Overview

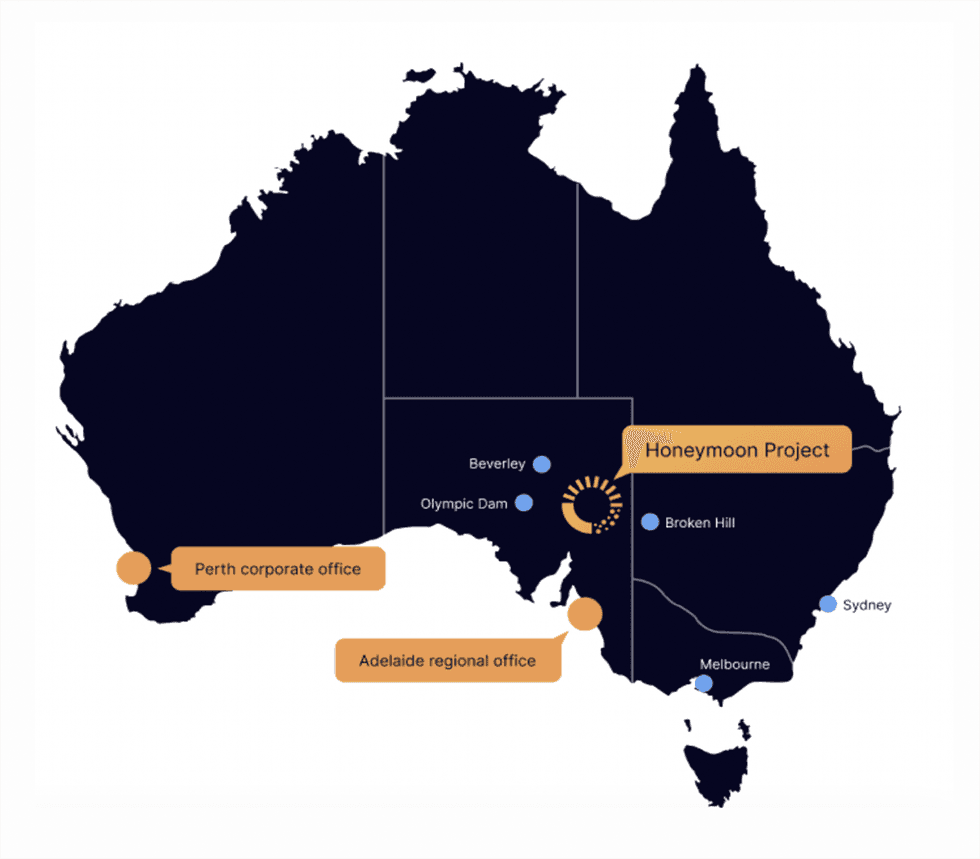

Boss Energy (ASX:BOE, OTCQX:BQSSF) is a listed Australian producer of uranium. The company has two projects – the 100 percent owned Honeymoon uranium project in South Australia and the 30 percent owned Alta Mesa project in the US.

The macro-environment and steps taken by the US government remain favorable for uranium producers such as Boss Energy. The United States Congress recently enacted legislation prohibiting the importation of Russian uranium products. Known as the Prohibiting Russian Uranium Imports Act (HR 1042), this legislation was passed by the House of Representatives on December 11, 2023, and later approved by the Senate on April 30, 2024. The prohibition is valid until 2040.

The legislation's sunset provision, set for 2040, aims to encourage the sustained deployment of uranium conversion and enrichment facilities and services in the United States and its allied nations over the long term. This should benefit domestic suppliers such as Boss Energy.

According to UxC estimates, annual uranium demand could surge by nearly 65 percent, exceeding 300 million pounds (Mlbs) U308 by 2030, up from the current demand level of 197 Mlbs U308. Meanwhile, the projected mine supply for 2024 is approximately 155 Mlbs U308, suggesting a deficit of nearly 40 Mlbs.

Moreover, there is an expected surge in demand for uranium due to the projected 18 percent increase in nuclear reactor capacity from 2023 to 2030. Nuclear energy will be critical in meeting the global ambition of net zero emission. Thus, ensuring a secure supply is crucial, and the Honeymoon mine is strategically positioned to provide uranium from South Australia to a market facing escalating geopolitical instability.

Spot uranium prices have jumped dramatically. They are the highest since 2008, at over US$80/lb. Due to the tightness of the uranium supply/demand balance, prices are expected to remain strong.

The company’s first drum production in April 2024 at the Honeymoon mine is timed with strong market fundamentals. Boss has entered into two binding sales agreements to sell ~1.8 Mlbs U308 to two major Western utilities in 2032. These agreements ensure a stable revenue flow for Boss, offer strong profit margins, and reinforce the trust utilities placed in the supply from the Honeymoon Uranium Mine in South Australia.

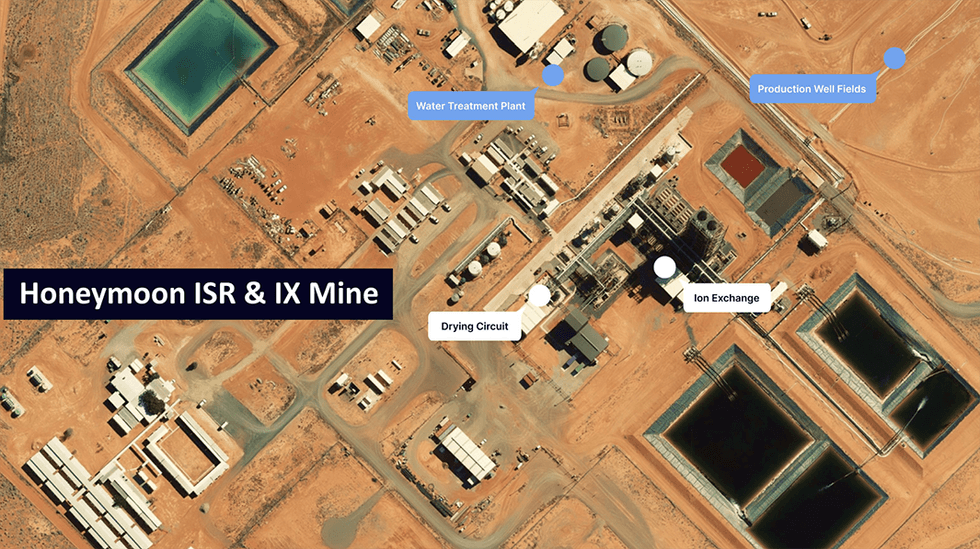

Honeymoon utilizes in-situ recovery (ISR) coupled with ion exchange for uranium extraction and processing. The process is environmentally friendly and more cost efficient compared to traditional mining.

Boss is expanding its senior management team to align with its expanding presence as a global uranium producer. Justin Laird, a highly experienced financial executive, has been appointed CFO, while Robert Gordon, a respected mine production executive, has taken on the role of general manager at Honeymoon.

As of 31 March 2024, the company had AU$100 million in cash and no debt. It also holds a strategic inventory of 1.25 Mlb of U308, which has a current spot market value of AU$169 million. Boss Energy possesses multiple producing uranium mines and is strategically positioned to capitalize on the improving fundamentals of the uranium market.

Get access to more exclusive Uranium Investing Stock profiles here