Investor Insight

Troy Minerals’ focused growth strategy—anchored by two high-purity silica projects nearing production and a diversified exploration portfolio targeting critical minerals—positions the company as a compelling investment opportunity with strong future upside..

Overview

Troy Minerals (CSE:TROY;OTCQB:TROYF;FSE:VJ3) is a rapidly emerging player in the critical minerals space, focusing on the development of high-purity silica and other essential materials for the clean energy transition.

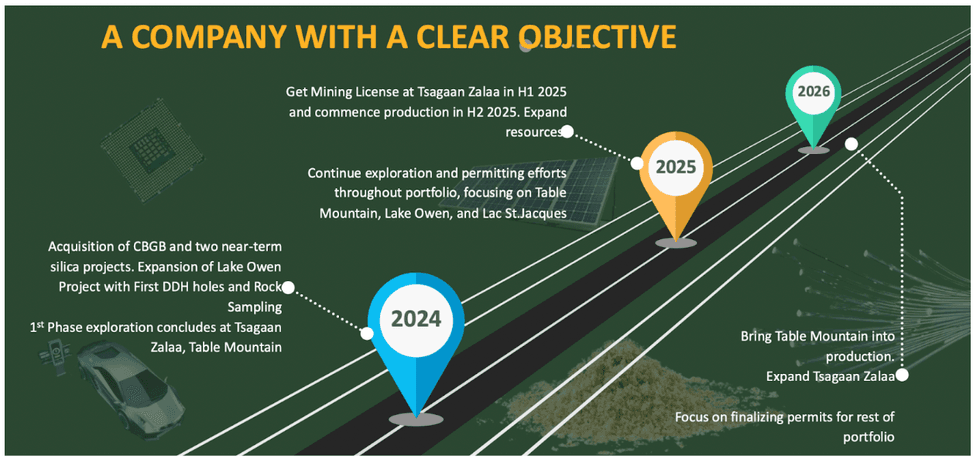

Troy Minerals’ diverse portfolio targets the rising demand for raw materials in high-growth sectors like renewable energy and semiconductors. Leading the portfolio are two high-purity silica projects—Table Mountain (British Columbia) and Tsagaan Zalaa (Mongolia)—acquired through the strategic purchase of CBGB Ventures in September 2024. Tsagaan Zalaa is slated for production within 2025, followed by Table Mountain in 2026. These assets support Troy’s strategy to become a key supplier of critical minerals for the global energy transition.

Troy Minerals is targeting a transition from an exploration company to a production company, a move expected to significantly increase our shareholders value.

Troy Minerals is advancing exploration in titanium, vanadium and rare earths through projects in Wyoming, USA, and Quebec, Canada—broadening its exposure to critical minerals essential for industries like aerospace and energy storage.

Its assets are strategically located near key infrastructure and major markets such as the US and China, positioning the company to create significant shareholder value through exploration, development, and future production.

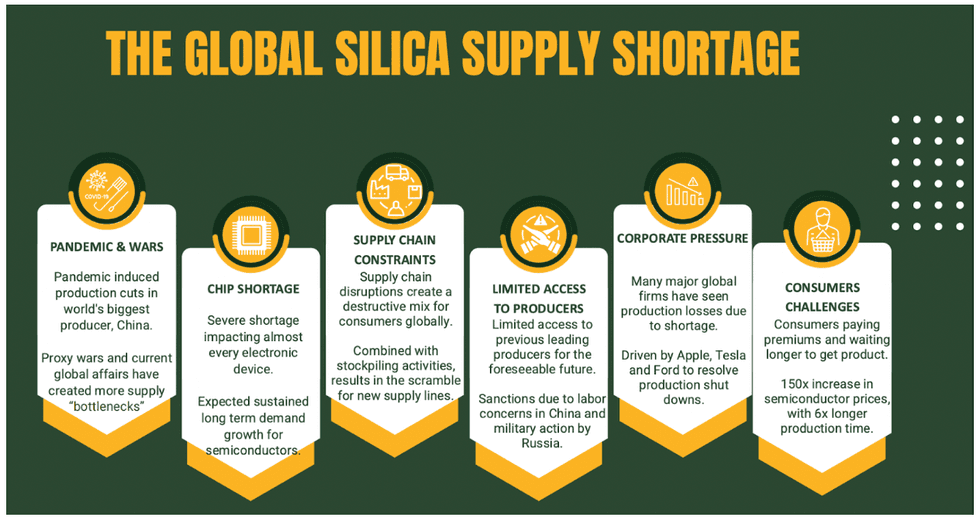

High-purity silica—vital for solar panels, semiconductors, and advanced high-quality glass—is central to the clean energy transition. Troy’s high-grade silica assets are well-suited for these applications, with the global market projected to reach US$104.34 billion by 2030.

With supply shortages worsened by geopolitical tensions and supply chain disruptions, Troy is well-positioned to become a key supplier, targeting near-term production at both its silica projects.

Troy Minerals maintains a diversified portfolio with key vanadium and rare earth element (REE) assets essential to EVs, renewable energy storage, and advanced electronics. The Lake Owen project in Wyoming is prospective for titanium and vanadium, while Lac St. Jacques in Quebec targets REEs—especially neodymium and praseodymium. In its recent corporate news release, Troy announced the discovery of scandium, the first metal element in the REE sequence at Lake Owen Project.

Vanadium supports vanadium redox flow batteries (VRFBs), a scalable energy storage solution for renewables. REEs are critical for permanent magnets used in wind turbines, EV motors, and electronic devices.

Scandium has green-energy technologies applications, but additionally it is the most effective known microalloying element that can strengthen aluminium, while also offering improved flexibility, resistance to heat and corrosion, and lighter weight, therefore Scandium finds applications in the space, military and civilian aviation industries.

Company Highlights

- Troy Minerals acquired CBGB Ventures in September 2024, securing two flagship high-purity silica projects in British Columbia and Mongolia.

- The Tsagaan Zalaa project in Mongolia is in mine permitting stage, being targeted to commence high-purity silica production within 2025, thereby positioning the company as a key supplier for the solar and semiconductor industries.

- The Table Mountain project in British Columbia is being targeted to begin high-purity silica production by 2026, with a 24-month development timeline. A maiden NI43-101 MRE is anticipated within Q2 2025.

- High-purity silica, similar to the company’s projects, is critical for solar panel production, semiconductors, fiber optics and high-performance glass.

- At its 100 percent owned Lake Owen Project in Wyoming, USA, the company has recently announce a Scandium discovery in its first two drilled holes.

- The company also maintains an exploration portfolio of critical mineral assets, including vanadium and REE, in tier 1 jurisdictions.

Key Projects

Tsagaan Zalaa Project (Mongolia)

The Tsagaan Zalaa project, located near the China-Mongolia border, is a near-term high-purity silica asset that is being targeted to commence production within 2025. The project’s proximity to key consuming markets, such as China, Japan and Korea, provides significant logistical advantages for the transportation of silica.

Tsagaan Zalaa’s silica deposits boast purity levels above 99 percent, making them suitable for advanced technological applications such as solar panels, semiconductors and fiber optics. The project’s minimal overburden and low strip ratio make extraction cost-effective, further enhancing its economic potential. Given the global demand for high-purity silica, this project has the potential to generate significant revenue for the company.

Troy Minerals has completed drilling and environmental studies at its Tsagaan Zalaa project and submitted a mining license application in February 2025. Government approval is anticipated in Q2 2025.

Table Mountain Project (British Columbia)

The Table Mountain project in British Columbia is a high-purity silica asset with strong near-term production potential. Spanning 1,698 hectares, it benefits from excellent infrastructure access, including roads, power, and natural gas, positioning it as a strategically located asset for the North American market. Troy Minerals expanded the project in 2025 through direct staking of two additional mineral claims totaling 606 hectares, contiguous to the existing property.

Recent analytical results confirmed broad zones of high-purity silica, reinforcing the project’s suitability for critical applications such as solar panels, high-performance glass, and electronics. Troy Minerals has submitted a drilling permit application and is advancing the project toward production, targeted for 2026, following a 24-month development timeline.

An NI43-101 compliant maiden Mineral Resource Estimate (MRE) is expected to be announced and filed within Q2 2025.

With rising demand for high-purity silica and growing emphasis on regional supply chain security, Table Mountain is well-positioned to help reduce North America’s reliance on imports and support the clean energy transition.

Lake Owen Project (Wyoming)

The Lake Owen project, located 50 km southwest of Laramie, Wyoming, is an early-stage exploration asset with strong potential for vanadium, titanium, and other critical minerals. Covering 1,932 acres (782 hectares), the project sits within the Proterozoic Lake Owen mafic to ultramafic layered intrusive complex, geologically favorable for titanomagnetite-hosted mineralization.

Troy Minerals has announced a strategic expansion of its Lake Owen Project, significantly increasing its land position in this highly prospective region. The project has effectively doubled in size—from 714 hectares to 1,433 hectares—through the addition of adjacent claims secured via recent targeted staking. These newly acquired claims are well-located, with excellent access to existing infrastructure, and cover ground considered highly prospective for critical mineral discoveries.

Recent drilling results have confirmed the presence of high concentrations of vanadium pentoxide (V₂O₅) and titanium dioxide (TiO₂), along with the discovery of scandium and rare earth elements, significantly enhancing the project’s critical mineral profile. Additionally, the presence of platinum group elements and gold adds further exploration upside.

Lake Owen is supported by the US Geological Survey (USGS)’s Earth MRI (Earth Mapping Resources Initiative), which is delivering key geoscientific data and helping reduce exploration costs. As part of this initiative, a high resolution airborne magnetic and radiometric survey has been recently flown by USGS covering Troy’s Claims. This federal backing highlights the project’s strategic importance within the US critical minerals landscape. The data have become available to Troy, which is currently designing the 2nd Phase, H2 2025, exploration program.

Lac St. Jacques Project (Quebec)

The Lac St. Jacques project, located 250 km north of Montreal, Quebec, is a rare earth element (REE) exploration asset spanning 2,889 acres (1,169 hectares). With excellent road access and nearby hydroelectric power, the project offers cost-effective logistics and a sustainable energy source for future development.

Rare earth mineralization at Lac St. Jacques is hosted in pegmatitic syenite and granite intrusives, with a carbonatite deposit rich in light REEs—particularly neodymium and praseodymium. These elements are critical for manufacturing permanent magnets used in EV motors, wind turbines, and other advanced technologies. Recent drilling has returned promising results, with neodymium and praseodymium concentrations ranging from 500 to 2,000 parts per million, underscoring the project’s strong potential.

The company is currently executing a DDH drilling program at Lac St. Jacques. Results are anticipated in the coming months.

Management Team

Yannis Tsitos - President

Yannis Tsitos has over 35 years of experience in the mining industry, having spent 19 years with the BHP Billiton group. He has worked on projects in 32 countries including Mongolia, lived and worked in South Africa, Ecuador, Greece and the United Kingdom, and has been working in Canada since 2000. Originally a physicist-geophysicist, he left BHP in 2008, where he had the title of new business manager for Global Minerals Exploration. He has been instrumental in the identification, negotiation and execution of more than 50 exploration, joint venture, royalty, mining and commodity trading agreements over 11 different commodities with juniors, majors, as well as with state exploration and mining companies. He was the president of Goldsource Mines till its recent acquisition (July 2024) by the precious metals' producer, Mako Mining. Tsitos sits on several companies' boards as an Independent Director, has published articles in exploration and mining magazines on relevant topics and has been a strong advocate of anti-corruption policies in the mining industry.

Rana Vig - CEO and Director

Rana Vig has more than 30 years of business experience, helping launch five business ventures in the private sector. He has been involved in publicly traded companies since 2010, and from 2011 to 2016 he was the president of Musgrove Minerals, an Idaho-focused gold and copper mining exploration company. From 2013 to 2016, he was the chairman and CEO of Continental Precious Minerals, a TSX senior board listed mining exploration company with a focus on advancing one of the largest uranium deposits in the world located in Sweden. Vig was a recipient of the Senate 150th Anniversary Medal, awarded to top Canadians actively involved in their communities who, through generosity, dedication and hard work, make their hometowns and communities, a better place to live.

Norman Brewster - Director

Norman Brewster’s mineral industry career includes serving on various company boards, financing and developing the Aguas Tenidas Mine in Spain, and negotiating the purchase of the Condestable Mine in Peru. He also led the committee in reviewing the successful acquisition of Iberian Minerals by the Trafigura Group in an all-cash takeover valued at around $497.8 million.

Gurdeep Bains - Director

Gurdeep Bains is a chartered professional accountant. He received his chartered accountant designation from the Institute of Chartered Accountants of BC in 2003 and in 2004 graduated from Simon Fraser University with a Bachelor of Business Administration. From 2000 to 2005, he was a senior auditor, assurance services at KPMG.

From 2005 to 2014, Bains was with Canaccord Genuity as vice-president, internal audit and financial analysis where he was involved in the company’s global expansion by performing the due diligence and integration of $850 million in acquisitions in Canada, US, UK, Australia and China. From June 2014 to October 2017, he was the CFO at OK Tire Stores, an automotive company with over 330 locations across Canada. From October 2017 to March 2019, Bains was CFO at Zenabis, contributing in both finance and business development roles.

Regina Lara Yunes - CFO

Lara Yunes is a chartered professional accountant with a Bachelor of Technology in accounting from the British Columbia Institute of Technology. She is currently a financial reporting manager at Treewalk, providing accounting, financial reporting and compliance services to publicly listed firms. Prior to this, she worked at Smythe LLP as an accountant, offering audit and tax services to both private and public companies.