Tech 5: US Lifts EDA Restrictions for China, Apple Explores Third-party AI for Siri

This week's top tech news to know includes a massive Meta AI restructuring and Apple considering using third-party AI for Siri.

The stock market had a dynamic start to Q3, pushing indexes to new highs after earlier tariff concerns.

On Monday (June 30), markets generally saw strong gains, with the S&P 500 (INDEXSP:INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC) reaching new record highs in the US, while the S&P/TSX Composite Index (INDEXTSI:OSPTX) climbed higher after a last-minute policy reversal to rescind a planned digital services tax targeting US tech firms.

Canadian markets were closed for Canada Day on Tuesday (July 1). As for US markets, following two consecutive days of highs, the S&P 500 and Nasdaq Composite declined after a renewed feud between Tesla (NASDAQ:TSLA) CEO Elon Musk and US President Donald Trump sent Tesla shares down by over 5 percent.

However, tech stocks boosted the performance of both Canadian and US markets on Wednesday (July 2) and Thursday (July 3) after export restrictions to China were lifted and the US labor market reported better-than-expected unemployment data.

US markets were closed on Friday (July 4) for a holiday, while Canadian markets ended the day slightly positive.

1. Meta announces AI restructure, continues talent acquisition

Last weekend, reports surfaced that Meta Platforms (NASDAQ:META) has hired four additional researchers from OpenAI, bringing the total number of high-profile AI talent poached from other tech labs to 13, according to an X post from former Scale AI CEO Alexandr Wang, who was recently recruited as Meta’s Chief AI Officer.

Then, in an internal memo to employees on Monday, Meta CEO Mark Zuckerberg unveiled the company was restructuring its AI division under the name Meta Superintelligence Labs. According to the memo, which was reviewed by Bloomberg, the new division will be led by Wang and one of its commitments is "developing AI 'superintelligence' or systems that can complete tasks as well as or even better than humans."

Meta has reportedly offered researchers contracts and signing bonuses worth up to US$100 million; however, Chief Technology Officer Andrew Bosworth has pushed back on those reports, claiming the figures are inflated.

Helen Toner, a former OpenAI board member and director of strategy at Georgetown’s Center for Security and Emerging Technology, told Bloomberg TV on Thursday that Meta’s bid to become an AI leader would be “difficult” considering its track record of internal dysfunction and questions around the return on its massive talent spending.

“Meta has started to get a reputation of having a little bit of a dysfunctional AI team, not really having its organizational structure set up in a way that really lets them succeed and innovate. And what I think we're seeing here is CEO Mark Zuckerberg really stepping in and saying, well, we have to do something differently. We need a big new push, we need a big new effort," she said.

"I think (Meta is) really trying to start something new, to pour enormous amounts of financial resources into that. So the question (to watch) is six months from now, 12 months from now, is that paying off for them?"

2. Apple considers third-party AI for Siri overhaul

Apple (NASDAQ:AAPL) is reportedly in active discussions with Anthropic and OpenAI to integrate their foundation models into an overhauled version of its voice assistant Siri, a significant pivot from the company’s in-house approach to AI.

According to people familiar with the discussions who spoke to Bloomberg, Apple has asked both companies to train versions of their models that could be tested on Apple’s infrastructure, the publication reported Monday.

Apple announced plans to release a new version of its voice assistant at its Worldwide Developers Conference in 2024. The release was slated for 2026, but the company has run into multiple engineering snags and delays, and ultimately replaced John Giannandrea with Mike Rockwell as the new Siri chief executive.

Rockwell and software engineering head Craig Federighi launched an evaluation, instructing staff to assess Siri’s performance using third-party tech, including Anthropic's Claude, OpenAI's ChatGPT and Alphabet's (NASDAQ:GOOGL) Gemini. According to Bloomberg's sources, the team found Anthropic’s technology most promising for Siri, leading Apple’s vice president of corporate development to open discussions with Anthropic.

Bloomberg’s sources maintain that the development of an in-house model is still active, and Apple hasn't made a final decision on using third-party models.

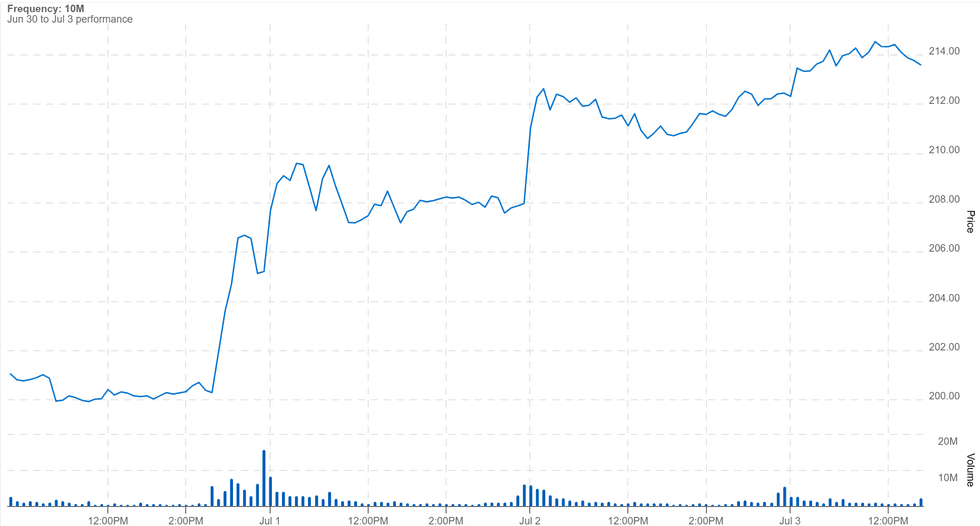

Apple performance, June 30 to July 3, 2025.

Chart via the Investing News Network.

Apple shares closed up 6.24 percent for the week.

3. Oracle and OpenAI ink massive computing deal

OpenAI will rent roughly 4.5 gigawatts of computing power from Oracle (NYSE:ORCL) as part of the Stargate Project, according to sources for Bloomberg. The news follows a US$30 billion single cloud deal announced on Monday with an unnamed customer. The Stargate energy deal is reportedly a component of that larger contract.

Sources added that Oracle will develop multiple data centers in the US, considering sites in Texas, Michigan, Wisconsin and Wyoming, and that the company will expand its recently built center in Abilene, Texas, to accommodate about two gigawatts of power capacity.

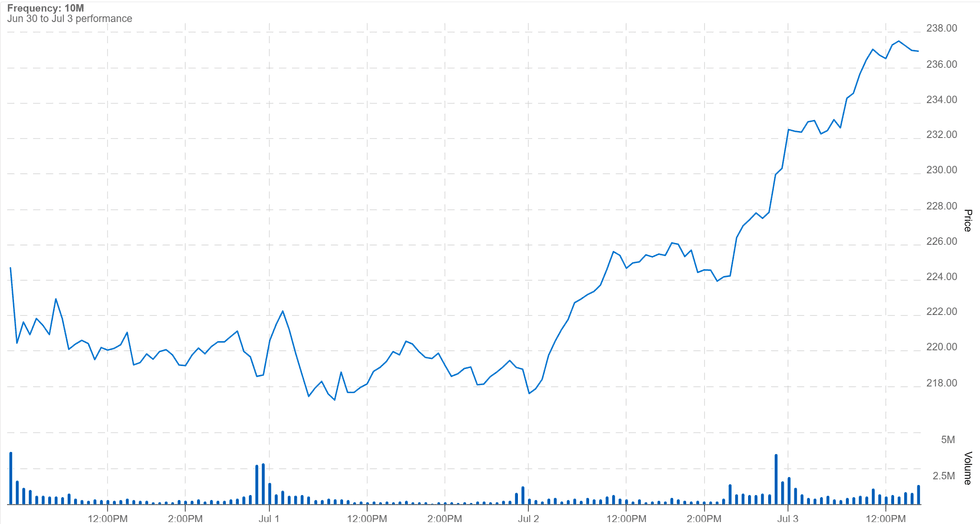

Oracle performance, July 1 to July 3, 2025.

Chart via the Investing News Network.

This collaboration underscores the escalating demand for high-performance computing necessary to train and operate advanced AI models. OpenAI, a leader in AI research and development, requires immense computational resources to fuel its projects, including large language models and other sophisticated AI applications.

The Stargate initiative positions Oracle as a crucial enabler of this next generation of AI innovation, solidifying its role in the evolving cloud and AI ecosystem. The long-term implications of this partnership could see a significant shift in how AI companies acquire and manage their computational infrastructure, potentially paving the way for more dedicated and extensive cloud partnerships in the future.

4. CoreWeave deploys first Nvidia GB300-powered AI server

CoreWeave (NASDAQ:CRWV) said it has received the first AI server system built around NVIDIA's (NASDAQ:NVDA) ultra-powerful GB300 Grace Blackwell AI chip.

The server is deployed within Dell Technologies' (NYSE:DELL) integrated rack-scale system — a turnkey AI infrastructure platform combining compute, networking and cooling — and features 72 of Nvidia’s GB200 chips.

CoreWeave said it will install the cutting-edge hardware in the US and roll out more servers over time. The company will offer the server as part of its AI cloud platform, allowing clients like OpenAI to train and deploy massive, next-generation AI models with faster speeds and greater efficiency.

In the announcement, CoreWeave claimed the NVIDIA GB300 NVL72 significantly boosts AI reasoning performance, offering a 10 times improvement in user responsiveness and five times better throughput per watt than the Hopper server. This translates to an increase of fifty times in reasoning model inference output, enabling faster, more complex AI models.

5. US lifts EDA software export restrictions to China

License requirements for design software sales in China were lifted this week as part of a trade deal between the US and China. On Wednesday, the US Department of Commerce told Synopsys (NASDAQ:SNPS), Cadence Design Systems (NASDAQ:CDNS) and Siemens (XETR:SIE), three of the world’s leading design software providers, that they will no longer need to seek government licenses to conduct business in China.

Official announcements from the companies confirmed they would be resuming business with Chinese counterparts, sending each of their stock prices up between 3 and 6 percent.

The US government restricted sales of electronic design automation (EDA) tools to China in late May as a response to China’s decision to limit shipments of essential rare earth minerals.

Last week, the two countries reached a trade agreement that would re-allow shipments of EDA software after Beijing speeds up approvals of critical mineral exports to the US.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.