Gold Price Above US$1,900 Ahead of Possible Russian Military Action

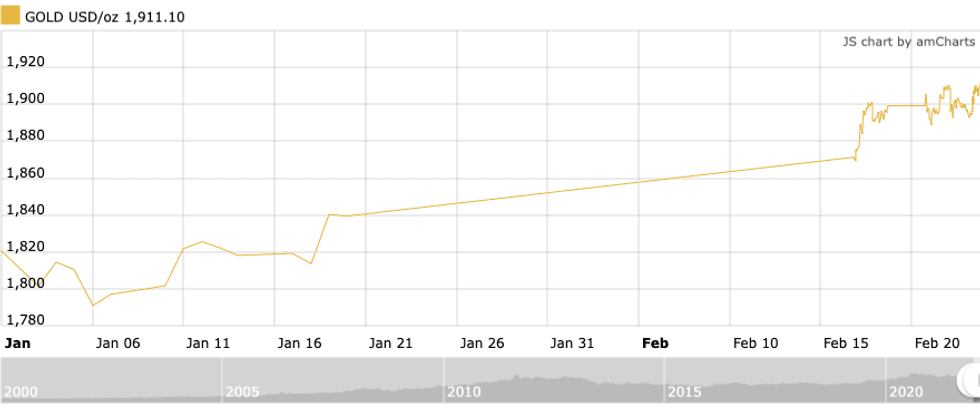

Since January, the gold price has climbed by US$108 — 6.03 percent — following a year of flat price movement.

Gold continued to ascend this week, registering an eight month high of US$1,910.50 per ounce by midday on Wednesday (February 23). The February rally has come amid rising tensions at the Ukraine border.

As Russia's military presence intensifies in the region, Ukraine’s government announced on Wednesday a 30 day state of emergency across the country, with the exception of Donetsk and Luhansk. The international community followed with hardline warnings to the Kremlin to de-escalate tensions and withdraw from the area.

Russian President Vladimir Putin responded in a video message saying the country’s interests and security are non-negotiable; however, he went on to say he is open to diplomatic dialogue.

The geopolitical uncertainty has left equity markets in North America in the red for much of the month, with investors gravitating toward the golden safe-haven asset. Since January, the gold price has climbed by US$108 — equivalent to an increase of 6.03 percent — following a year of flat price movement.

Year-to-date gold performance.

Chart via Kitco.

“Gold performs well during times of economic, geopolitical and health crises as there are increased risks and uncertainties associated with such events,” said Sagar Kalra, senior analyst at Wood Mackenzie.

“These generally lead to unfavorable macroeconomic conditions like high levels of inflation, supply chain hurdles, etc. and investors increase exposure to gold to protect their wealth," he explained to the Investing News Network (INN) last week. "The current conflict between Russia and Ukraine has provided support to the price in recent months and it has reached its highest since July 2021 during the week.”

In addition to safe-haven appeal, gold offers liquidity, which is also desirable in times of rampant volatility.

“Gold is a highly liquid asset, and central banks hold it as a part of their foreign reserves to ensure adequate liquidity,” Kalra said. “A similar logic is also employed by investors.”

Historically gold has performed well in times of conflict and crisis, but Kalra said the current circumstances are somewhat different given the lingering impact of the pandemic, surging inflation and global debt.

“With inflation at record levels in parts of the world, we expect central banks to adopt a more hawkish stance and raise interest rates, which would create headwinds for gold. Simultaneously, geopolitical tensions, high inflation and threat of vaccine-resistant COVID-19 variants would provide support, and we expect price volatility to be a feature of 2022 as well," he said, joining other experts who expect tumultuous times for the yellow metal.

In response to Russia’s mounting aggression and fortification at Ukraine’s borders, the UK, US and Canada have implemented sanctions targeting Russia’s finances. These strategic sanctions are meant to cut Russian state banks off from accessing US dollars. Other measures include sanctions on Russia's foreign debt, which are aimed at impeding the country’s ability to raise money from western banking institutions.

These punitive measures could force Russia to increase its reliance on gold, but as the third largest gold producer in terms of annual output, Russia also stands to benefit from higher gold values.

“This would further prompt Russia to rely more on gold than US dollars as a component of its international reserves, which would in turn lead to higher demand for Russian gold,” Kalra said. “Over the course of 2020, Russia increased the portion of gold in its international reserves to 23.3 percent from 19.5 percent in the previous year.”

Gold was priced just above US$1,910 at the end of Wednesday.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.