Silver Price Update: Q3 2022 in Review

What happened in the silver market in Q3? This silver price update examines the factors that are impacting the industry and where it may go in the future.

Click here to read the latest silver price update.

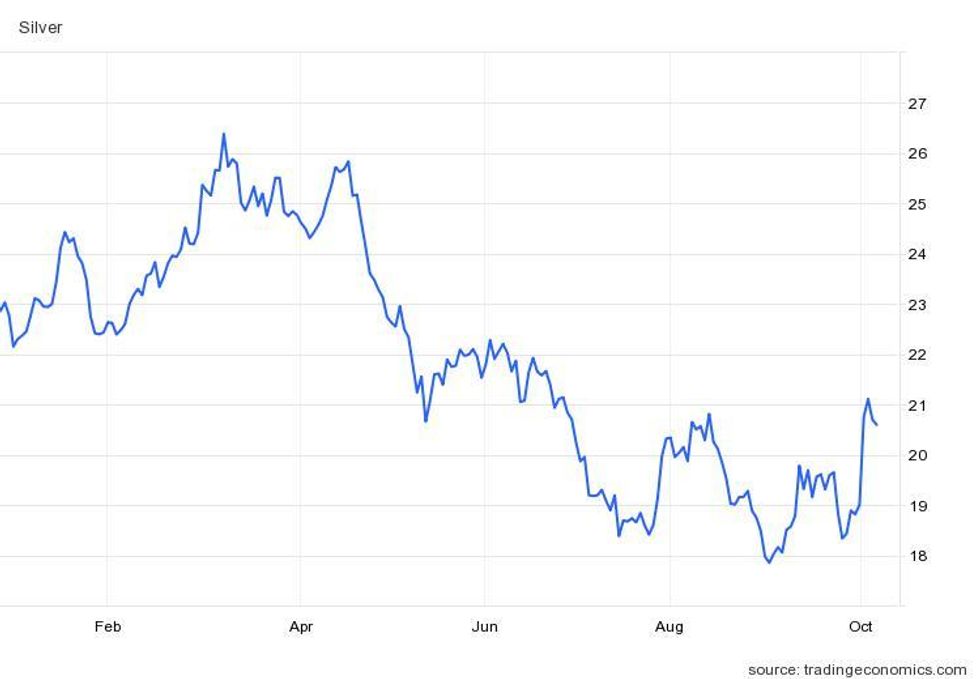

After spending 22 of the last 27 months above US$22 per ounce, the silver price has trended lower over the past five months, shedding 17.8 percent between January and October of this year.

The start of Q3 saw the white metal trading for US$20; however, seasonality, inflation, market weakness and lingering supply hiccups eroded its value from mid-August through September.

By mid-September, silver had slipped to US$17.76, representing a quarterly, year-to-date and two year low. The end of the quarter saw the versatile metal recoup some of its losses, ending the three month period at US$18.94.

Impeded by many of the same factors that kept gold below US$1,800 per ounce throughout the quarter, silver faced harsh headwinds from a strong US dollar. That circumstance and other economic conditions outweighed silver’s positive fundamentals, prompting investors to take a more risk-averse stance. At the same time, the precious metal found no refuge in its industrial side as rising interest rates targeted at taming high inflation prevented any meaningful gains.

Year-to-date silver price performance.

Chart via TradingEconomics.

“Despite the recent pullback in rate expectations and the impetus this has provided to precious metals, institutional investors still remain cautious about the outlook for the complex,” a recent Metals Focus weekly report reads.

"In spite of the strength in underlying silver demand, this caution remains the biggest headwind for the silver price.”

Silver price update: Values remain low despite market deficit

The start of the year's fourth quarter has seen silver move above US$20, but according to Metals Focus, this price level still doesn't account for the “substantial physical deficit” in the market.

“This is being reflected in a further decline in bullion stocks. For example, London vault stocks at 916Moz (million ounces) are at their lowest for the LBMA series, which stretches back to July 2016,” explains the firm's report, which was released on October 5. “Similarly, Comex stocks now stand at 313Moz, which is their lowest since June 2020.”

Part of the 2022 shortfall has been attributed to a surge in silver bullion demand from India. In August, imports totaled more than 1,000 tonnes, bringing total imports to 6,239 tonnes, the third highest level on record.

“Though the recent price gains may temper near-term imports, the forthcoming festive and wedding season and its associated jewelry and silverware buying mean it seems only a matter of time before India posts a new high, eclipsing 2015’s record of 7,530 (tonnes),” the precious metals report states.

Outside of India, retail investment has also been ticking higher in Germany and US, even though the former has levied a value-added tax on non-EU-issued silver bullion coins. This is a factor that could impact demand out of that region.

Growth in photovoltaic installations and electrification are also contributing to this year's deficit as both sectors boost output.

Silver price update: Inflation continues to weigh on sector

Traditionally gold and silver perform well in an inflationary environment as the former is used to safeguard wealth and the latter is a beta to gold. While both metals have mitigated losses in the volatile economic landscape, many market participants are wondering why these precious metals haven’t performed better.

Between January and the end of September, the silver price dropped 17.8 percent, and that number grows to 26.9 percent when factoring in the metal’s year-to-date high — US$26.46 in March — with its Q3 low of US$17.76.

The precious metals sector's weak performance has been attributed partially to the high value of the US dollar, which rose to a two decade peak in late September. The US Federal Reserve's efforts to curb inflation through interest rate increases have also impeded growth in the space. Here silver’s correlation to gold has outweighed the growth in industrial and physical demand.

“Gold is under pressure because of the strength in the dollar and the Federal Reserve's consistent telegraphing that they will continue to hike rates until they tame inflation,” Jorge A. Ganoza, CEO, president and co-founder of Fortuna Silver Mines (TSX:FVI,NYSE:FSM), told the Investing News Network.

The Canadian company, which has projects across Latin America and West Africa, is both a gold and silver producer, with the white metal accounting for 22 percent of its sales. This duality has helped the company weather silver's lower price, but as Ganoza explained at the Gold Forum Americas, the rising cost of everything is most impactful.

“Inflation is a reality and it's pinching everybody across industries, not just mining,” he said. “We monitor closely inflation on diesel, on cyanide — which is a main reagent for operations — explosives, steel, cement. All of those consumables that are key to our business.” These expenses have grown by 25 to 70 percent over the last 18 months, according to the CEO.

The company has been able to hedge some of its diesel costs by increasing diesel efficiency by 20 to 25 percent. Cost controls are especially important now as Fortuna prepares to open a new mine in 2023.

“We're developing an exciting new project in the Ivory Coast, called Séguéla, which is 78 percent complete,” Ganoza said during the late September interview. “Once in production it will be our fifth operating mine and our flagship asset."

He credited the growth Fortuna has been able to achieve to the company’s decision to not be a pure-play silver miner.

“The conundrum for a silver producer is how to grow your business with sound fundamentals, high margins and long life of reserves in the silver space, and that's why you see most silver producers expanding into gold,” he said. “We still pursue growth opportunities in silver, but we're really agnostic on silver and gold.”

Silver price update: Is value dip a signal to buy?

As silver now appears to be holding steady in the US$20 range, some are wondering if now is the time to buy ahead a potential price run, especially considering the positive demand fundamentals that are in place.

In a recently released investment report from the Silver Institute, investors with “global multi-asset portfolios” are encouraged to increase their silver holdings because the metal is a “strategic investment allocation.”

The overview, which was conducted by Oxford Economics, suggests investors would benefit by allocating an average of 4 to 6 percent of their portfolio to silver — significantly higher than the current holdings of most institutional and individual investors.

Despite silver’s close correlation to gold, the report notes that the metal’s “characteristics are sufficiently different from gold to make it a valuable diversification tool that deserves its own portfolio commitment.”

Citing silver’s higher volatility, the Silver Institute also comments that the metal has more upside during industrial booms.

The comprehensive market overview goes on to highlight catalysts that could benefit the metal moving forward. “Silver is likely to benefit from an increasingly positive structural demand outlook over the medium term, given its use in many green technologies, indicating that we may be entering a period where the gold-silver price ratio shifts back in favor of silver,” it states.

Some of silver’s fundamentals are already offering support as the gold-silver ratio fell to a 60 day low of 82 in early October after hitting a one year high of 95 in late August.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Silver Trends 2021: Demand Grows as Supply Shrinks | INN ›

- Silver Outlook 2022: Supply/Demand Trends Could Catalyze Price ... ›

- Should You Invest in Silver Bullion? | INN ›

- What Was the Highest Price for Silver? | INN ›

- When Will Silver Go Up? | INN ›