What to Look for in Cannabis Quarterly Financials

A financial expert explains what investors should be on the lookout for when they review financial numbers from their cannabis stock picks.

When the time comes for cannabis companies to share quarterly financial reports, there can end up being more questions than answers for new cannabis investors.

The trick to avoid confusion is to know what to look for in these detailed reports.

Here the Investing News Network (INN) outlines tips and suggestions from experts when it comes to evaluating cannabis companies and their financial results.

Examine the company's location

Matt Carr, chief trends strategist at the Oxford Club, told INN that when evaluating a cannabis company in the US he begins by looking at which states the company is operating in.

Given the fractured nature of the US cannabis landscape, companies operate on a state-by-state basis without a federal framework available or intrastate commerce allowed.

For Carr, this means placing a significant amount of attention on where companies are allowed to operate.

“That's what I'm always looking at with the company forecasts, because you do have new states kind of waiting in the wings to come online,” Carr said.

Nawan Butt, portfolio manager with Purpose Investments, previously told INN that when it comes to 2022 he will be closely monitoring the states of New Jersey, Pennsylvania, Ohio and Florida as critical markets for cannabis companies. Butt is a manager for the Purpose Marijuana Opportunities Fund (NEO:MJJ).

Profits a key goal for cannabis companies

When it comes to reviewing companies in the cannabis industry, there are unique factors that investors should learn about to properly understand the market. However, experts often point out that investors should also be mindful of tried-and-true metrics that apply to any publicly traded company, no matter the industry.

Carr told INN that earnings and revenue growth are at the top of his list of what to focus on, but they can be tougher to find than expected in the cannabis space.

“In the cannabis space less than half of companies are actually reporting profits,” Carr said.

So what should investors focus on if their pick is not profitable yet? The financial expert told INN in that case he wants to see a change to the firm's losses.

“If they're not profitable, you at least want to see that their loss per share is declining,” he said. “That the situation isn't getting worse, and that they're moving towards profitability.”

The cannabis industry is still in its early stages, and investors need to understand that this comes with its own unique set of challenges. “This market is still very young; there's a lot of upside,” Carr said. However, the expert added that not achieving profitability won’t be an excuse for much longer.

Red flags when examining cannabis numbers

The crippling effects of inflation are impacting markets across the globe, and cannabis is no different.

Carr told INN he wants to make sure costs from inflation are not “outpacing” the price of adding new products.

“When I'm evaluating companies, I'm always looking at revenue, I'm always looking at earnings; I'm looking at income from operations, which tends to be sort of an organic number,” Carr said.

He noted that when considering cannabis companies' core pillars, increasing operational costs can be a red flag that might lead the company down the path of expanding losses.

2022 offers opportunity amid US political unrest

Cannabis investments have gone through significant volatility over the years, moving from a green rush to dramatic lows following a depreciation in current operations from companies in Canada.

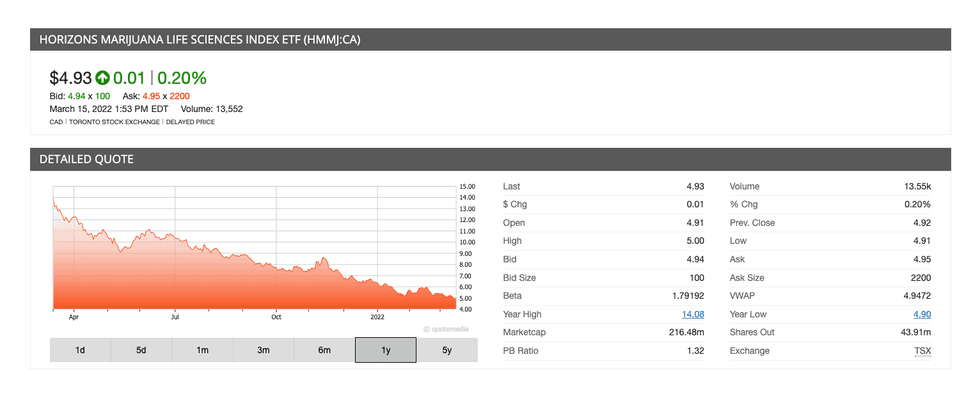

One year performance of Horizons Marijuana Life Sciences Index ETF (TSX:HMMJ).

When it comes to US players, they have vaulted into the spotlight as leading companies despite the fact that they are still not allowed to trade on senior US exchanges like the NASDAQ and the NYSE.

Many market participants believe what 2022 will bring is implicitly tied to the progress of US politics. This year voters will head to the polls for midterm elections to determine the leading parties in the Senate and the House.

“With this year being a midterm election year in the US, it's going to be a lot more difficult,” Carr said.

Additionally, cannabis policies will likely head to the polls in 2022 as more states vote on opening programs.

Investor takeaway

The cannabis industry offers many opportunities to those who are ready to take on the necessary due diligence.

But a critical eye is needed when researching and reviewing cannabis companies these days, as outside influences affect the performance and long-term outlook for the market.

Don’t forget to follow us @INN_Cannabis for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Cannabis Trends 2021: Investment Market Grapples with Future ... ›

- Cannabis Analysts: Institutional Investors Still on the Sidelines | INN ›

- How to Invest in a Cannabis Stock | INN ›

- Why Consider Investing in the Cannabis Industry? | INN ›

- 3 Cannabis Investing Experts Explain US Legalization Hype | INN ›

- Cannabis Weekly Round-Up: Leading MSO's Revenue Stalls, Shares Drop | INN ›

- Could Germany's Cannabis Actions Create a Domino Effect for Europe? ›