Australia Precious Metals Update: Q3 2022 in Review

What's happened so far this year in Australia's precious metals sector? Here's a review of the major updates for gold, silver, platinum and palladium.

Click here to read the previous Australia precious metals update.

The precious metals sector put on a mixed performance during the third quarter of the year, with both palladium and silver making small gains, while platinum and gold registered declines.

Across the board, inflation, rising interest rates and a strong US dollar wreaked havoc on global markets and impeded growth in the precious metals sector. Read on to learn more about the factors that drove prices for precious metals in Q3.

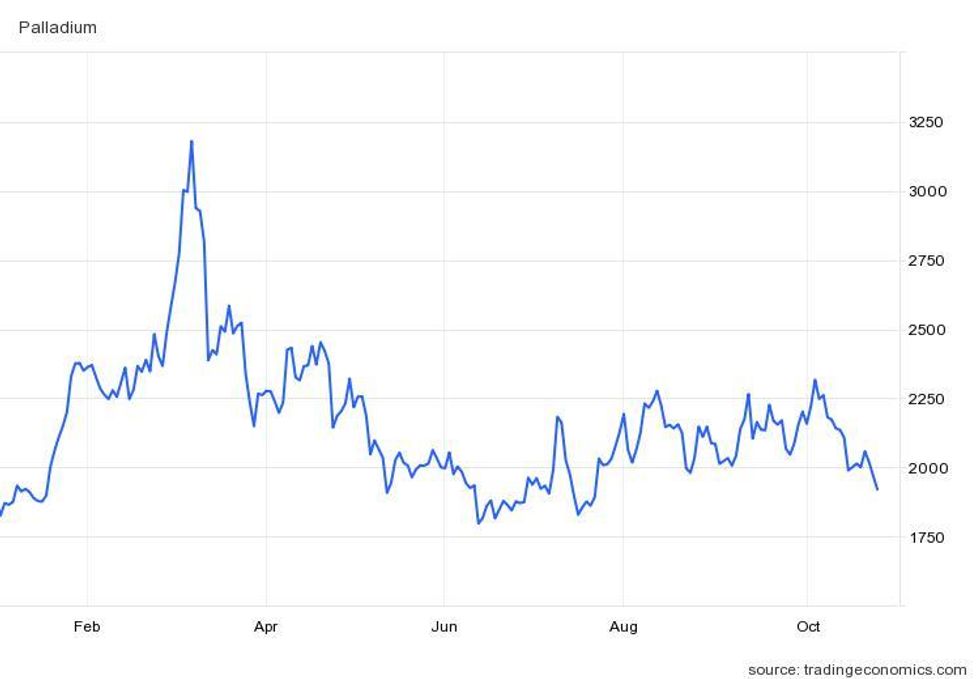

Australia palladium price update: Supply concerns provide support

Despite those and other headwinds, prices for palladium reached a third quarter high of US$2,279 per ounce in mid-August before the metal slipped to US$1,965 at the end of the three month session.

Uncertainty around potential palladium supply disruptions due to the Russia-Ukraine war continue to drive the market, and pushed the automotive metal to an all-time high during the first half of 2022.

“The palladium price skyrocketed to US$3,442 on March 8th as consumers and speculators believed the Russian/Ukraine war would severely curtail supply,” a report from Metals Focus notes.

The firm's annual precious metals overview goes on to explain, “Again, as realization grew that the metal would find its way to market, prices dropped, dipping to a low of US$1,790 mid-June.”

Although Russian palladium supply hasn’t faced sanctions, concerns about processing and transporting the metal as the war continues are growing. Production declines out of South Africa also helped palladium its Q3 high of US$2,279.

Year-to-date palladium price performance.

Chart via Trading Economics.

Scheduled maintenance from the country’s two largest platinum-group metals miners ― Anglo American Platinum (LSE:AAL,OTC Pink:AGPPF) and Impala Platinum (OTCQX:IMPUY,JSE:IMP) ― prompted both companies to reduce their guidance for the year.

Paired with the risk around Russian shipments, the palladium market is anticipated to see a deficit this year.

“Even though palladium remains the metal of choice in gasoline after-treatment catalysis, the erosion of share due to platinum substitution and the acceleration of battery electric vehicle production will see the deficit shrink in 2023 to -337,000, which has left investors largely indifferent towards the metal’s investment prospects,” as per Metals Focus.

Australia platinum price update: Green momentum keeps building

As its sister metal palladium benefited from price upside, platinum shed 3.16 percent between July and October. Starting the period at US$886.84 per ounce, values fell to a 26 month low of US$858.85 at the beginning of September.

Platinum’s primary price headwind has been reduced automotive demand as that sector continues to grapple with a semiconductor shortage, supply chain disruptions and the war in Ukraine.

“In addition, Covid lockdowns in China during March and April have resulted in the temporary closure of some vehicle assembly plants, creating significant additional downside for auto production forecasts,” a report from Johnson Matthey (LSE:JMAT,OTC Pink:JMPLF) explains. Contracting auto demand weighed heavily on platinum prices in Q3.

There has been some recovery in Australian automotive demand, with August and September recording 17 percent and 12 percent upticks, respectively. After declining during the first and second quarters, the Australian auto market reversed its trajectory for Q3, reporting a 9.8 percent uptick for the three month period.

Despite platinum’s Q3 decline, the outlook for the metal remains positive as substitution in the auto sector and clean energy demand increases, according to Metals Focus. “Platinum’s role as a critical raw material in the hydrogen economy, and China’s expanding interest in this sector, also supported buying interest and imports,” it states in a weekly report.

Additionally, some of the production reductions that have impacted palladium will also affect platinum mine supply at a time when there is a shortage of scrap metal recovery.

“(This all provides) a price floor as platinum shifts to a deficit of 142,000 ounces this year, deepening to 589,000 in 2023, should automotive production recovery continue,” the report said.

Australia silver price update: Precious vs. industrial factors at play

Industrial demand for platinum is anticipated to remain robust this year, but fellow white metal silver has faced headwinds from both its correlation to gold and its industrial exposure.

Persistent inflation, combative interest rates and recessionary worries have drawn silver down from its year-to-date high in March of US$26.44 per ounce to a more than two year low of US$17.87 at the beginning of September.

Despite the nine month decline, silver did register an incremental 0.5 percent gain for Q3, supported by its versatility.

“In terms of supply/demand, industrial fabrication will continue to strengthen after hitting record highs in 2021 and 2022, thanks to ongoing electrification, growing 5G technologies and government commitments to green infrastructure,” Metals Focus indicates.

The firm's report goes on to note that silver’s price future is largely dependent on its relationship with gold and global inflationary pressures, the ongoing post-pandemic recovery and more stability in supply chains.

Inflation appears to have peaked, with recently released Purchasing Managers Index (PMI) data indicating that the Australian economy did an about-face in October, reversing eight consecutive months of growth.

“Both input costs and output prices remained on the rise at the start of the fourth quarter,” an S&P Global research report states.

The flash PMI results also indicate the nation’s private sector shrank in October for the first time in 2022.

“While input cost inflation in both Australia and Japan showed signs of easing from the previous month, it failed to translate to lower selling price inflation,” S&P continues. “Instead, output prices climbed at faster rates in both Australia and Japan during October to pose risks to both economies.”

This trend could erode demand through higher costs, which may also deplete some industrial need.

On the investment side, rising interest rates in an inflationary environment pose a threat to silver's price growth.

“Despite robust fundamentals, silver’s annual average price is projected to decline by 17 percent, as silver is expected to be hit by an overspill from gold,” Metals Focus points out.

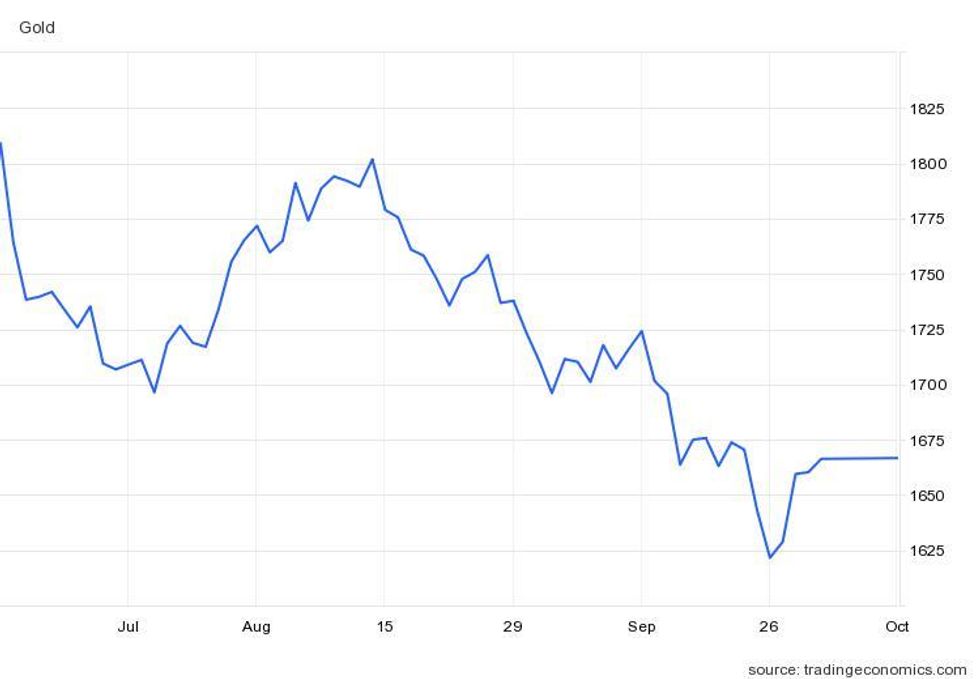

Australia gold price update: Economic contraction may offer tailwind

The third quarter proved most challenging for gold as the metal fell 8 percent from its July start value. Catalysts like inflation and uncertainty offered no aid as a strong US dollar prevented any gains.

Gold's Q3 2022 price performance.

Chart via Trading Economics.

Unable to find support through its status as a hedge, the yellow metal slipped to US$1,620 per ounce in late September, its lowest value since April 2020. Gold's fall came as the US dollar reached a 20 year high; however, experts have emphasized that prices for the metal remain high elsewhere in the world — for example, gold is now priced at AU$2,500.

In mid-October, the US dollar began to contract, giving gold room to grow after testing its two year bottom on October 19. However, miners and explorers are still hoping for higher prices to help them balance rising input and energy costs.

“The uncertainties around inflation and interest rates and supply chain issues have caused many companies to adopt a more cautious approach to decision making and near-term strategic business development activities,” Fred Earnest, president and CEO of Vista Gold (TSX:VGZ,NYSEAMERICAN:VGZ), told the Investing News Network at the Gold Forum Americas.

Vista, which owns the Mt. Todd gold project, located approximately 250 kilometres southeast of Darwin in Australia's Northern Territory, has found the current economic environment prohibitive in its search for a project partner.

After completing its feasibility study in January, the company announced intentions to seek a project partner or “other form of transaction to maximize shareholder value.” The January study incorporated some of the cost pressures related to inflation, such as steel and concrete expenses, but there are others that were incalculable.

“What we've not captured is wage increases — in the last several months, we started to see wage increase pressures in Australia," said Earnest. That said, the company has been able to control its energy costs.

“One advantage that we enjoy is that our natural gas prices in the Northern Territory have been quite stable,” he explained, adding that the nature of natural gas production in the area has insulated the company from some of those price pressures.

“But it's something that we continue to watch very closely,” he said.

Moving forward, Earnest foresees a higher gold price, but expects some economic turmoil first. “Sure, we'd all love to see a US$1,800 or US$2,000 gold price, and quite honestly, I believe that it will get there,” said the company head.

In the meantime, he is concerned a recession could be sparked by rising interest rates aimed at reducing inflation. “Ultimately, once all that settles and the smoke clears, that it's going to be very positive for gold.”

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Canaccord Analyst: Gold Sector Volatility Presents “Good Value ... ›

- 5 Top Australian Gold Stocks - Investing News Australia ›

- Gareth Soloway: Next Buying Level for Gold, Oil Outlook After Price ... ›

- Matt Watson: Silver Mine Supply Needs to Double, What's in Store ... ›