3 Biggest US Silver Miners in 2026

ASX Silver Stocks: 5 Biggest Companies

How to Invest in Gold Royalty and Streaming Stocks

Silver Stocks: 5 Biggest Silver-mining Companies

Overview

Nevada is home to some of the most robust mining operations in the world, thanks to its established history of gold and silver mining, pro-mining regulations and abundance of mineral-rich deposits. The Fraser Institute’s 2020 Annual Survey listed Nevada as “the top jurisdiction in the world for investment based on the Investment Attractiveness Index.” In fact, Nevada claimed first place from its third place rank in 2019.

What makes Nevada so mining-friendly? According to the United States Bureau of Land Management (BLM), Nevada hosts over 180,000 mining claims and the BLM’s largest mining program. Simply put, Nevada and mining go hand in hand, and the resources produced within the state play a critical role in the development of its infrastructure and overall economy.

Considering Nevada’s established mining history, it comes as no surprise that there is no shortage of mining and exploration activity within the state. Notable prospects and mines in the immediate area include Kinross Gold’s (TSX:K,NYSE:KGC) Round Mountain and Goldhill projects, Viva Gold’s (TSXV: VAU, OTCMKTS:VAUCF) Midway project and Huntsman Exploration’s (OTCMKTS:BBBMF) Baxter Spring project.

One of the other great mining jurisdictions in the US is Minnesota, which has world-recognized iron ore deposits that have been a key part of the state and the national economy for more than a century. Minnesota also has the largest high-grade unmined deposit of manganese in North America at a time when the use and demand for the mineral continue to grow.

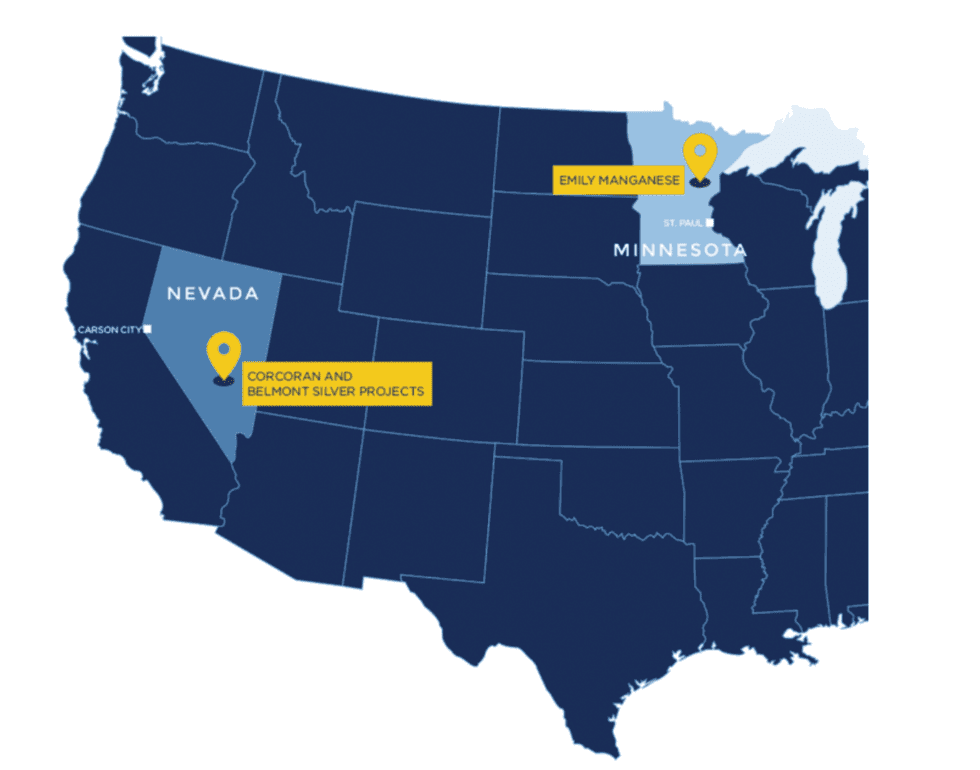

Nevada Silver Corporation (TSXV:NSC,OTCQB:NVDSF) is a Canadian mineral exploration company that currently has two active and advanced stage projects, both of which are 100 percent owned by the company:

- The first is its flagship Corcoran Silver project located in Nye County, Nevada. This project resides near numerous historical and active gold and silver mines, including projects operated by Kinross and Viva Gold. In addition to Corcoran, Nevada Silver recently expanded its land holding in Nevada to cover the historic Belmont Silver Mining district, which was among the earliest and richest silver mining camps in the Tonapah district.

- The second is the Emily Manganese project located in the Cuyuna Iron Range in Crow Wing County, Minnesota. The Emily Manganese project has the highest-grade manganese resource in North America.

These projects give Nevada Silver access to both established silver - gold deposits (Corcoran and Belmont Silver) and an underutilized strategic mineral in manganese (Emily Manganese).

“The market's affinity for silver now is where the market's affinity was for uranium two and a half years ago,” said veteran investor and speculator Rick Rule in an interview with INN. Outlining his positive outlook on silver, Rule noted that precious metals bull markets first tend to favor gold as “fear buyers” rush toward it for insurance. Once gold has momentum and the precious metals narrative has gained wider acceptance, investors and speculators (so-called “greed buyers”) enter the market and silver begins to take over.

There are several reasons why Nevada Silver is an attractive option in an investor’s portfolio. The company’s highly experienced management team features decades of combined investing and mining expertise. They also recently announced positive results from drill core assays which hit 3470g/t of silver.

“The exceptional high silver grades in both CC21-02 and CC21-17 indicate widespread high values of silver with appreciable hold, relatively close to the surface,” said Nevada Silver CEO Gary Lewis.

Company Highlights

- Nevada Silver is a Canada based publicly traded exploration, mineral development, and resource expansion company that primarily operates advanced stage projects in Nevada and Minnesota.

- The Corcoran Project is Nevada Silver’s flagship asset, with an inferred mineral resource of 33.5 million silver-equivalent ounces, and is located in Nye County, Nevada, in proximity to current and past producing mines, some of which are run by Kinross and Viva Gold.

- The Emily Manganese project is Nevada Silver’s other project and is located in Crow Wing County, Minnesota. Due to manganese being a critical mineral on the US 2021 List of Critical Minerals, the need for manganese warrants resource exploration and expansion.

- With a rise in demand for silver as well as difficulties in mining operations abroad, there is a need for a safe, domestic supply of silver.

- With a strong multidisciplinary management team fully invested in the Company, Nevada Silver consists of multiple individuals with strong backgrounds in mineral resources and project development.

Get access to more exclusive Gold Investing Stock profiles here