Ankh Capital Inc is a capital pool company.

Investor Insight

Quetzal Copper has a copper-focused exploration strategy and North American assets. The company is in an excellent position to capitalize on rising domestic copper demand, with a plan to play a key role in the critical minerals race.

Overview

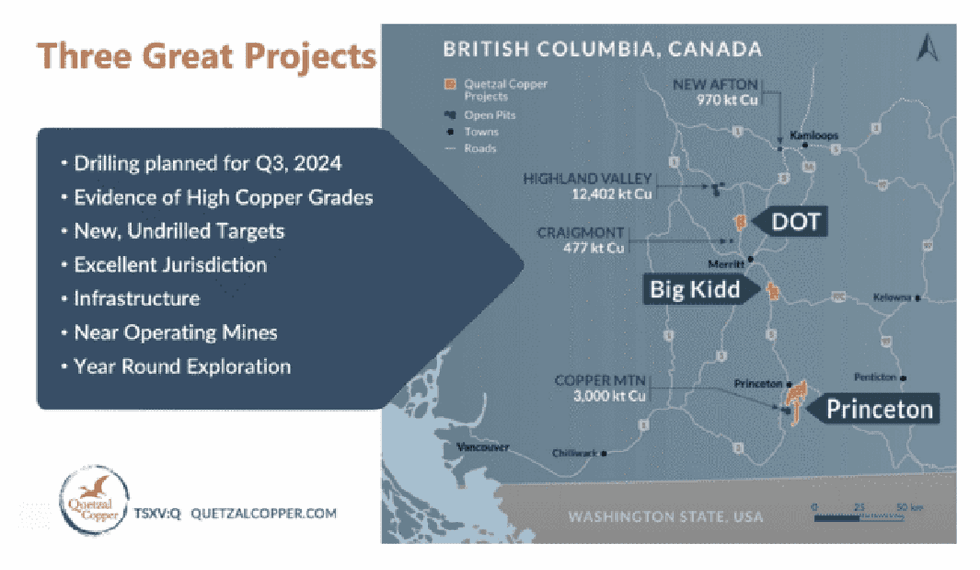

Quetzal Copper (TSXV:Q) is a copper exploration company focused on three drill-ready copper projects in British Columbia, Canada: Princeton, Big Kidd and DOT. All three projects are situated in the copper-rich jurisdiction of British Columbia between the Highland Valley copper mine and the Copper Mountain mine. This is a highly prospective area that historically produced millions of pounds of copper.

All three BC projects are easily accessible by road and close to infrastructure. The area is mining-friendly as evidenced from the multiple active and retired mines in the region.

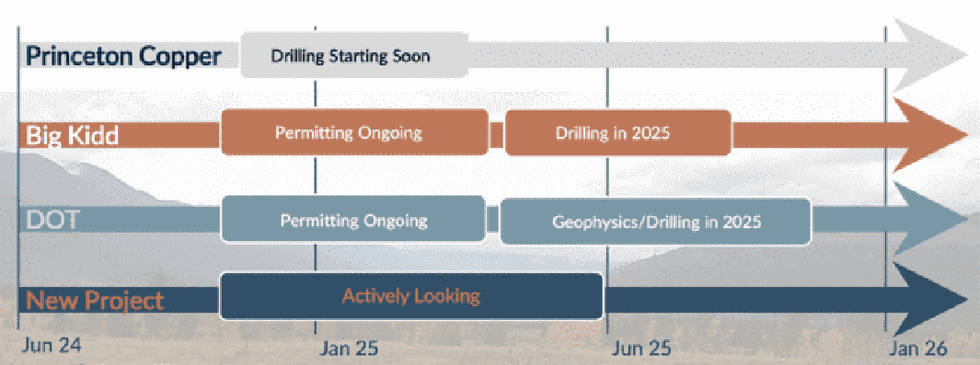

The company’s flagship is the Princeton copper project, which abuts the north side of the Copper Mountain mine property. The project had limited historical drilling. However, modern geophysics and soil samples identified prospective copper targets. Quetzal plans to begin drilling at the Princeton project in 2025. The company received its drill permit for four targets: Bud South, Knob Hill, Aura and Contact.

The Dot copper project is located just 25 km northwest of Merritt, B.C. Mining on the property goes back to 1887. The area hosts four significant target areas: the Northwest, Southeast, Copper and Lower Vimy Zones.

In 2010, Aurora Geosciences published a non-compliant historic resource estimate for the Dot project (calculated at $3 per pound of copper and $1,200 per ounce of gold). According to the report, Dot contains 6.5 million tonnes of indicated resources at 0.5 percent copper equivalent and 6.6 million tonnes at 0.38 percent copper equivalent.

In 2025, Quetzal Copper plans to evaluate that historic resource and follow up on the recommendations from the report. That includes drilling to connect existing mineralization and testing additional geophysical anomalies outside the known zones to expand the resource base.

The Big Kidd project is located approximately 20 km southeast of Merritt, BC. The project saw extensive drilling by previous operators including Xstrata. Quetzal geologists, along with Dr. Alan Wilson, reviewed all available core and compiled a new understanding of the geology.

In his 2024 report, Dr. Wilson laid out a series of field work recommendations for the project. He identified high-priority drill targets associated with chlorite-magnetite alteration. Due to the sulfide-poor nature of the system at Big Kidd, he believes that IP Chargeability geophysics should highlight targets.

The company’s focus on copper is attractive given current supply and demand dynamics.

The supply of copper is far more concentrated than oil. While three countries account for 40 percent of the oil supply, only two countries – Chile and Peru, contribute 38 percent of the copper supply. Given the history of political instability in these countries, a supply source from North America, with its stable policy environment, makes it very attractive.

Government-supported tailwinds also encourage domestic copper supply, with Canada and the US promoting copper production through tax breaks and incentives.

The demand scenario for copper looks attractive given expectations of rapid growth. According to Nornickel, global copper demand is estimated to rise by 20 percent to 30 million metric tons (MT) per year by 2035, from around 24.8 million MT per year in 2022. This growth in demand will be led by applications such as electric transport, power transmission grids and renewable electricity generation.

Quetzal Copper is likely to be a beneficiary of Western countries trying to realign their supply chain of critical minerals by sourcing them domestically or from friendly countries. Quetzal, with its portfolio of copper projects in tier 1 mining jurisdictions, is well positioned to offer domestically sourced copper to fill any supply gap.

Company Highlights

- Quetzal Copper is a new copper exploration company focused on three drill-ready copper projects in British Columbia: Princeton, Big Kidd, and DOT. The company has a fourth project, Cristinas, in Chihuahua, Mexico.

- The flagship Princeton copper project is located adjacent to the producing Copper Mountain mine in British Columbia. The company plans a significant drill program for the project in 2025.

- The Big Kidd copper project is located in southern British Columbia, midway between the Copper Mountain and Highland Valley copper mines.

- The DOT copper project is located south of the Highland Valley mine in southern British Columbia.

- Given that around 38 percent of the world's copper is supplied by two countries (Chile and Peru), a North American supply source makes the company’s projects very attractive.

- The company’s senior leadership team is well-experienced in both geoscience and capital markets, which will help the company unlock the potential of its projects.

Key Projects

Princeton Project

The Princeton copper project spans an area of 11,500 hectares and is approximately 5 kilometers from Princeton town in British Columbia. The project is located to the north of Copper Mountain mine. The project represents an ideal location and favorable geology for copper exploration, located between the Copper Mountain mine and the Miner Mountain properties. Several operators have conducted various property surveys over the past 60 years. The geophysical and geochemistry surveys conducted in 2020 and 2021 have identified multiple drill targets. The project has three key targets: Bud South, Knob Hill and Aura.

- Bud South: Historically drilled in 1987, this will be a primary drill target in 2024. One of the drills encountered copper and gold over 10.5 meters. The section yielded 0.184 percent copper, 0.33 grams per ton (g/t) gold, and 8.7 g/t silver over 10.7 meters. Moreover, a lower section graded 0.149 percent copper, 0.121 g/t gold, and 3.2 g/t silver over 4.6 meters.

- Knob Hill: The target is located 2 kilometers south of August Lake and is characterized by granodiorite outcropping over an area of 1,000 meters x 600 meters. Historically, two samples have reported 0.99 g/t and 0.51 g/t gold, 33.6 g/t and 49.0 g/t silver, and 0.60 percent and 1.22 percent copper.

- Aura: This target has similarities to porphyry copper deposits, having a mineralized zone at the periphery.

Big Kidd Project

The company has an option to acquire 100 percent interest in this project. The Big Kidd copper project spans an area of 4,055 hectares in southern British Columbia. It is located just 20 kilometers from the city of Merritt, and benefits from excellent infrastructure in terms of accessibility by a network of roads. The region hosts several copper and gold deposits, such as the Copper Mountain mine and the Craigmont mine.

The historic exploration dates back to the 1890s. In 1916, 10 tons of ore was extracted with 1,000 lbs of copper. Moreover, in 1918, a mine produced 44 tons of ore with 12 percent copper, 68 g/t silver, and 0.57 g/t gold. In 2019, Jiulian Resources completed a drill program on the project. A 2004 resource estimate has identified a non-compliant resource of 122.4 Mt at 0.33 g/t gold and 0.15 percent copper. Additional drilling has expanded the footprint of the mineralization beyond the 2004 estimate.

The project has three important targets for 2024. 1) Target 1 – a narrow target spanning 100 m x 400 m; 2) Target 2 – that spans an area of 200 m x 350 m; 3) Target 3 – this opportunity is in the Dago zone.

DOT Project

The company has an option to acquire 100 percent interest in this project. The DOT copper project spans 846 hectares and is located in the southern portion of the Guichon Creek batholith. The project is located just 25 kilometers away from Merritt, and enjoys excellent accessibility by roads. DOT is located in a region with a history of copper exploration for more than 130 years. Moreover, the project is adjacent to Highland Valley mine (20 km) and Craigmont mine (12 km). In 2008, Aurora Geosciences estimated a non-compliant indicated resource of 5.3 Mt at 0.49 percent copper equivalent and 2.9 Mt of non-compliant indicated resource 0.45 percent copper equivalent.

Moreover, in 2010, a resource report identified the following grades: 30.2 meters @ 1.32 percent copper, 27.4 meters @ 2.58 percent copper, and 76.2 meters @ 0.91 percent copper. These grades and thicknesses indicate a robust copper system on the property.

The project covers five zones of copper-gold-silver-molybdenum mineralization: southeast, northwest, west, east and copper zones. All five zones remain open. The company is planning an exploration program at DOT, which will include a comprehensive IP survey across the property, drilling at the east zone and northwest zone, trench and drilling at the southeast zone, and metallurgical testing.

Management Team

Matthew Badiali – CEO and Director

Matthew Badiali holds an M.Sc. degree in geology from Florida Atlantic University. He is a geologist and has over 18 years of experience as a financial analyst covering the natural resources sector with Stansberry Research. He is also a founder of Mangrove Investor Media, a publishing company.

Chris Lloyd – VP Exploration

Chris Lloyd is a geologist with over 35 years of experience, working in Canada and Mexico. He is a co-founder of Soltoro, which discovered the El Rayo silver deposit and was acquired by Agnico Eagle. He was also associated with the Panuco Project of Vizsla Silver.

Charles Funk – Technical Advisor

Charles Funk is a geologist with experience in gold, silver and copper projects, and is associated with multiple deposit discoveries in Australia and Mexico. He has more than 14 years of experience with several mining companies, including Evrim Resources and Newcrest. He is also the CEO of Heliostar Metals.

Dr. Roy Greig – Technical Advisor

Dr. Roy Grieg is a geologist highly experienced in advancing copper projects. He served for over two years as vice-president of exploration for Amarc Resources, where he advanced their district-scale porphyry copper-gold-molybdenum projects in British Columbia in collaboration with major partners Freeport McMoRan and Boliden. Greig holds a Ph.D. from the University of Arizona.