Battery Storage Market Surging as Electricity Demand Enters New Era

Grid-scale battery storage is rapidly becoming one of the defining pillars of the global energy transition, driven by soaring electricity demand, falling battery costs and shifting supply chains.

Speaking at Benchmark Week, Iola Hughes, head of battery research at Benchmark Mineral Intelligence, outlined a market that is undergoing “very strong growth" and becoming indispensable to energy security.

Hughes described energy storage as the fastest-growing segment in the battery sector today.

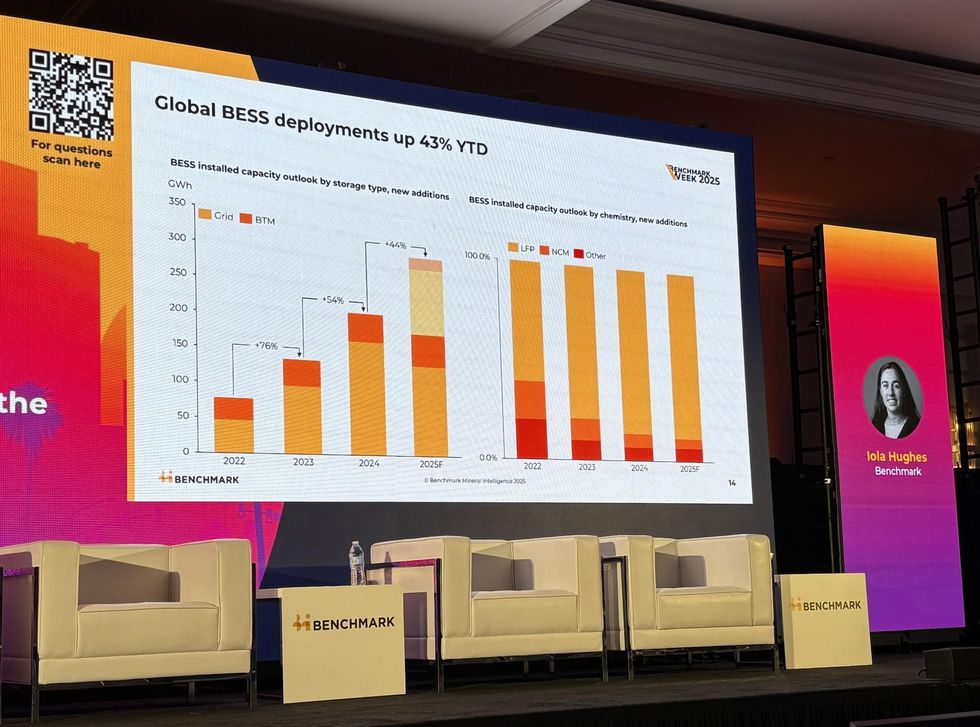

Benchmark expects the market to expand by roughly 44 percent this year, nearly doubling the growth rate of overall lithium-ion battery demand, which is projected at 25 percent.

As a result, energy storage is set to account for a quarter of total battery demand in 2025.

Global battery energy storage system deployment, 2022 to 2025.

Photo via Georgia Williams.

In the US, the trend is even more pronounced.

“We’re expecting energy storage to account for 35 to 40 percent of battery demand in the US in the next few years,” Hughes told the audience at the California-based conference. That shift is reshaping the supply chain, chemistry choices and the strategic priorities of both policymakers and manufacturers.

LFP chemistry takes center stage

The rise of utility-scale storage has in many respects become the story for lithium iron phosphate (LFP) chemistry.

LFP's lower cost, strong performance profile and “dominance … on behalf of the innovation we’ve seen in LFP cells over the last few years” make it the chemistry of choice, Hughes said.

The cost advantage of LFP batteries is especially significant at a moment when policymakers are tightening sourcing standards and examining supply chains for vulnerabilities. Add to that the supply chain complexities associated with nickel, cobalt and manganese (NCM) chemistries and the LFP segment again stands out.

Despite rapid deployment, grid storage remains highly concentrated, with China and the US together representing 87 percent of all global installations to date. But that dominance may be tested sooner than expected.

Hughes pointed to Saudi Arabia, which “a year ago wasn’t even on this chart,” yet deployed 11 gigawatt hours of storage in just the first three months of this year. “It really goes to show just how early this market is,” she said.

New regions can move from nonexistent to major players “in a matter of months.”

That acceleration is directly linked to plunging costs.

Fully integrated storage systems in China are now sold below US$100 per kilowatt-hour, a milestone that dramatically strengthens project economics, even in environments where subsidies or tax supports have been reduced.

US energy storage market booming

Storage deployment in the US continues to surge, led by California, Texas, Arizona, Nevada and New Mexico.

New Mexico's rise is particularly telling, according to Hughes.

“New Mexico being the fifth largest state … is just two or three projects,” she noted. That underscores just how early the US storage market still is, and how quickly major projects can reshape state-level capacity.

Hughes also said very large installations are becoming increasingly central. Benchmark defines “giga-scale” projects as those exceeding 1 gigawatt hour, once an industry novelty. Now they are transforming demand patterns.

“This year, we’re expecting nine of these to come online, accounting for 20 percent of battery demand,” Hughes said. By next year, 21 more are in the pipeline, accounting for nearly 40 percent of expected demand.

However, the US policy landscape is shifting. The Inflation Reduction Act’s investment tax credit remains intact for storage, but now comes with stricter sourcing rules for both cells and systems.

That has triggered a rush to secure US-eligible supply, particularly for LFP. The number of announced LFP gigafactories jumped 61 percent between January and November of this year.

Much of that new capacity is being driven by Korean manufacturers such as LG Electronics (KRX:066570), SK Innovation (KRX:096770) and Samsung Electronics (KRX:005930,OTC Pink:SSNLF).

Even so, manufacturers still face a major challenge in qualifying for the Section 45X production tax credit as cathode and precursor supply remains heavily dependent on China.

“That is definitely the biggest pinch point right now for the energy storage sector,” Hughes said.

Electricity demand set to surge in the US

The storage boom is tied to a deeper structural shift: electricity demand is rising after 15 years of stagnation.

Since the 2008 financial crisis, US electricity demand has been “basically flat,” Hughes said, as a result of offshored manufacturing and limited grid investment. But that stagnation is ending as artificial intelligence (AI) data centers, electrified heating, electric vehicle adoption and reshored industrial capacity drive consumption sharply higher.

Benchmark now expects 20 to 30 percent growth in US electricity demand by 2030. That surge “has very strong implications for the grid, for energy security,” Hughes noted, and puts storage “at the center of that conversation.”

Large language models and AI hyperscalers are quickly becoming a dominant force. While data centers have existed for decades, the new generation requires far greater power — and, increasingly, on-site battery storage.

“These large projects are the ones that are going to be having high requirements for batteries” in the coming years, Hughes said, with the US positioned as the global epicenter of AI-driven load growth.

Beyond LFP: The next storage frontier

Looking ahead, chemistry innovation will shape how storage supports the grid at different durations.

LFP is expected to remain the clear winner in four hour applications, while sodium-ion compositions could emerge as a disruptor in the same range. Between four and 10 hours, LFP is increasingly pushing out technologies like flow batteries and sodium-sulfur batteries due to cost advantages. Beyond 10 hours, a new suite of technologies is still in development, with US companies particularly active in that long-duration space.

As Hughes concluded, the role of storage is only growing.

With electricity demand accelerating and policy tightening, battery systems have moved from a peripheral technology to a strategic necessity, and the global energy transition is quickly reshaping around them.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.