10 Biggest EV Stocks to Watch in 2026

Top 3 ASX Cobalt Stocks (Updated January 2026)

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Overview

Canada Nickel Company (TSXV:CNC) is a potential leader in next-generation, large-scale nickel supply and one of the few suppliers outside of Indonesia and China.

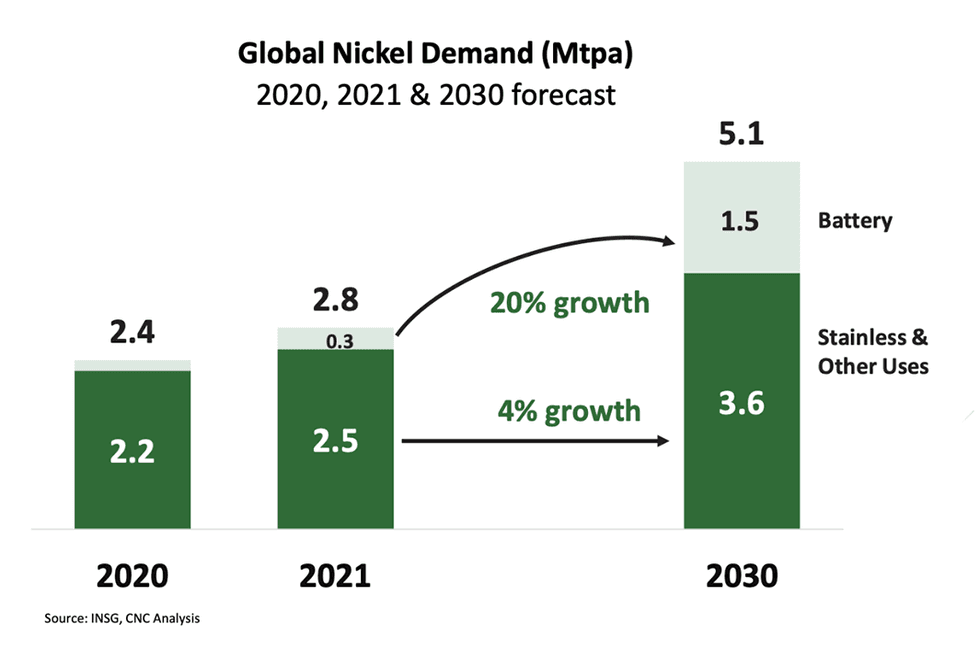

Nickel demand has very sound growth prospects led by its applications in batteries for EVs and stainless steel, and other uses. Global nickel demand has grown at an annual pace of 9 to 10 percent in the first three years of this decade and is expected to continue to maintain that pace going forward, according to the International Nickel Study Group. Canada Nickel has its forecast and expects demand to double by 2030 to more than 5 Mt and potentially upwards of 6 Mt. The bulk of this growth is expected to come from the EV sector.

The nickel supply dynamics contain significant political risks. Just three countries – Indonesia, Philippines and Russia – control over 67 percent of the overall supply, with Indonesia alone accounting for nearly 50 percent. This concentration of supply is risky and any resource outside these three countries will be regarded as highly valuable.

The other issue with the current supply is its high carbon footprint, and the nickel produced is typically termed as “dirty nickel.” Indonesian supply carries a massive carbon footprint, generating 60 to 90 tons of CO2 per ton of nickel produced. Furthermore, integrated Chinese supply chains are unfavorable given the geopolitical tensions between China and many countries.

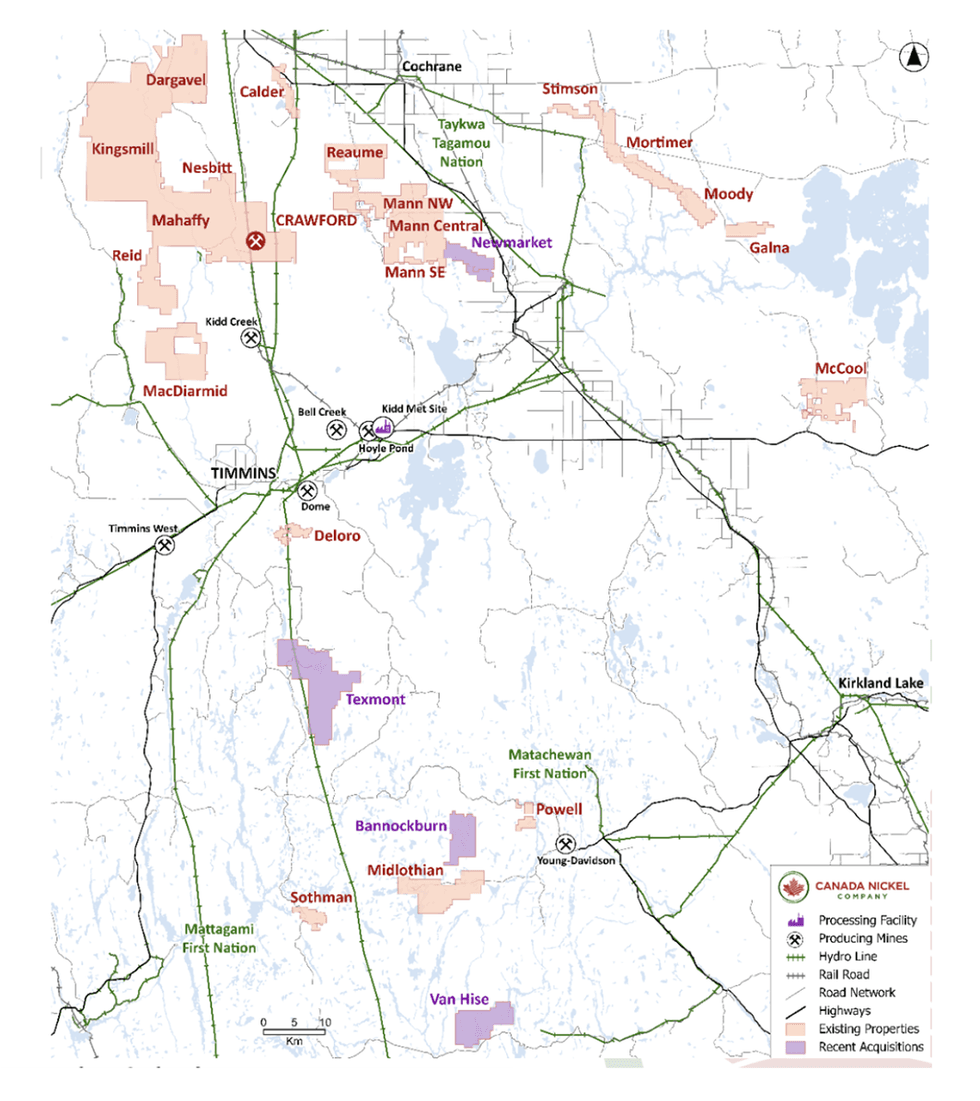

Against this backdrop, Canada Nickel offers the potential for large-scale nickel supply outside of Indonesia and China, with the potential for zero carbon production. The company operates in a substantial new nickel district in the established Timmins mining camp in Ontario, led by its flagship Crawford nickel sulfide project.

The Crawford project has the world’s second-largest nickel reserve. With a mine life of 41 years, the project offers an after-tax NPV of US$2.5 billion and an IRR of 17.1 percent. Factoring in carbon capture and store credits will increase the after-tax NPV to US$2.6 billion and IRR to 18.3 percent. Based on the bankable feasibility study, Crawford is expected to be a low-cost producer with first quartile net C1 cash cost of US$0.39/lb, and net all-in-sustaining costs of US$1.54/lb. The economics suggest a highly profitable mine with an annual EBITDA of US$667 million and annual free cash flow (FCF) of US$431 million over the life of the mine.

The project is expected to be environmentally friendly with a net negative contribution to the global CO2 footprint. Further, Canada Nickel has developed a novel method for accelerated carbon capture and storage called, in-process tailings (IPT) carbonation. The ability to capture and store carbon will make Canada Nickel eligible for carbon credits (current rate at C$25/t) which will provide significant additional revenue on top of the nickel revenue.

Canada Nickel expects to receive the final permits for the Crawford project by mid-2025, after which the decision for construction will be taken. The project is anticipated to start production by the end of 2027.

Besides the Crawford project, Canada Nickel also owns or holds the option to own 25 additional targets in the Timmins region, all within proximity of the Crawford project. Eleven of these targets have similar mineralization to Crawford and have a larger footprint. Thus, Canada Nickel aims to unlock a district-scale nickel camp in the Timmins region.

The potential of the region is further endorsed by several investments from mining majors and other global companies. Samsung SDI announced an investment of US$18.5 million by buying 15.6 million shares at C$1.57/share. Following this, Samsung SDI now owns approximately 8.7 percent of Canada Nickel shares on a non-diluted basis.

Samsung SDI’s investment follows Agnico Eagle’s investment in early January 2024, whereby it purchased a 12 percent stake in Canada Nickel. Anglo American, a major global miner, also invested C$24 million in Canada Nickel for a 9.9 percent interest. We believe these investments underscore confidence in the potential of Crawford.

Canada Nickel also recently announced that it intends to develop Downstream Nickel and Stainless Steel Facilities in Timmins Region under a wholly owned subsidiary, NetZero Metals. This is expected to be the largest nickel processing facility in North America and largest stainless-steel and alloy production facility in Canada to fill a key gap in the North American electric vehicle supply chain – utilizing proven, low environmental footprint technology.

Each production facility is expected to use Canada Nickel’s carbon storage capacity at its Crawford Nickel project to deliver zero carbon nickel and stainless steel and alloy production. The Company is currently at the site-selection stage, considering several sites in the region. The Company is also in the process of choosing engineering firms to complete the design of both facilities and expects to announce the selected firms shortly. Feasibility studies are underway and expected to be completed by year-end, with the nickel processing plant expected to begin production by 2027.

Mike Cox, will lead NetZero metals and has assembled a global experienced team. Mike has 35 years of nickel processing experience and senior leadership positions with Inco Ltd. and Vale SA overseeing a global portfolio of nickel refineries.

The funding for each project expected to come from various government programs (Federal/provincial/DOD) and potential partners (multiple discussions underway).

Company Highlights

- Canada Nickel Company is focused on delivering large-scale nickel supply via its flagship property, the 100 percent owned Crawford Nickel Sulphide project in Timmins, Ontario.

- The presence in the prolific Timmins mining camp with access to excellent infrastructure and proximity to other producing mines is a positive.

- Crawford’s bankable feasibility study demonstrates strong financial returns based on a large resource with significant upside potential. The project boasts of the world’s second-largest nickel reserves, with approximately 3.8 million tons (Mt) with a mine life of 41 years, after-tax NPV of US$2.5 billion, and IRR of 17.1 percent (excluding projected carbon capture and store credits).

- Nickel demand prospects are very bright, driven by the increasing demand for batteries needed for electric vehicles. The nickel market is expected to remain in a shortfall in the medium to long term with little supply outside of Indonesia and China.

- The Crawford project has the potential to produce net-zero carbon nickel. A large and zero carbon production source of supply away from Indonesia and China makes it very attractive.

- Several established companies have large ownership in the company. Agnico Eagle holds a 11 percent stake, Samsung SDI holds 8.7 percent and Anglo American maintains 7.6 percent ownership. Such significant investment by major global companies increases confidence in the potential of the company’s assets.

Get access to more exclusive Nickel Investing Stock profiles here