historical context shows that copper could run much higher."

Boosting domestic copper production

Copper is part of both the Canadian federal government's C$4 billion Critical Minerals Strategy and the Inflation Reduction Act in the US. These strategies from both governments include multiple tax incentives for sustainability, mining and exploration. In Canada, for instance, provincial mining taxes and royalties related to mineral resource income are fully deductible on federal income tax.

The Canadian government also provides favorable capital cost allowances, allows exploration expenses to be claimed at a 100 percent deduction, and allows development expenses to be deducted at 30 percent. The government also offers a C$1.5 billion critical minerals infrastructure fund and investment tax credits of 30 percent for exploration activities.

In addition to these tax benefits, Canada offers the Mineral Exploration Tax Credit (METC), a 15 percent non-refundable tax credit that can be applied by investors against tax they would otherwise pay for a year and may be carried back three years and carried forward 20. In 2024, Deputy Prime Minister and Minister of Finance Chrystia Freeland announced that the current METC, set to expire on March 31, 2024, will instead be extended through 2025.

In the US, the Inflation Reduction Act provides a US$7,500 per vehicle consumer tax credit when purchasing electric vehicles from select suppliers. By 2026, 80 percent of all EV components will need to be extracted and processed either in the US or with one of the country's free trade partners. If at least half of a battery's components are manufactured or assembled in North America, there is also an additional US$3,750 tax credit.

Most notably, the legislation extends additional loan guarantees of up to US$40 billion to support critical minerals projects.

Together, these incentives are being leveraged by junior mining companies to fuel a new wave of exploration and development in highly prospective regions, such as BC and the Yukon. Already, there are many different copper projects at varying stages of development across North America.

Below, we've listed a few of the more promising investment possibilities.

Princeton

Located immediately north of the Copper Mountain mine, Quetzal Copper’s 11,500 hectare Princeton copper property houses multiple promising anomalies, including three drill-ready targets. Quetzal identified Bud South and Knob Hill as particularly high-priority targets — both have standout geophysical anomalies with supporting trenching and drilling data. Drilling is set to commence in 2024.

Quetzal has the option to earn 80 percent interest in the Princeton project, as well as the option to earn a 100 percent interest in the Big Kidd and DOT properties near Merritt, BC.

Black Butte

Notable for being one of the world's highest-grade undeveloped copper projects, Black Butte is 87 percent owned by Sandfire Resources (ASX:SFR) subsidiary Sandfire Resources America (TSXV:SFR,OTCQB:SRAFF). Sandfire intends to combine best-practice technology and modern mining techniques to develop Black Butte into an underground mine that has a minimal environmental impact and a low surface footprint. In February 2024, Sandfire scored a major win on the project when the Montana Supreme Court reversed a 2022 decision to invalidate its mining permit.

Murray Brook West

Owned and operated by Canadian Copper (CSE:CCI), Murray Brook West is an underexplored project located adjacent to the Murray Brook deposit. Due to the fact that it is situated between the Caribou and Restigouche mines, the property is highly prospective for copper. Future work at the property will involve comprehensive exploration and drill target development, including prospecting activities geared toward identifying potential mineralization.

Investor takeaway

Copper is arguably one of the most critical minerals to both electrification and the clean energy transition. Unfortunately, current copper supply is not keeping pace with demand. In order to change that, governments are working to incentivize further exploration and development with the goal of developing a stable domestic supply.

In North America, this represents a considerable investment opportunity — anyone interested in adding copper properties to their portfolio would do well to pay attention.

This INNSpired article is sponsored by Quetzal Copper (TSXV:Q). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Quetzal Copper in order to help investors learn more about the company. Quetzal Copper is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Quetzal Copper and seek advice from a qualified investment advisor.