Zinc Price 2022 Year-End Review

Here’s an overview of the main factors that impacted the zinc price in 2022.

Zinc prices had a strong start to 2022, hitting an all-time high during the first three months of the year.

However, zinc was unable to hold on to its gains, and ended the year hovering around the US$3,000 per metric ton (MT) mark — a level that is still quite high for the base metal used to galvanize steel.

Here the Investing News Network (INN) looks back at zinc trends for 2022, from supply and demand dynamics to how the metal performed and what analysts said quarter by quarter.

Zinc price in Q1: Russia-Ukraine war breaks out

At the end of last year, analysts were expecting zinc prices to remain high throughout the first months of 2022, and the base metal lived up to expectations. Russia's invasion of Ukraine raised worries over a supply shortage, with concerns running high about potential sanctions on Russia and how the conflict could impact the power crisis in Europe.

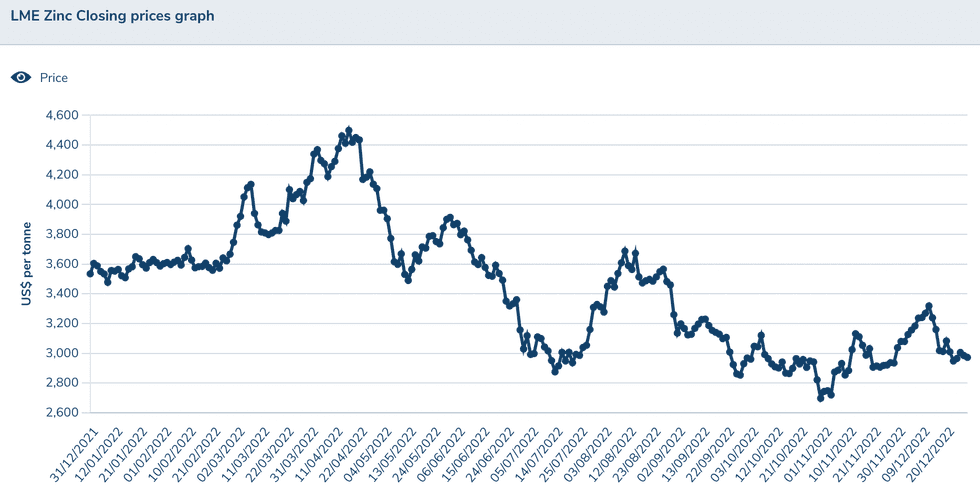

Zinc's price performance in 2022.

Chart via the London Metal Exchange.

“Zinc prices were stronger in the first half of 2022 than we expected at the start of the year, mainly due to the impact of Russia’s invasion of Ukraine on energy prices and zinc prices,” Helen O’Cleary of CRU Group told INN.

High power costs in Europe had been impacting the space since the previous year, with zinc smelters suspending operations. But the energy crisis deepened in 2022 due to the war, which led to more smelters cutting back on production, increasing supply fears.

CRU estimates that high energy costs in Europe accounted for around 67,000 MT of smelter output losses in the first quarter.

“We currently expect a further 40,000 to 45,000 tonnes of disruption in Q2 in Europe, and 15,000 tonnes of non-energy-related disruption elsewhere in ex-China,” O’Cleary said at the time.

Zinc prices kicked off the year trading above US$3,500 and ended the quarter above US$4,100.

Zinc price in Q2: Prices reach all-time high

The second quarter of the year saw zinc prices continue to climb to an all-time high, rising above US$4,500.

Speaking with INN, Jonathan Leng of Wood Mackenzie said prices performed as he had expected in the first six months of the year.

“Zinc began the year at US$3,600, which is fairly high for the metal, but then really took off in late March, pushing up to over U$4,500 briefly in April,” he said. “This was based on the solid fundamentals of low and falling metal stocks on the exchanges as demand was good in most regions, while refined production was constrained by high power prices in Europe, the permanent closure of the Flin Flon smelter in Canada and disruptions at several other smelters.”

But as volatility impacted the markets and the US dollar rose, the base metal faced pressure. It ended the first half of 2022 trading at US$3,157 — down around 12 percent.

During the first six months of 2022, fresh COVID-19 restrictions in China hit several metals markets. The Asian nation is a top consumer of zinc, but demand for the commodity was no exception. “The rebound in the end-use side of the economy seems set to be much slower, with fears of renewed coronavirus restrictions damaging sentiment and encouraging consumers and businesses to save instead of spending,” Leng said when asked about Chinese demand for zinc so far in 2022.

“Perhaps the greatest drag on the Chinese economy comes from the property sector, which has seen the nascent recovery from last year's downturn effectively reversed by this year's lockdowns,” he added.

At the beginning of the year, CRU was forecasting a 2022 refined market deficit of 100,000 MT, but revised its numbers by the end of the first half. “We are now forecasting a global refined deficit of almost 250,000 tonnes, 170,000 tonnes of which is accounted for by our smelter disruption allowance,” O’Cleary said.

Prices ended the first six months of the year at US$3,157, almost US$400 below where they started 2022.

Zinc price in Q3: Macro factors hit the market

Zinc prices continued their decline during the first weeks of the third quarter, hitting its lowest level in the period at US$2,875.

In line with its sister base metals, zinc prices suffered from concerns over how a global economic slowdown could impact metals demand in the short to medium term, according to FocusEconomics.

“Ongoing Covid-19 restrictions and property market woes in China have spooked investors, hurting zinc prices in turn,” analysts at the firm said. “Fears of global recession seem to be more than offsetting a tight supply backdrop: Zinc inventories in LME warehouses remained at extremely low levels in July, which drove a spike in physical premiums.”

Prices took a turn in August, breaking through the US$3,500 threshold one more time to reach US$3,686.50.

“Zinc was the star performer among base metals in August, with prices bouncing back after three months of contraction,” FocusEconomics analysts said. “Tightening supply drove the rally.”

But the base metal was unable to hold on to gains as worsening demand conditions due to faltering global economic growth and muted consumption prospects in top consumer China hit the metal. Prices ended the quarter at US$2,968.

Zinc price in Q4: All eyes on smelters

During the fourth quarter, zinc prices performed with volatility, but were able to hit a high of US$3,318.50 in December.

According to the International Lead and Zinc Study Group (ILZSG), world demand for refined zinc metal is forecast to fall in 2022 by 1.9 percent to 13.79 million MT, and to rise by 1.5 percent to 13.99 million MT in 2023.

In China, demand is forecast to decrease by 3.3 percent this year.

“This will primarily be driven by decreased activity in most major zinc consuming sectors as a consequence of policies aimed at controlling a resurgence in COVID-19 cases,” the ILZSG said.

But even though demand has been declining, supply of refined zinc has also been hit hard this year following further closures of smelters, in particular in Europe.

Top smelter Nyrstar (EBR:NYR) put its zinc smelting operations at Budel in the Netherlands on care and maintenance in September, while its Auby operation in Northern France has remained closed due to “challenging market conditions.”

The cut in production from Nyrstar added to zinc producer Glencore’s (LSE:GLEN,OTC Pink:GLCNF) decisions to dismantle its Portovesme plant in Italy at the end of 2021 and put its Nordenham smelter in Germany on care and maintenance in November.

With almost 450,000 MT per year of smelter capacity currently idled in Europe, CRU expects disruptions related to energy prices to continue throughout next year.

“Smelter disruption will also remain a theme in North America and Australia,” O’Cleary said. “Smelter closures in Europe will continue next year and some could become permanent.”

Zinc finished 2022 trading at US$2,972.50, declining almost 15 percent throughout the 12 month period.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Top 10 Countries for Zinc Production ›

- Understanding the Zinc Spot Price and Zinc Futures ›

- Biggest Zinc Stocks on the TSX and TSXV ›