February 04, 2025

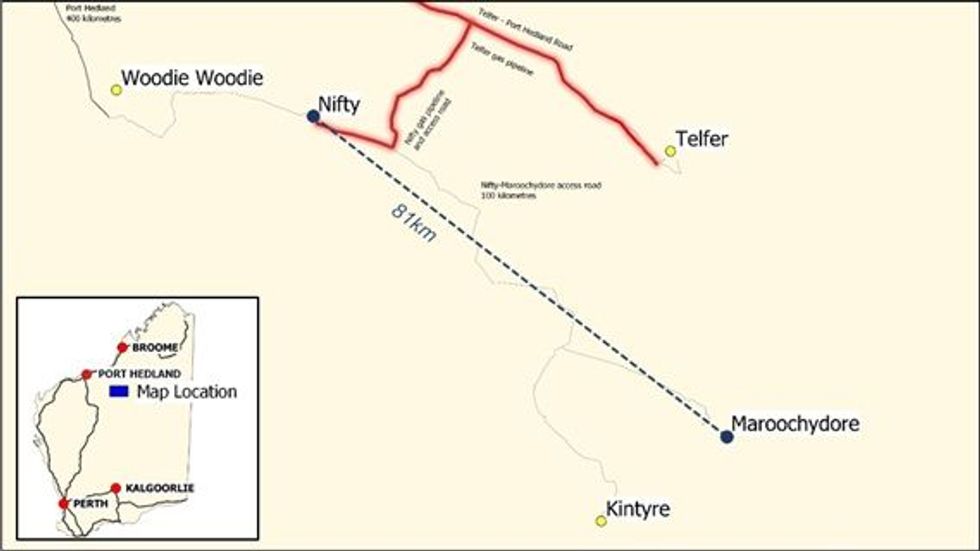

Cyprium Metals Limited (ASX: CYM, OTC: CYPMF) (Cyprium or the Company), a copper developer focused on recommencing production at the Nifty Copper Complex in the Paterson region of Western Australia (Nifty), has upgraded its mineral resource estimate for its 100% owned Maroochydore Copper-Cobalt Project (Maroochydore). The Maroochydore project is also located in the Paterson region of Western Australia, 81km from the Nifty Copper Complex.

Highlights of the Resource Upgrade include:

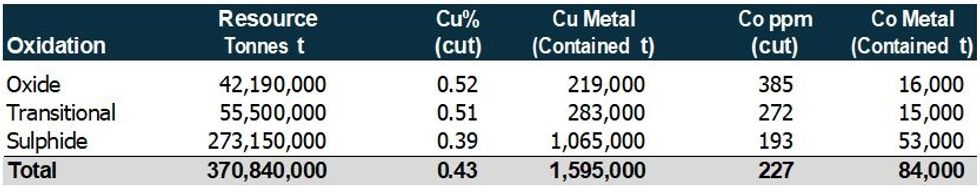

- Inferred resources of 370,800,000 tonnes at 0.43% Cu and 227 ppm Co for 1,595,000 contained copper and 84,000 tonnes contained cobalt at 0.25% Cu cut-off grade.

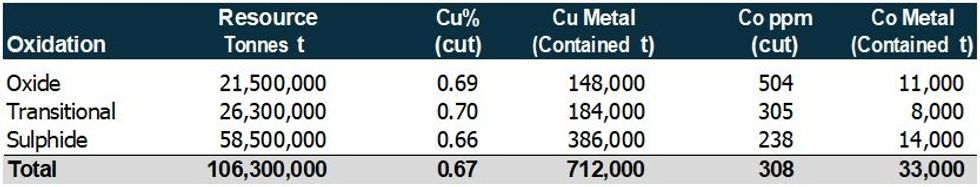

- Higher-grade zone contained within the inferred resource of 106,300,000 tonnes at 0.67% Cu and 308 ppm Co for 712,000 tonnes contained copper and 33,000 tonnes contained cobalt at 0.45% Cu cutoff grade.

- Sedimentary copper mineralisation style demonstrating significant continuity of mineralisation and resource scale - similar geology to nearby Nifty Copper Complex.

- Higher grade domain will be further studied as satellite feed operation to Cyprium’s nearby Nifty mill and concentrator in the Paterson district.

Cyprium Executive Chair Matt Fifield commented: “Maroochydore has seen little attention over the last decade - previous work was focused on the near-surface copper oxide mineralization. Cyprium recognised the same sedimentary copper mineralisation style that we have at Nifty and turned our attention to the potential of the copper sulphide resource. We remodelled the historic resource from first principles and included an additional 19,456 meters of core and RC drilling that was available.

The results are clear – Maroochydore is a very large, near-surface sulphide resource with a higher- grade zone that has high potential to be a medium-term expansion project for Cyprium. An important moment for Cyprium, and a potential meaningful source of Australian copper and cobalt.”

0.25% Cu cutoff. Metal grades take into account top and bottom cut. Numbers are rounded to reflect a suitable level of precision and may not sum due to rounding. The reported contained metal is not the same as a "recoverable" or "marketable" amount, as recovery rates and other factors can influence how much metal can be extracted. See accompanying technical report for additional details and important disclosures.

0.45% Cu cutoff. Metal grades take into account top and bottom cut. Numbers are rounded to reflect a suitable level of precision and may not sum due to rounding. The reported contained metal is not the same as a "recoverable" or "marketable" amount, as recovery rates and other factors can influence how much metal can be extracted. See accompanying technical report for additional details and important disclosures.

Updated Resource Model Shows Near-Surface, Flat-lying Sedimentary Copper System

Maroochydore is a sediment-hosted deposit type located in the Paterson region of Western Australia. The project is 81km by air and ~100km by unsealed road from Cyprium’s Nifty Copper Complex.

Stratigraphy at Maroochydore is part of the Broadhurst Formation (Yeneena Group) similar to the nearby Nifty Copper Complex.

The deposit is a mixture of oxide/supergene and primary sulphides. The upper resources are dominated by oxide and transitional materials hosted in the 50 to 100m thick mineralised horizon consisting of carbonaceous shales and recrystalised dolostones.

The structural framework that hosts the mineralised sequence is less restricted than what is found at Nifty, which leads to Maroochydore’s more extensive and diffuse mineralisation system. Current mineralised material is defined over a strike length of ~7km and is shallow, with cover varying from 20m depth at the south-eastern end to 80m depth at the north-western end, and relatively flat lying.

Click here for the full ASX Release

This article includes content from Cyprium Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CYM:AU

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 March 2025

Cyprium Metals

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth

Advancing Western Australia’s historic Nifty copper mine for near-term production and long-term growth Keep Reading...

23 January

Capital Raise Presentation

Cyprium Metals (CYM:AU) has announced Capital Raise PresentationDownload the PDF here. Keep Reading...

22 January

A$41M Capital Raise via Placement & Entitlement Offer

Cyprium Metals (CYM:AU) has announced A$41M Capital Raise via Placement & Entitlement OfferDownload the PDF here. Keep Reading...

19 January

Paterson Exploration Review Update

Cyprium Metals (CYM:AU) has announced Paterson Exploration Review UpdateDownload the PDF here. Keep Reading...

19 November 2025

Cathode Restart Approved by Cyprium Board

Cyprium Metals (CYM:AU) has announced Cathode Restart Approved by Cyprium BoardDownload the PDF here. Keep Reading...

13 November 2025

Senior Loan Facility Refinanced with Nebari

Cyprium Metals (CYM:AU) has announced Senior Loan Facility Refinanced with NebariDownload the PDF here. Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Sign up to get your FREE

Cyprium Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00