Reviving the Walker Lane Trend — Nevada’s Next Golden Frontier

Nevada's Walker Lane Trend offers a unique blend of proven production history and untapped potential in mineral exploration as market momentum builds up.

Nevada's Walker Lane Trend is rapidly becoming a prime target for mineral exploration, offering investors a unique blend of proven production history and untapped potential.

This geological corridor along the California-Nevada border is experiencing a resurgence, driven by recent discoveries, advanced exploration techniques, a strong precious metals market and growing demand for domestic metal supply.

The Walker Lane Trend's combination of geological richness, a favorable jurisdiction and strategic importance in North American mineral resources presents a compelling case for investors seeking high-reward opportunities in a relatively low-risk environment.

Reintroducing the Walker Lane Trend

Walker Lane is currently one of the hottest, if not the hottest, exploration area plays in the US and is known for its high-grade gold and silver discoveries. The trend is a geologic trough extending along the California-Nevada border, characterized by its sinistral strike-slip faults that have shaped the regional topography. This area has been a focal point for understanding the geological processes that formed the Sierra Nevada mountains and surrounding regions.

Unlike the well-known Carlin and Cortez trends, which are primarily associated with sediment-hosted gold deposits, the Walker Lane is renowned for its diversity of mineral occurrences, including epithermal gold-silver deposits and porphyry copper systems. This geological variety offers explorers a wider range of potential discoveries.

The trend's resurgence can be attributed to advances in exploration techniques, a favorable precious metals market and the increasing demand for domestic mineral resources. Ongoing geological studies and detailed mapping efforts are refining our understanding of the Walker Lane, enhancing the potential for new ore deposit discoveries.

Currently, the Walker Lane Trend hosts several significant precious metal deposits, including Comstock Lode, Round Mountain (Kinross Gold (TSX:K,NYSE:KGC)), Silicon and Merlin (AngloGold Ashanti (NYSE:AU,JSE:ANG)) and Mesquite and Castle (Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX)).

Nevada's favorable infrastructure, skilled laborforce and supportive permitting environment contribute to its high investment attractiveness. The state ranked second globally in the 2023 Fraser Institute Mining Industry Survey.

Macro drivers fueling investor interest

As of the beginning of 2025, the outlook for precious metals, particularly gold and silver, remained optimistic.

Analysts predict the gold price could reach up to US$5,155 per ounce by 2030, as of this writing, driven by potential US Federal Reserve rate cuts and persistent geopolitical tensions. Silver is also expected to perform well, with strong bull market dynamics suggesting a solid upward trajectory. These positive forecasts for precious metals are bolstering interest in exploration and mining activities within the Walker Lane Trend.

Furthermore, there's a growing push in the US to enhance domestic metal supply. This initiative is driven by increasing federal debt and shifting global trade relationships, emphasizing the need for self-sufficiency in critical raw materials. Nevada, with its stable political environment and rich mineral endowment, is perfectly positioned to meet this demand, attracting significant capital inflows to low-risk jurisdictions like the Walker Lane Trend.

Key traits of high-potential juniors in the region

Investors looking to capitalize on the Walker Lane's potential should focus on junior exploration companies that exhibit the following characteristics:

- Robust project pipeline: Companies with a mix of grassroots exploration and advanced-stage assets demonstrate long-term potential and near-term catalysts.

- Experienced management: Teams with a proven track record in mining and exploration are crucial for navigating the complexities of resource exploration and development.

- Strategic land package: The quality and location of land holdings are vital. Companies with 100 percent ownership of their projects can leverage their assets more effectively.

- Infrastructure access: Proximity to existing infrastructure can significantly reduce operational costs and improve project feasibility.

Additionally, investors should look for companies with clear catalysts for value creation, such as upcoming drill programs, resource estimates or strategic partnerships. The potential for consolidation and strategic positioning in the early stages of growth can also be a significant factor in a company's success.

Walker Lane Resources: A case study in strategic repositioning

Walker Lane Resources (TSXV:WLR), formerly known as CMC Metals, exemplifies the emerging narrative of the Walker Lane Trend. The company's recent rebranding and strategic repositioning reflect its commitment to capitalizing on the opportunities within this geologically rich region.

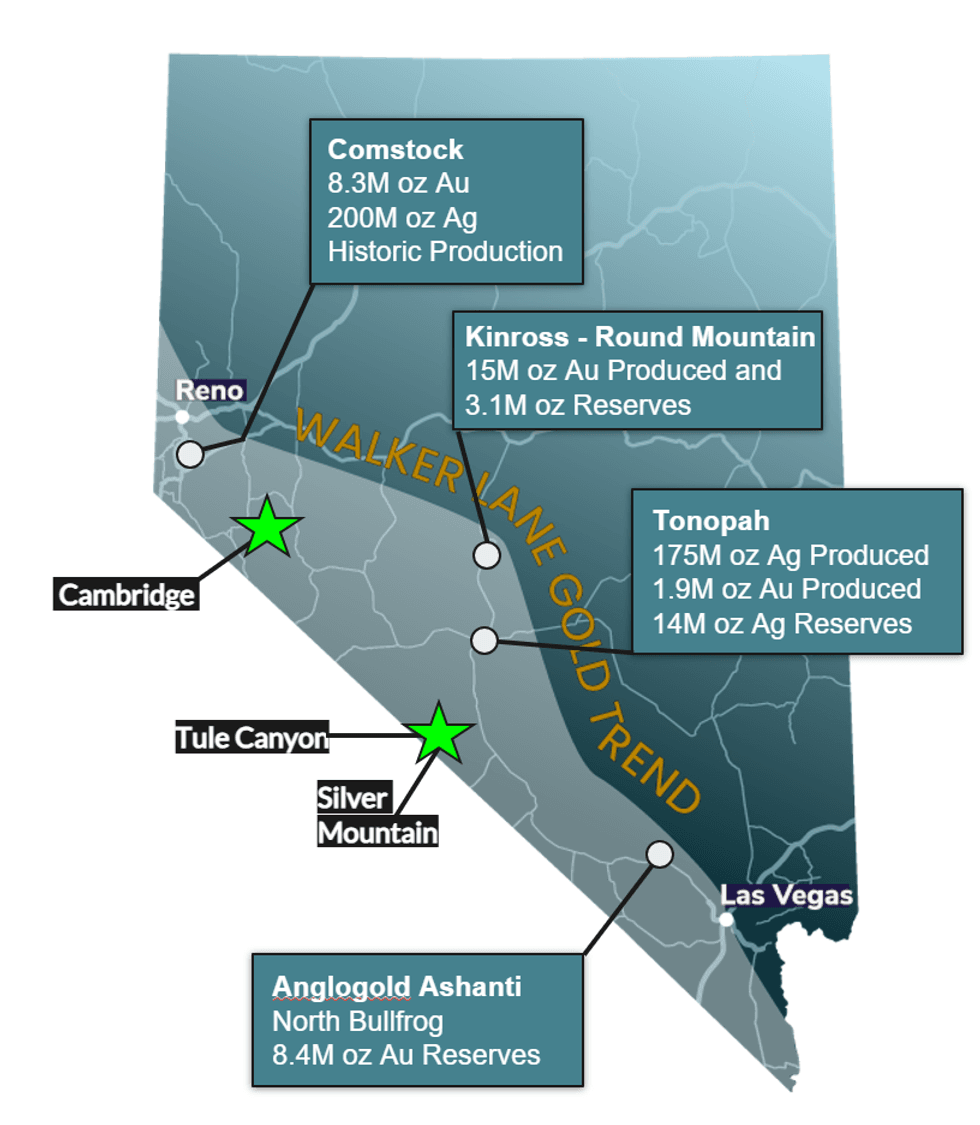

Walker Lane Resources’ project location.

On March 21, 2025, Walker Lane Resources announced its name change and share consolidation, signaling a renewed focus on exploring and developing projects within Nevada's Walker Lane Trend.

The company has expanded its footprint in the Walker Lane Gold Trend by optioning three properties — Tule Canyon, Cambridge and Silver Mountain — from Silver Range Resources (TSXV:SNG). Additionally, Walker Lane secured a right-of-first-refusal on the Shamrock property in eastern Nevada. These acquisitions align with the company's strategy to establish a year-round exploration portfolio in a region renowned for its rich mining history and underexplored potential.

This strategic shift aligns Walker Lane Resources with the growing investor interest in domestic metal supplies and the favorable outlook for precious metals. The company's low valuation, combined with its strong upside potential and Nevada focus, makes it an intriguing case study for investors looking to gain exposure to the Walker Lane Trend's resurgence.

Investor takeaway

The Walker Lane Trend offers a unique blend of historical production and untapped potential. As market momentum builds, identifying the right players early can be highly beneficial for investors.

Companies like Walker Lane Resources, with their strategic focus on this trend, represent the kind of opportunities that savvy investors are seeking in the current market environment.

The combination of favorable macroeconomic factors, increasing demand for domestic metal supplies and the geological richness of the Walker Lane Trend creates a compelling narrative for investment. As exploration activities intensify and new discoveries are made, the Walker Lane may well become the next frontier in Nevada's storied mining history.

This INNSpired article is sponsored by Walker Lane Resources (TSXV:WLR). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Walker Lane Resources in order to help investors learn more about the company. Walker Lane Resources is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Walker Lane Resources and seek advice from a qualified investment advisor.