Silver Price 2025 Year-End Review

Silver broke its decades-long price record in 2025, and looks set to move even higher.

The silver price put on a strong performance in 2025, breaking a high set 45 years ago.

Despite its characteristic volatility, factors like increasing industrial demand, safe-haven buying from investors and weakening mining supply all came together during the year to support gains in the price.

All told, silver has more than doubled in price since the start of 2025, outperforming gold's 59 percent gain.

Silver price in Q4

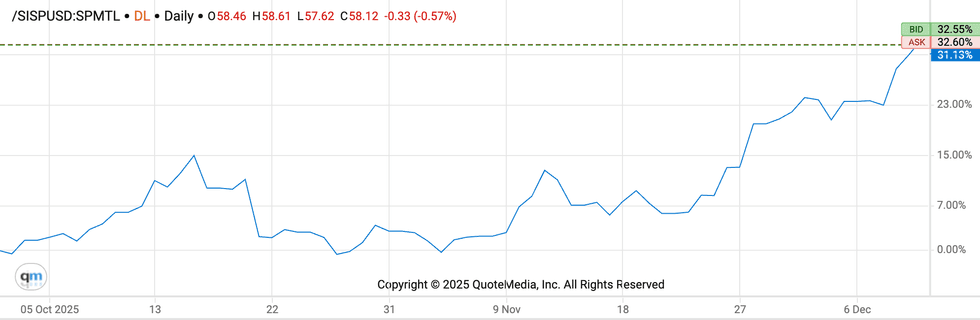

Silver began Q4 on a strong note, clocking in at US$47.32 per ounce on October 1. By October 9, the precious metal had breached its previous all-time high of US$49.95, which was set on January 17, 1980.

Silver continued its impressive rally, heading to what was then a new record high of US$54.46 by October 17 as a supply squeeze in London helped boost the price alongside strong demand out of India.

Although the price of silver had retreated back to the US$48 level by the end of the month, the white metal would go on to test this high multiple times throughout the fourth quarter.

On November 9, the longest US government shutdown in history finally came to an end, driving the silver price back above US$50. The precious metal’s value had spiked as high as US$53.50 by November 12.

Silver managed to stay trading above the key US$50 level for the rest of the month before surging to US$56.53 on November 28. Its takeoff followed a 10 hour shutdown of trading on CME Group's (NASDAQ:CME) Comex due to a "cooling issue" at a CyrusOne data center used by the exchange.

The blackout led some to speculate that the Comex may have been deliberately taken offline due to a lack of silver to fulfill deliveries. In an interview with the Investing News Network (INN), Clem Chambers of aNewFN.com explained that this was likely not the case, and in fact, these outages are not that uncommon.

Silver price, Q4 2025.

Chart via the Investing News Network.

Negative reports surrounding Chinese silver stockpiles also lent support to the silver price in Q4. According to Bloomberg, stockpiles are now at their lowest level in a decade after large shipments to London.

Silver's strength continued as the final month of the year kicked off. December 1 saw the price reach as high as US$58.47 on the way to a new silver all-time high of US$60.56, which it set on December 9.

Investor demand for the precious metal is heating up as the date of the next US Federal Reserve interest rate announcement approaches. The majority of market participants are betting on another interest rate cut. Silver is also benefiting from increased geopolitical tensions as the US-Venezuela conflict intensifies.

How did silver perform for the rest of the year?

Silver price in Q1

Silver hit the ground running in the first quarter of the year, buoyed by its precious metal safe-haven status as US President Donald Trump’s tariff policies began to take shape.

The price of silver peaked at its quarterly high of US$34.43 on March 27.

However, fears of a looming economic recession and the impact that might have on industrial demand tempered expectations as the quarter came to an end.

At the time, Peter Krauth, editor of Silver Stock Investor, told INN:

“We don’t really have any indication yet that industrial demand has weakened. There is, of course, a lot of concern regarding industrial demand, as tariffs could cause demand destruction as costs go up.”

Krauth also mentioned that tariffs could actually be positive for industrial demand as countries look for more ways to be energy independent. In addition, he noted that in China there is the need to transition from older PERC technology to newer TOPCon cells, which require significantly more silver inputs.

Silver price in Q2

The big news from the second quarter was silver breaking through the US$35 barrier to 14 year highs.

The price continued to be fueled by uncertainty in financial markets and demand for safe-haven assets, but also saw support from strained supply for industrial uses such as solar panels, artificial intelligence, vehicle electrification and grid infrastructure. Growing speculation that Israel was preparing to attack Iranian nuclear sites also provided a boost from investors anticipating disruptions to international trade and oil markets.

The quarter opened with the price of silver sinking to a low of US$29.57 on April 4 after Trump’s "Liberation Day" tariffs caused concerns that industrial demand would be impacted. However, by the start of June silver began to soar, reaching a quarterly high of US$37.12 on June 17 as tight supply continued to weigh on the market.

In a mid-June interview with INN, Krauth said deficits are likely to deepen in the coming years.

“(We have) flat supply, growing demand — demand that’s nearly 20 percent above supply," he said. "And our ability to meet those deficits is shrinking because we’re tapping into these aboveground stockpiles that have shrunk by about 800 million ounces in the last four years, which is equivalent to an entire year’s mine supply. So it’s the perfect storm."

Silver price in Q3

Silver didn’t take a break from its upward momentum in the third quarter, posting record highs that silver bugs had waited decades to see again. The silver price first took a run at the US$40 level in July, making it as high as US$39.30 by July 22, before retreating toward the US$36 level by the end of the month.

Silver spent most of August rangebound, trading around the US$38 mark.

Fed Chair Jerome Powell’s remarks at the Jackson Hole Economic Policy Symposium at the end of the month helped the precious metal break past the US$40 mark on September 1. By the end of the quarter, the price of silver had reached US$46.66, flirting with the precious all-time high set in 1980.

At that time, Adam Rozencwajg of Goehring & Rozencwajg told INN that even though silver had been outperforming gold, it was still relatively cheap compared to its sister metal, with more room to grow.

“Do I think that this bull market run is done? No, I don't think it is at all. I still continue to hold the same view that ... gold will continue to have a strong run, and that the silver move lies somewhere out ahead of us,” he said.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Peter Schiff: Gold, Silver Correction Over? Next Price Triggers, Where to Focus ›

- US$200 Silver? 3 Experts Talk Price, Supply and Demand ›

- Ed Steer: Silver Rally Now Unstoppable, Price to Hit Triple Digits ›

- When Will Silver Go Up? ›

- What Was the Highest Price for Silver? ›

- Could the Silver Price Really Hit US$100 per Ounce? ›