Nickel Price Update: Q2 2023 in Review

How has nickel performed so far this year? Read our quarterly update to find out what factors have been driving the metal.

Nickel prices declined more than 30 percent in the first six months of the year, and uncertainty and volatility are expected to continue to affect the market for the base metal in the coming months.

Increasing supply from Indonesia and a slower-than-forecast demand rebound from China have hit the sector in recent months, even as the market continues to recover from last year’s London Metal Exchange (LME) meltdown.

What happened in the second quarter of this year in the nickel space? Read on to learn about the main trends in the nickel market in Q2, including supply and demand dynamics and what market participants are expecting for the rest of the year.

How did nickel prices perform in Q2?

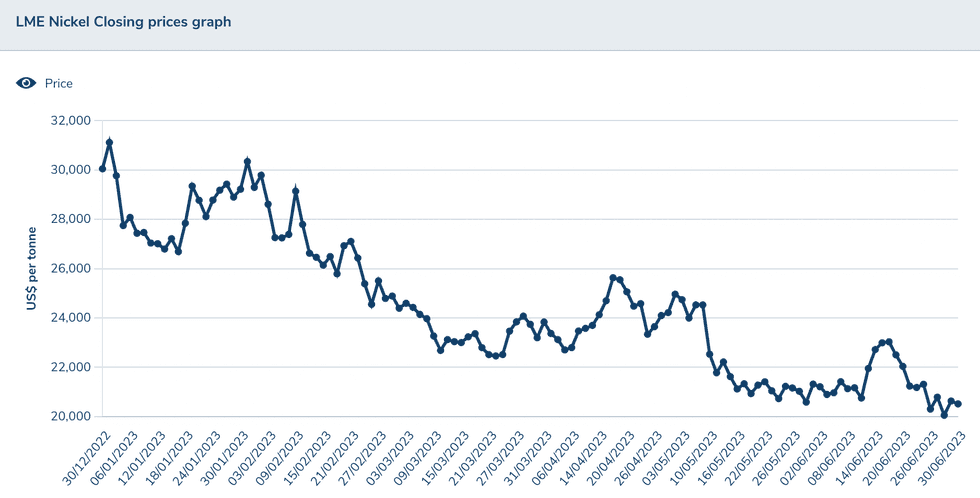

Nickel prices kicked off the year trading at the US$30,000 per metric ton (MT) level, hitting their highest point of 2023 on January 3 at US$31,118. Since then, prices have plummeted to hover around US$20,000.

Nickel's price performance in H1 2023.

Chart via the London Metal Exchange.

Q2 started with nickel trading at US$23,838; it then rose to its highest point of the quarter on April 18 at US$25,633.

“The increase was likely driven by a surge in demand, as consumers believed prices had bottomed out — nickel prices declined by 21.4 percent from January to March — as well as a rise in demand for stainless steel,” analysts at FocusEconomics said in May.

But the base metal was unable to sustain that level, and fell throughout the three month period to touch its lowest point on June 28, when it was changing hands for US$20,056.

During Q2, Wood Mackenzie Principal Analyst Adrian Gardner said prices performed in line with his expectations.

The main factors impacting the nickel market in the second quarter were "the poor pickup in the Chinese economy and the increasing excess of nickel supply,” the analyst told the Investing News Network.

“I thought that the Chinese economy and domestic demand for nickel-related items, such as stainless steel, would fare better than they have. Right at the end of June, the Chinese government and its central bank acknowledged that its economy needed help, and so they reduced lending rates and introduced a significant subsidy program to boost production and sales of electric vehicles (EVs) over the next four years," he explained.

“Although the volumes have stabilized over the past few months, they are still at lower levels than before the nickel crisis last year,” ING’s Ewa Manthey said in a note. “We expect more near-term volatility to continue until the LME rebuilds trust in the benchmark nickel contract, volumes pick up again and the market’s confidence in it recovers.”

Nickel prices have declined almost 37 percent since the start of the year, ending the second quarter at US$20,516.

What is the nickel supply and demand forecast for 2023?

At the end of last year, analysts were expecting the nickel market to remain under pressure as a surplus in the industry built up. Most continue to agree that a surplus is on the horizon in 2023.

“In the past, market surpluses have been due to Class 1 nickel; however, in 2023, the surplus will be on account of Class 2 nickel,” Manthey said. Class 1 nickel is the type deliverable on the LME, while Class 2 includes nickel pig iron and ferronickel.

Production of stainless steel accounts for around 70 percent of nickel demand. However, Chinese demand during the first months of the year did not see as strong of a revival as analysts had expected.

“In light of the Chinese economic and EV sector-specific incentives just released, we are expecting a better H2 from both the stainless and battery segments,” Gardner said. Chinese demand is expected to be up by 8 percent for stainless steel and 18 percent for the battery segment in the second half compared to the first half of this year.

Looking further ahead, the nickel market will see a shift in demand segments in the coming decade, with the battery space growing its share. Fastmarkets is forecasting its share of demand will jump from 12 percent in 2022 to 41 percent in 2033.

“This is going to require substantial additional nickel units, and not the type of units that the industry has geared itself to produce in the recent past,” Olivier Masson of Fastmarkets said in a keynote presentation in June.

As a result of the increased need for supply, Indonesia has been gathering attention from investors in the nickel space for some months, in particular when it comes to the role the country could play in the battery space. Reuters data shows that the country has signed more than a dozen deals worth more than US$15 billion for battery materials and EV production.

“Chinese investors are expecting to see their new acid leaching and matte projects in Indonesia come on stream, with one at least going all the way through to nickel sulfate,” Gardner said. “So far, the ramp-up success has been good, but the question is — will it continue?”

Additionally, the analyst added, when it comes to Indonesia and China, the market needs to see the excess of nickel pig iron in both countries being absorbed by better performance in domestic stainless steel consumption in China.

Looking over to supply in 2023, Wood Mackenzie expects H2 refined supply to be only marginally above H1 at 1.77 million MT compared to 1.73 million MT. “But we have an eye to H1 2024’s growth to 1.91 million tonnes as new projects both ramp up from a Q4 2023 start or become commissioned during Q1 2024,” Gardner said.

When asked about the main challenges junior miners face today, Gardner said there is considerable appetite among majors, including conventional miners/refiners and automotive OEMs, for the “right” resource for battery raw materials.

“Junior miners/exploration companies need to hold their nerve and not accept the takeover/equity investment bid from the first offer that comes along,” he added.

What's ahead for nickel prices in 2023?

Nickel has been the worst-performing metal on the London Metal Exchange so far this year, according to ING.

“This underperformance is likely to continue as we head into the second half of 2023 with the market likely to test lower levels amid a weak macro picture and sustained market surplus,” Manthey said.

ING sees prices averaging US$21,000 in the third quarter and US$20,000 in the fourth quarter.

“Prices should, however, remain at elevated levels compared to the average prices pre the historic LME nickel short squeeze due to nickel’s role in global energy transition, and the metal’s appeal to investors as a key green metal will support higher prices in the longer term,” Manthey added.

In terms of prices, Wood Mackenzie expects nickel to hold steady at between US$22,000 to US$22,500. Given the oversupply outlook forecast by the firm, prices are unlikely to rise again for the next few years.

For FocusEconomics panelists, nickel prices are seen rising above the levels seen at the end of June by the close of the year, supported by surging demand from the EV sector.

“However, excess supply from Indonesia and China should keep the market in surplus,” they said in their latest report.

FocusEconomics panelists see nickel prices averaging US$21,156 in Q4 2023 and US$20,738 in Q4 2024.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- What is Nickel Used For? (Updated 2023) ›

- Top 9 Nickel-producing Countries (Updated 2023) ›

- Nickel Price Hits Record US$100,000 on Short Squeeze, LME Suspends Trading ›

- Top 5 Nickel Stocks on the TSX and TSXV in 2022 ›

- Nickel Price 2022 Year-End Review ›