How to Invest in Gold Royalty and Streaming Stocks

Top 5 Canadian Cobalt Stocks (Updated January 2026)

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 Canadian Nickel Stocks

Top 5 ASX Nickel Stocks

Top 4 ASX Uranium Stocks

Overview

The electric vehicle boom is unstoppable. Battery-powered cars could reach a 40 percent increase in global sales and the demand for lithium is expected to double to 1.5 million tonnes by 2027. The bullish outlook could be traced back to lithium-ion battery’s ability to charge faster and store higher power capacity in a lighter package.

Although Australia, Chile and China have long been the world’s top lithium producers for years, Argentina has now emerged at the forefront accounting for 21 percent of the world’s reserves. The country’s lithium mining pipeline consists of two that are currently operational, 13 planned and dozens under consideration.

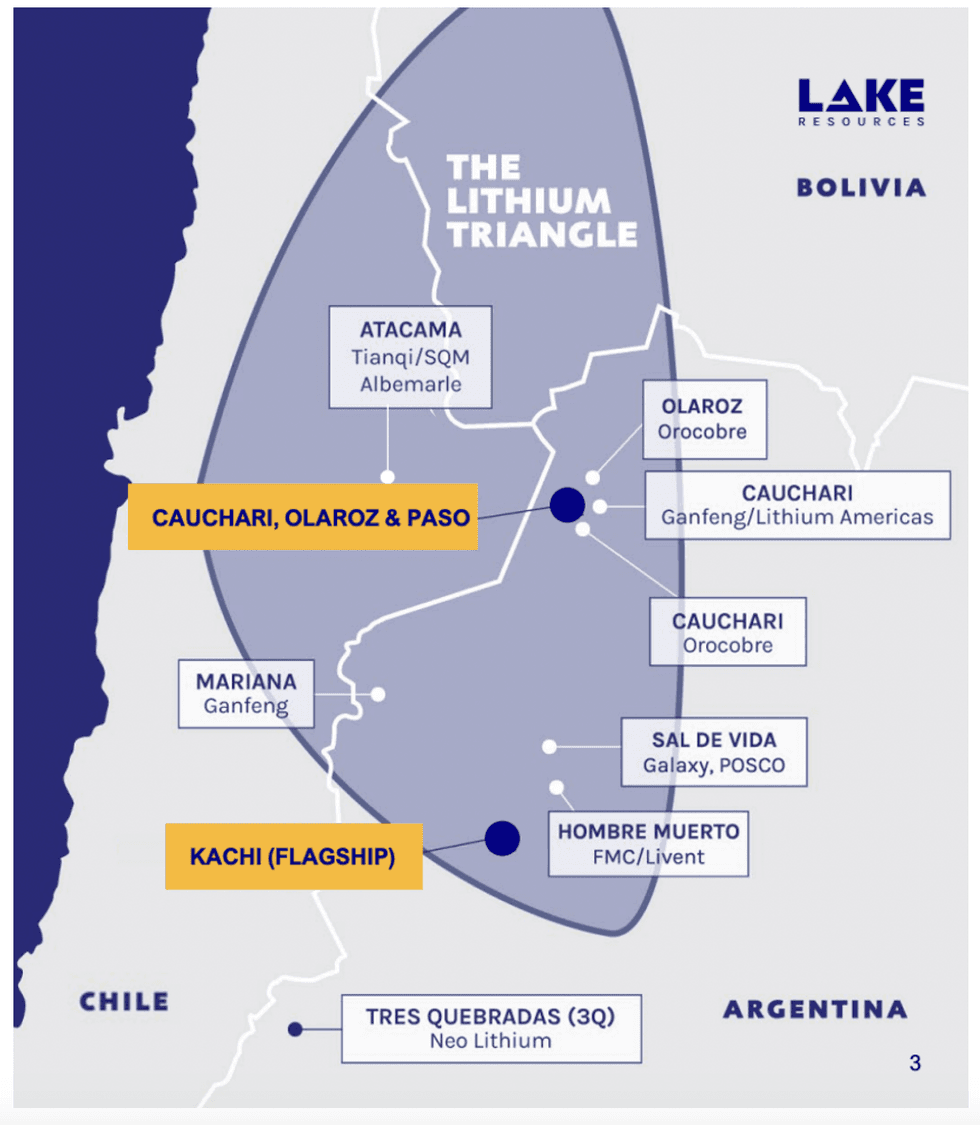

Lake Resources (ASX: LKE,OTCQB:LLKKF) is a lithium development company focused on producing high-purity, sustainable lithium at a low cost from its four lithium brine projects in Argentina. The projects lie within one of the most sizable, wholly owned land packages amongst the largest players within the Lithium Triangle — home to 40 percent of the world's lithium supply.

Lake Resources has five lithium projects in the heart of the Lithium Triangle but is primarily advancing its wholly owned Kachi lithium project, approximately 100 kilometers south of the FMC Lithium (NYSE: LTHM) Hombre Muerto lithium brine production site.

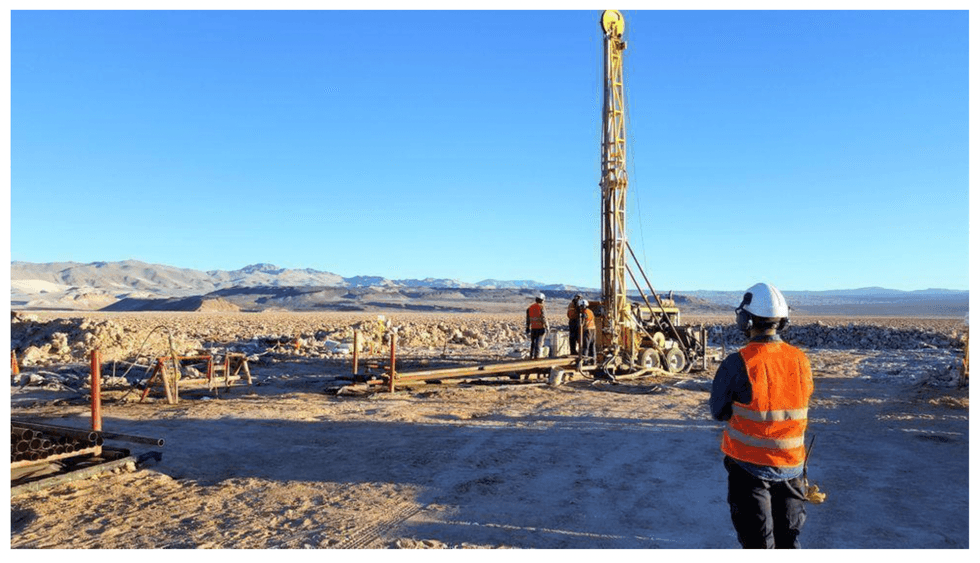

In 2023, Lake Resources provided an update on the resource estimates in 2023. Additional drilling has upgraded and increased confidence in the resource in the central area of the salar, with measured and indicated (M&I) resources of 2.2 Mt of LCE defined, to a depth of 400 meters over 81 square kilometers. Surrounding the M&I resources are inferred resources of 3.1 Mt LCE defined over 117 square kilometers. The resource remains open to a depth of approximately 700 meters and opens laterally, where drilling is underway to better define the resource extent.

In February 2020, Lake Resources released a prefeasibility study (PFS) for its Kachi lithium project, which indicated an annual production target of approximately 25,500 tonnes of battery-grade lithium carbonate using Lilac Solutions' direct lithium extraction (DLE) technology.

The study was based on Kachi's indicated resource of 1.01 MtLCE at 290 mg/L lithium. The study projects an operating cost of US$4,178 per tonne, totalling approximately US$544 million in total capital expenses.

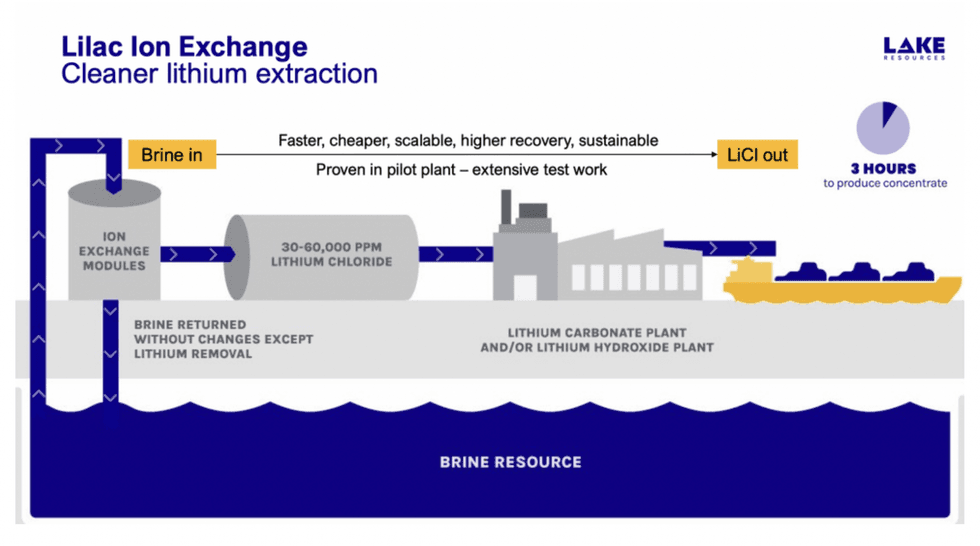

Lake Resources has partnered with Lilac Solutions to build a direct extraction pilot plant at the Kachi project. Lilac Solutions has developed a proprietary ion-exchange technology for the extraction of lithium from brine resources. It’s capable of achieving high recoveries, at minimal cost, with rapid processing times, all while providing numerous environmental benefits — particularly water preservation. Katchi aims to provide the world’s cleanest lithium using its unique procedure.

The modular demonstration plant, designed and built by the engineering team at Lilac Solutions, was dispatched to the Kachi Project in Argentina in March 2022, after which Lilac began operating the demonstration plant for several months to produce lithium chloride (eluate) representing 2.5 tonnes of lithium carbonate.

As of December 31, 2022, Lilac has successfully operated the demonstration plant for 1,000 consecutive hours and produced 40,000 liters of lithium chloride eluate, meeting all key testing milestones outlined in Lake Resources' agreement with Lilac. The lithium chloride eluate produced by Lilac will be converted to lithium carbonate, after which it will be independently tested for purity.

Project Kachi is on track to move from its pilot phase into commercial-scale development after Lake Resources and Lilac Solutions announced the production of 2,500 kilograms of lithium carbonate equivalents (LCE). This successful result led Lilac to increase its ownership of the Kachi Project from 10 percent to 20 percent. The 2,500 kilograms of LCEs were extracted at Kachi with 80 percent lithium recovery, 90 percent plant uptime, 1,000 times less land compared with evaporation ponds, and 10 times less water compared with conventional aluminum-based absorbents.

Lake Resources has appointed Saltworks, an independent assay laboratory based in Canada, , to produce larger samples of lithium carbonate. Lake Resources has conditional framework agreements in place with SK On and WMC Energy for offtake. The terms provide each partner with 25,000 tpa, along with a 10 percent equity stake in Lake Resources.

The Cauchari and Olaroz lithium brine projects are adjacent to one another and are surrounded by major players such as Lithium Americas (TSXV:LAC), SQM (NYSE:SQM), Ganfeng Lithium, and Advantage Lithium (TSXV:AAL). Drilling at Cauchari has so far returned values up to 540 mg/L lithium on the project. Lake Resources hopes to prove that both projects are extensions of the neighboring projects.Company Highlights

- Lake Resources has four clean lithium brine projects in stable mining jurisdictions in Argentina.

- Projects are near major lithium brine properties operated by Livent (NYSE:LTHM), Lithium Americas, SQM, Ganfeng Lithium and Advantage Lithium.

- Lake Resources is developing a multi-asset Tier One producer, with lithium at 99.7 percent purity that aims to provide cleaner lithium for an electric world.

- Kachi property has a mineral resource estimate of 2.2 million tonnes (Mt) of contained lithium carbonate equivalent (LCE) with 3.1 million tonnes inferred resource.

- Partnership in place with Lilac Solutions for direct brine extraction which entitles Lilac to earn up to 25 percent equity in the Kachi Project upon the completion of performance milestones.

- Working with Saltworks to produce large samples of its battery-quality lithium carbonate.

- Cauchari and Olaroz are structured as strategic extensions of neighboring resources.

- Lilac increased its ownership of the Kachi Project from 10 percent to 20 percent after producing 2,500 kilograms of lithium carbonate equivalents (LCE) at Project Kachi.

Get access to more exclusive Lithium Investing Stock profiles here