Top 5 Canadian Cobalt Stocks (Updated January 2026)

5 Best-performing Gold Stocks on the TSX

Overview

Nord Precious Metals (TSXV:NTH, OTCQB:CCWOF, FF:4T9B) focuses on acquiring and redeveloping past-producing properties in pro-mining jurisdictions, with a portfolio of high-grade silver and cobalt properties with historic production in the Gowganda and Cobalt mining camps of Northern Ontario. The company also has 14 battery metals (nickel, copper, cobalt) properties in northern Quebec.

Silver should be top of mind for investors interested in renewable energy. The precious metal has long been prized as a store of value, but its conductive properties make it ideal for electronics — including emerging clean technologies. Silver and cobalt are essential metals in renewable energy technology. Cobalt is used in three main types of lithium-ion electric car batteries, while silver is used in 90 percent of crystalline silicon photovoltaic cells, a solar panel component.

Many analysts also highlight silver’s vital role in solar projects. The European Union recently announced a mandate for new solar panels on public and commercial buildings, which alone will contribute significantly to silver demand.

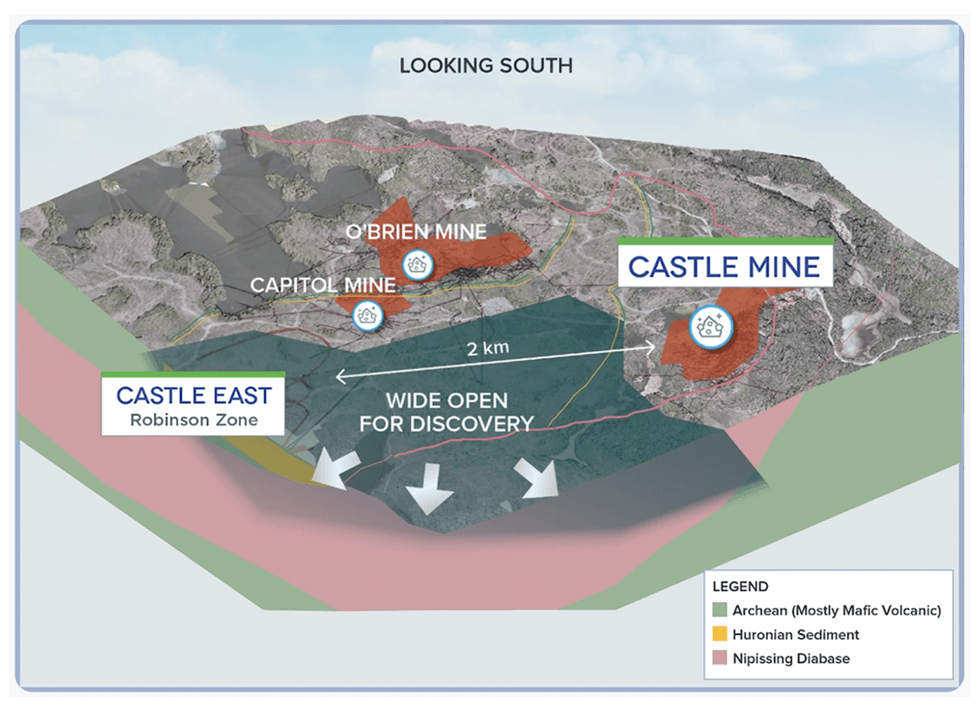

Nord Precious Metals is advancing the Castle Project, which has the highest silver grades in the world, with also gold and cobalt present. The project is located in Canada's silver-cobalt camp in Northern Ontario where, historically, 600 million ounces of silver and 30 million pounds of cobalt were mined in the 1900s. Nord's recent discovery at Castle East of drill grades up to 89,853 g/t silver (2,621 oz/ton) proves there is a lot more very high-grade silver still remaining to be mined in the camp.

With its exploration success and acquisition of the TTL high-grade processing facility in the center of the camp, Nord is leading the way in the necessary redevelopment of the camp to meet the need for greater amounts of silver for solar panels and cobalt for EV batteries for the energy transition from a safe and ecologically sound jurisdiction.

Castle East is currently in the advanced exploration stages with the potential to play a significant role in filling the anticipated increased demand for silver. Nord Precious Metals is presently working towards updating the project’s resource estimate, completing environmental baseline studies, preparing for its preliminary economic assessment and leveraging machine learning to identify drill targets.

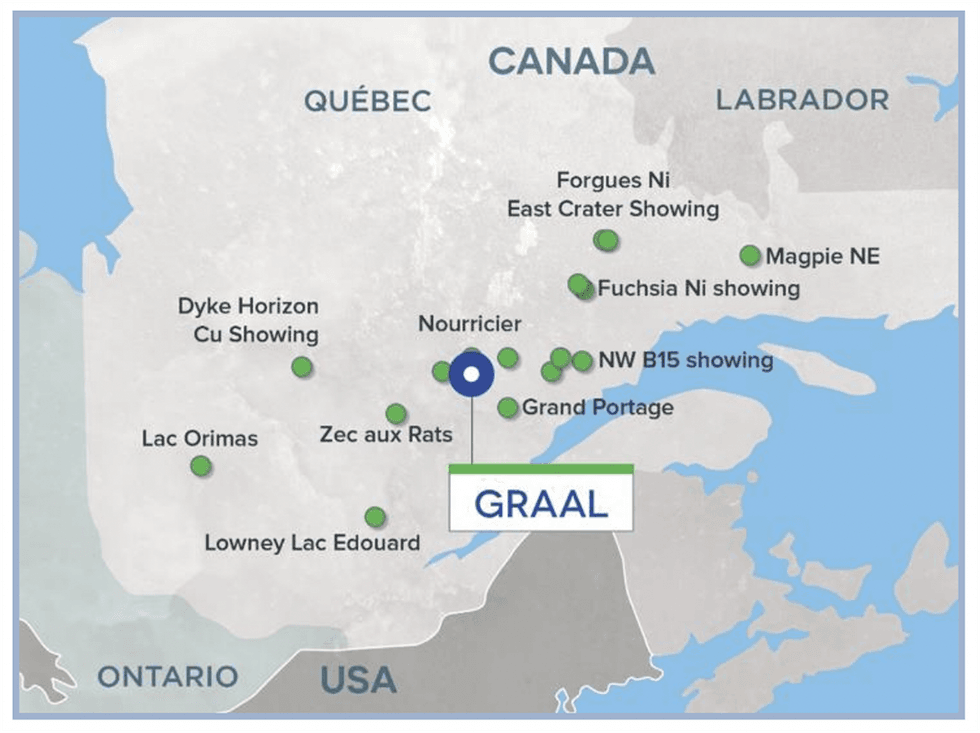

The company’s portfolio also includes the Eby-Otto gold project, the Graal battery metals project and the Beaver/Violet silver-cobalt projects. The tailings and waste rock piles at both the Castle and Beaver projects represent the potential for near-term revenue generation for Nord Precious Metals . Historic mining methods were not as efficient as today’s technologies, which provides an opportunity for the company to leverage substantial amounts of metals that may still remain in the waste piles. An updated NI 43-101-compliant technical report dated April 6, 2023 was filed by the company on SEDAR for its Graal nickel and copper project.

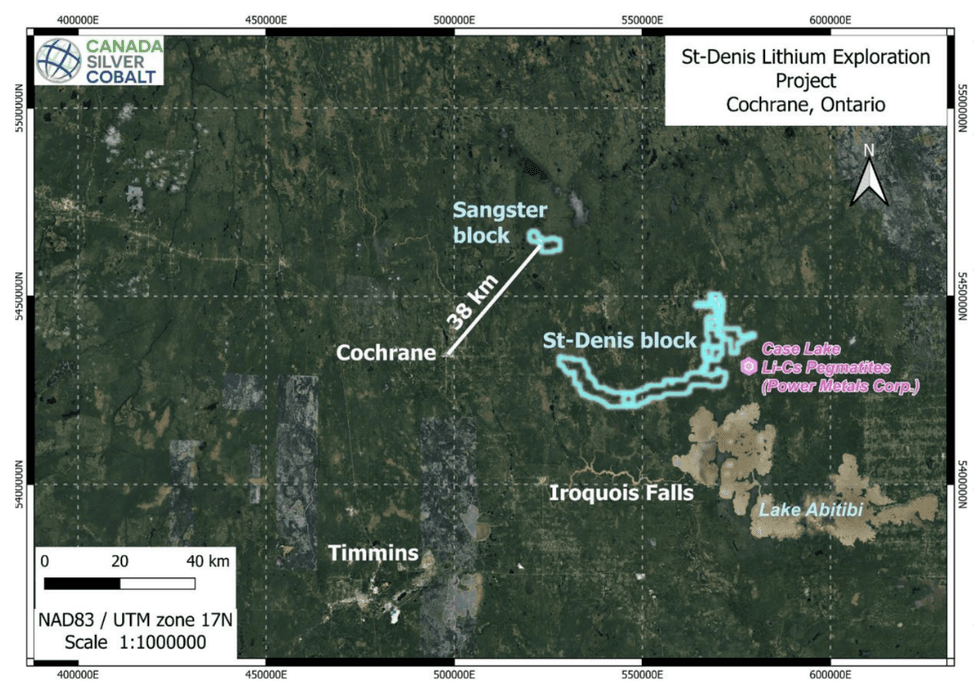

Nord Precious Metals also expanded its greenfield lithium holdings between Case and Stimson Townships in the Cochrane District, Ontario, by staking new claims for a total holding of 230 square kilometers. The claim package is contiguous to Power Metal's Case Lake Lithium Property where the West Joe Dyke and Main Dyke areas revealed some significant lithium grades, such as 1.58 percent lithium oxide (Li2O) over 15 meters in PWM-22-134. An airborne geophysical is being conducted at the property.

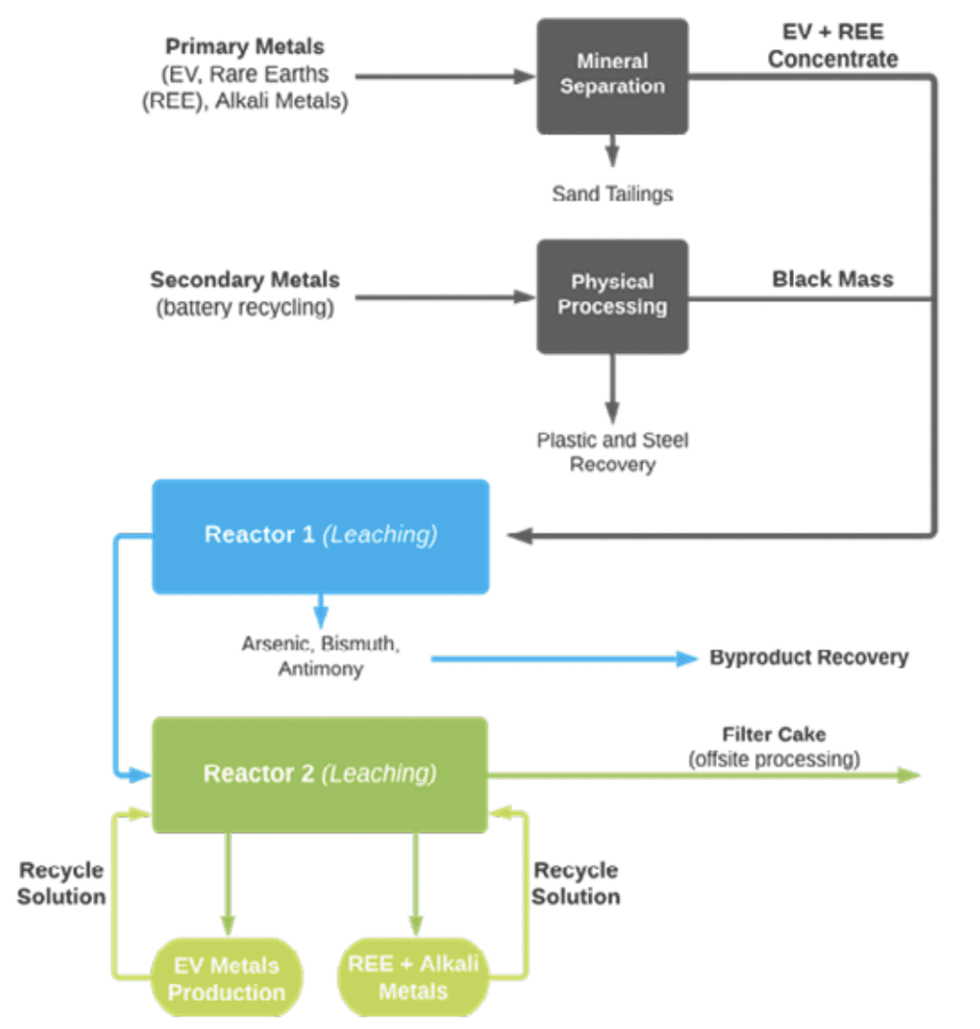

The Re-2Ox Process Flow Chart

Nord Precious Metals aims to create a suite of cobalt salts (powder) products for potential customers through a unique 100-percent-owned hydrometallurgical process called Re-2OX. Designed for high recoveries of multiple metals and elements from all feeds with varying chemistries, the Re-2OX process has taken on fresh importance in light of the increasing demand for cobalt and compelling opportunities in the battery and renewable energy sectors.

The company’s fully certified Temiskaming Testing Labs facility, which has the dual function of being an assay laboratory and a bulk sampling facility, is close to both the Castle and Beaver properties.

Nord Precious Metals CEO Frank Basa developed the Re-2OX in conjunction with the National Research Council, Canada’s premier scientific research organization. Basa has more than 35 years of global experience in mining and development. He is joined by a management team with combined expertise in corporate administration, international finance and geology.

Company Highlights

- Nord Precious Metals is an exploration and development company focusing on silver, cobalt and other battery metals to serve current and future clean energy needs.

- The company has 100 percent ownership of several formerly producing properties, including the Castle Mine in the Gowganda mining camp, and the Beaver and Violet silver-cobalt mines in the Cobalt mining camp. The company’s primary goal is to use modern mining techniques to resume underground mining at these properties.

- Nord Precious Metals has near-term revenue generation potential in tailings and waste rock piles. Preliminary metallurgical testing returned excellent silver and cobalt recoveries and concentrate grades.

- Castle Mine's historic production of 9.5 million ounces (Moz) of silver and 300,000 lbs of cobalt; grade averaged 25 oz/t silver (777 g/t silver) from 1923 to 1930, and 26 oz/t silver (808 g/t silver) from 1979 to 1989.

- Nord Precious Metals' proprietary Re-20X process aims to directly supply manufacturers with valuable cobalt products to aid clean energy production.

- The company expanded its Greenfield Lithium holdings between Case and Stimson Townships in the Cochrane District, Ontario, by staking new claims for a total holding of 230 square kilometers..

Key Projects

Castle Mine Project

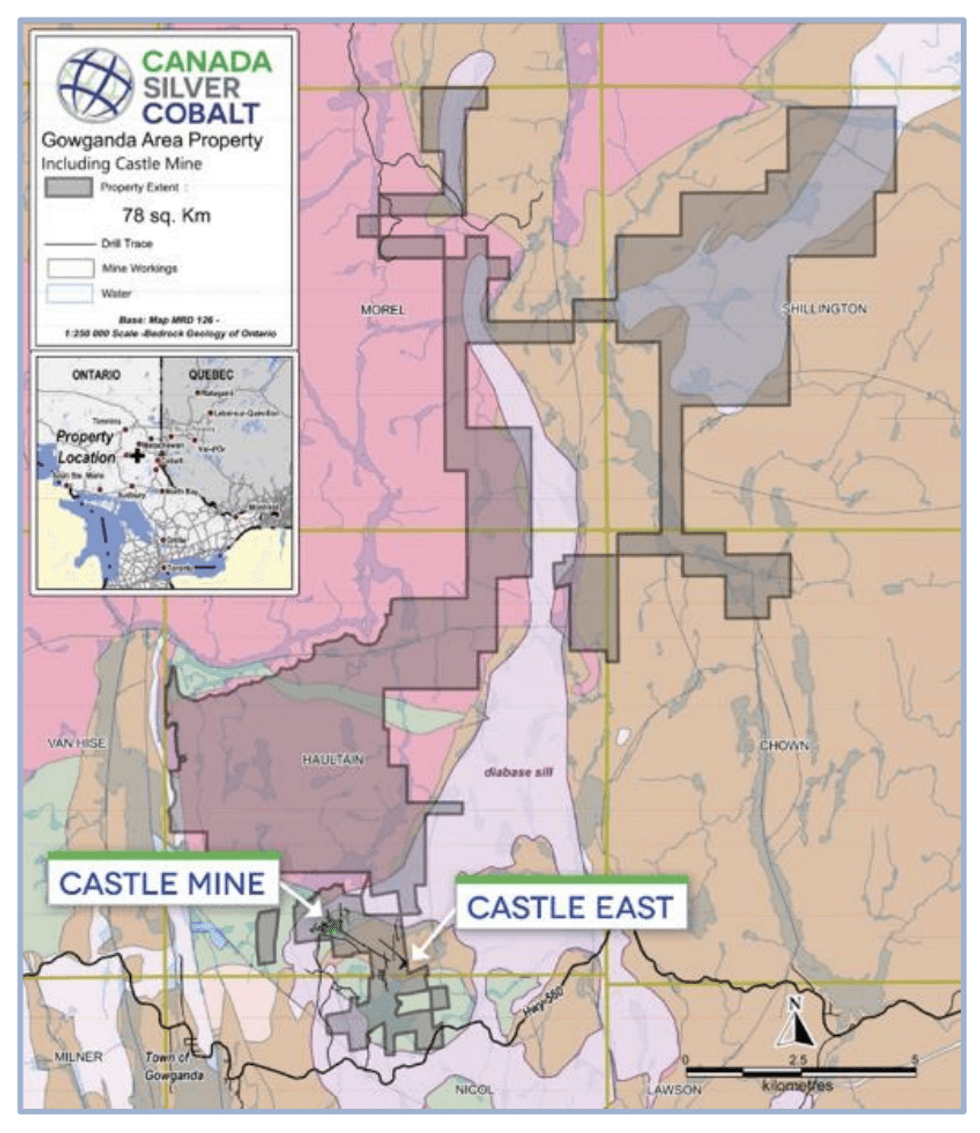

The Castle Mine project, which includes Castle East, covers a 78-square-kilometer property located in the historic Gowganda mining camp and 85 kilometers northwest of Cobalt, the center of the historic cobalt-silver mining camp in Ontario, Canada. The company is currently working towards completing environmental baseline studies, working towards its preliminary economic assessment and identifying drill targets by leveraging machine learning technology.

Project Highlights:

- Historic Silver Production: The Nord Precious Metals mine project includes the former silver and cobalt mine, which produced 300,000 lbs of cobalt and 9.5 Moz of silver. Historic underground ore grades averaged 25 oz/t silver (777 g/t silver) during production years 1923 to 1930, and 26 oz/t silver (808 g/t silver) between 1979 and 1989.

- Underexplored Cobalt Asset: Despite the past silver production at Castle, the property remains mainly underexplored and is highly prospective for hosting significant high-grade underground deposits. The veins in the cobalt camp are primarily cobalt veins with varying amounts of silver. Mining in the past focused on the veins with high-grade silver, while low-grade silver veins were ignored even if they had high-grade cobalt. Therefore, the area today has large amounts of cobalt and silver remaining with opportunity for profit.

- Promising Geological Features: Two geological trends have been identified on the property, including a north-south trending Nipissing diabase intrusive, which is the typical host rock for silver-cobalt-nickel deposits in the area; and the potential gold trend along the east-west trending Bloom Lake Fault. Infrastructure includes year-round access roads, water, diesel power and three adits.

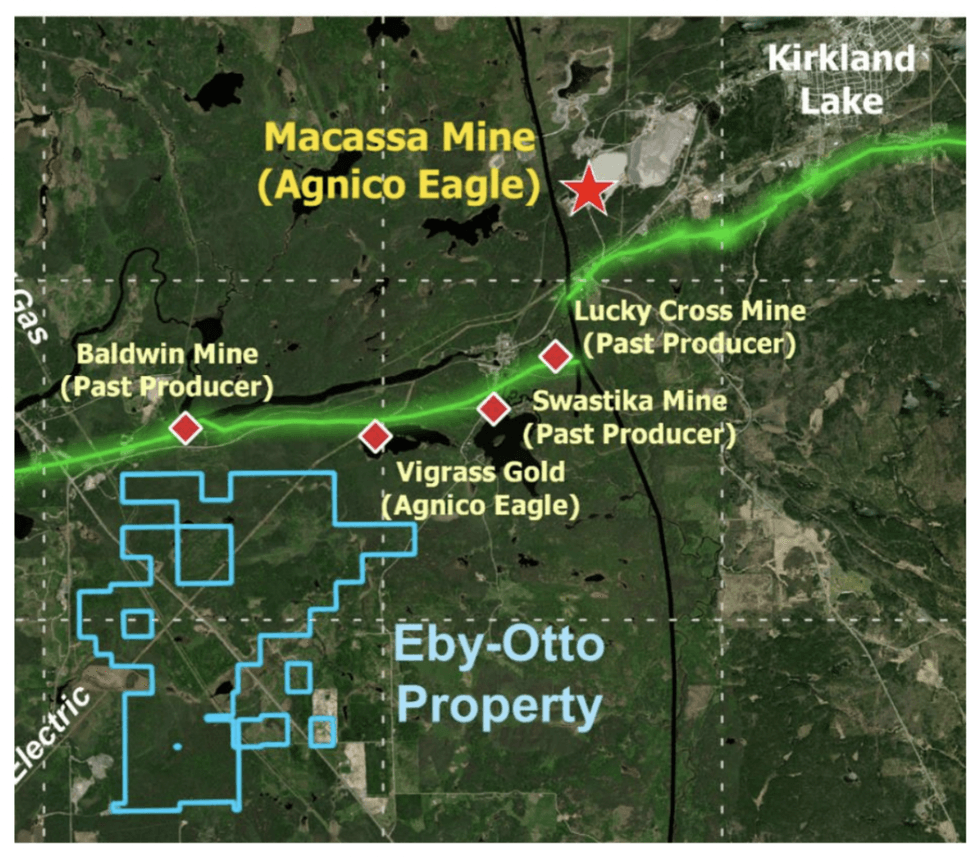

Eby-Otto Gold Project

The company’s highly prospective Eby-Otto gold asset covers 1,000 hectares of exploration properties in a prolific high-grade gold district in Northern Ontario. The region has produced more than 24 Moz of gold in the past 100 years, creating tremendous blue-sky potential for the asset.

Project Highlights:

- Encouraging Strike Mineralization: The asset contains an identified 2-kilometer strike length with multiple, strongly altered and mineralized quartz veins outcropping at surface. The type of mineralization is typical of gold-bearing veins within the district.

- Completed Exploration Survey: A recent geophysical drone mag survey campaign was completed at a 25-meter line spacing, creating valuable data to inform future campaigns. Additional geophysical work is being done.

- Assessment Underway to Prioritize Drill Targets: Nord Precious Metals is presently completing a comprehensive geological assessment based on geological mapping, stripping key outcrops, channel sampling, and additional exploration assays to identify priority drilling targets.

Graal Battery Metal Project

Nord Precious Metals Graal project covers 6,113 hectares in Quebec and shows potential to become a world-class battery metals camp. An identified 6-kilometer strike length mineralization indicates near-surface copper, nickel and cobalt.

Project Highlights:

- Promising Drill Intersections: A recent drill campaign intersected massive and semi-massive sulfides in most drill holes. Results include up to 2.08 percent nickel over 0.5 meters, 3.75 percent copper over 0.6 meters, and the additional presence of cobalt, platinum and palladium. Samples are pending lab results for additional details.

- Significant Historic Drilling: Historical drilling has previously indicated a potential target of near-surface tonnage of 30 to 60 million tonnes with a grade range of 0.60 to 0.80 percent nickel, 0.30 to 0.50 percent copper and 0.10 to 0.15 percent cobalt.

A proposed spin-out of the Graal property in Quebec into a separate public company called Coniagas Battery Metals Inc. was approved by the company’s board of directors. Approximately 37 percent of the shares of Coniagas will be distributed to the shareholders of Nord Precious Metals by way of a special dividend, consisting of approximately 11.7 million shares, each accompanied by one-half of a common share purchase warrant.

Beaver Silver-Cobalt Project

The Beaver Silver-Cobalt project is located in Ontario’s historic cobalt mining camp, adjacent to the former Timiskaming silver mine and approximately 80 kilometers southeast of the past-producing Castle mine. The project includes a former producer, the Beaver mine, which produced 7.1 Moz of silver and 139,472 lbs of cobalt averaging 1.4 lbs per tonne from 1907 to 1940.

Project Highlights:

- Excellent Historical Waste Analysis: Sampling of historical waste rock and tailings at Beaver in 2013 returned 7.98 percent cobalt, 3.98 percent nickel, and 1,246 g/t silver. Nord Precious Metals is conducting metallurgical testing to determine if the silver and cobalt remaining in the tailings and waste rock can be effectively recovered using modern technologies.

- Violet Silver-Cobalt Mine: Nord Precious Metals t also holds the formerly producing Violet Silver-Cobalt mine located near the Beaver property in the cobalt mining camp. The Violet mine has historically provided 897,000 ounces of silver. The company plans to conduct additional exploration to expand known mineralizations.

Sangster - St. Denis Properties

The St. Denis lithium exploration project covers a land area of 26,372.55 hectares with 1,648.96 under option. Characterized by pegmatitic outcrops identified at the surface with historic drilling featuring pegmatite intercepts nearby, the project is adjacent to Power Metal’s Case Lake Lithium LCT property, which shows significant lithium grades such as 1.86 percent lithium oxide over 19 meters in PWM-22-135.

Management Team

Frank J. Basa - Chairman and CEO

Frank Basa has more than 35 years of global experience in mining and development as a professional hydro-metallurgical engineer with expertise in milling, gravity concentration, flotation, leaching and refining of silver, cobalt, gold and other metals. He is a member of the Professional Engineers of Ontario and a graduate of McGill University. Basa has been the chairman, CEO and president of Granada Gold Mine Inc. since June 18, 2004.

Matthew Halliday - President, COO and Director

Matthew Halliday graduated from Dalhousie University in 2007, where he majored in Earth sciences then spent the next 13 years in exploration and as a resource geologist with Kirkland Lake Gold, First Cobalt and SGS Geostat.

Robert Suttie - Chief Financial Officer

Robert Suttie specializes in management advisory services, accounting and financial disclosure. Suttie also serves as the chief financial officer for a number of other junior mining and technology companies listed on the TSX-V and CSE.

Dianne Tookenay - Director

Dianne Tookenay holds a certificate in mining law from Osgoode Hall Law School, York University, a joint master of public administration from the University of Manitoba, a bachelor of administration from Lakehead University, and Native Band management and Indian economic development diplomas from Confederation College Applied Arts and Technology. Tookenay’s experience, knowledge and deep roots within the First Nation communities will continue to add significant value to Castle’s development efforts over the coming years.

Daniel Barrette - Director

Daniel Barrette possesses over 15 years of experience in the mining industry, including substantial experience in managing and restructuring mining companies. Barrette was instrumental in the restructuring and development of SearchGold Resources Inc. from 2011 until its successful RTO by Ubika Corp in 2013, including a $54 million financing. He has assisted public and private mining companies in acquiring mineral properties in the Democratic Republic of Congo, including claim staking, and establishing and developing business in the DRC, where Barrette has an extensive network of strategic contacts. Prior to SearchGold, he was COO for Gilla Inc. until its RTO with Snoke Distribution Canada Ltd. and also president and CEO of Affinor Resources Inc.

Ronald Goguen, Sr. - Director

Ronald Goguen has more than 40 years of experience in the mining exploration industry. He served as president and CEO of Major Drilling Group International from 1980 to 2000 and as a director of Northeast Bank from 1990. He was named Atlantic Canada's Entrepreneur of the Year in 1995. He is currently chairman of Colibri Resource and CEO of ONTOP Capital.

Tina Whyte - Corporate Secretary

Tina Whyte brings over 20 years of experience in the corporate and securities industry. Her expertise covers corporate governance, continuous disclosure, financing transactions and regulatory filings and compliance.