Gold Price Update: Q1 2024 in Review

Apr. 15, 2024 01:55PM PST

The gold price rose to record highs in the first quarter, and entering Q2 it has continued to move. Where will the yellow metal go next?

Lemonsoup14 / Shutterstock

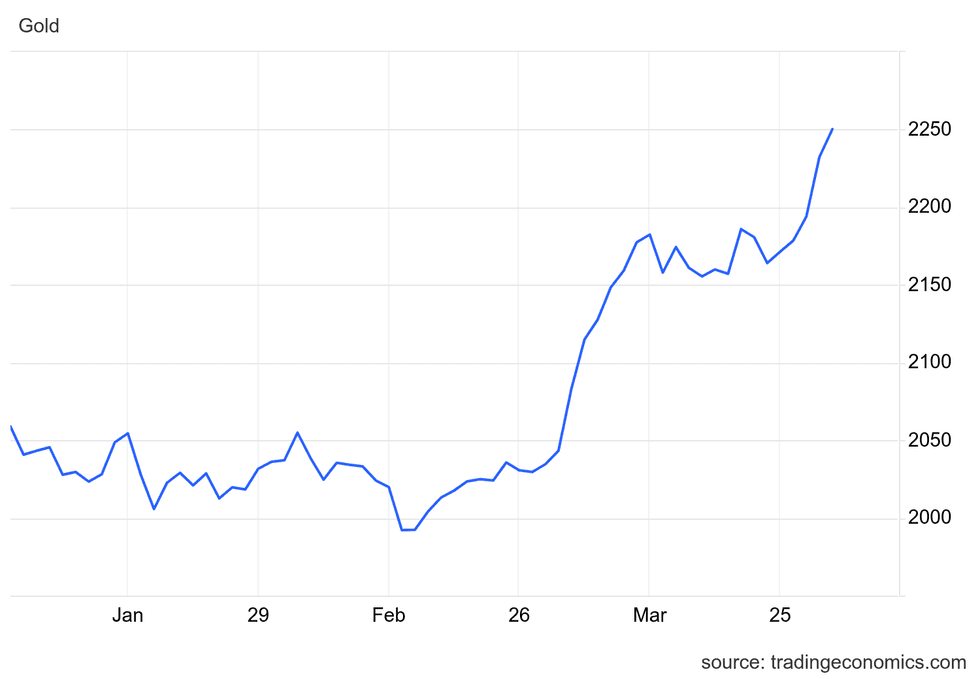

The gold price hit record levels in the first three months of 2024. Opening the period on January 2 at US$2,041.20 per ounce, the yellow metal was coming off previous highs set in December 2023.

Gold remained rangebound for the first two months of the year, staying above the US$2,000 level until it briefly broke through support in the middle of February, falling to its quarterly low of US$1,991.98 on February 13.

Following this low, gold began a slow climb toward the start of March, ultimately soaring to a quarterly high of US$2,251.37 on March 31. Gold has continued to move since then, briefly passing US$2,400 on April 12.

Central bank buying offsets ETF outflows

The first eight weeks of the year saw key gold market trends extend from 2023.

According to data from the World Gold Council (WGC), gold exchange-traded funds (ETFs) continued to see outflows in January and February, posting declines of 50.9 metric tons (MT) and 49.1 MT, respectively.

Joe Cavatoni, North American market strategist at the WGC, told the Investing News Network (INN) in an email that western gold ETFs marked three years of outflows in Q1, but this was offset by modest gains from Asian funds.

“One area of note in the ETF landscape is the Asian region. The Asian-domiciled ETFs, while smaller than the US and European markets, are positive in terms of net flows year-to-date (were positive in 2023 as well). This amplifies the importance of looking into the detail as it relates to gold investment to get a complete picture,” he said.

Despite overall outflows in ETFs, gold found support from continued central bank buying, with Chinese coffers seeing the largest gains, adding 10 MT of gold in January and an additional 12 MT in February. Reserve holdings for the People's Bank of China have grown for 16 consecutive months and have reached a total of 2,257 MT.

Other notable central bank buyers during the first two months of the year included Turkey, which added 16 MT of gold, Kazakhstan which purchased 12 MT, and India, which increased its reserves by 13 MT.

Lobo Tiggre, CEO of IndependentSpeculator.com, suggested to INN that other players may also be getting involved.

“With ETFs still seeing outflows, I think there’s a new buyer in the market, one that’s also interested in physical gold, not paper substitutes. This could be sovereign funds joining central banks, other institutions or other deep-pocketed players who don’t really care that much about the price, deciding that the time has come to hedge with gold,” he said.

On a different note, WGC data for the first month of the year indicates that Chinese wholesale gold demand jumped to 271 MT in January, the strongest ever for that month. While some gold is likely earmarked for jewelry markets, where demand remains high despite the elevated gold price, there was also increased demand for bars and coins.

Chinese investors have turned to the yellow metal as a safe haven against falling real estate and stock prices. In total, stocks in the country have lost nearly US$5 trillion in value over the past three years.

Purchases from Chinese investors continued into February as price stability helped take an additional 127 MT from Shanghai Gold Exchange stockpiles; that's above the month's 10 year average of 118 MT. Even though buying has been strong through the first couple months of 2024, the wholesale and investment markets are moving into what is traditionally a slow part of the year, which along with record high gold prices may put a damper on purchases.

Gold price hits record amid global uncertainty

Where the first two months of the year brought steadiness for the gold price, March was punctuated by strong gains and record highs. The precious metal started the month strong on the back of the solidifying belief that the US Federal Reserve would begin cutting rates as early as June; this helped drive buyers back into the gold market.

By the middle of March, gold had set record highs and was pushing against resistance at the US$2,200 mark.

Gold price, Q1 2024.

Chart via Trading Economics.

Investor sentiment was reaffirmed later in the month when the Fed met from March 19 to 20. With inflation coming in hotter than expected for February, the central bank held its benchmark rate at 5.25 to 5.5 percent. However, it also noted that it maintained the belief that it would make three rate cuts before the end of 2024.

This bullish sentiment helped stem western gold ETF outflows, with North America seeing inflows of 4.8 MT in March. The global pullback came to 13.6 MT, with largest losses coming from the UK, where a weak pound limited purchasing power, and traders sold off holdings to take profits as gold hit record high prices. European losses came to 22 MT.

More broadly, Cavatoni sees conditions setting up for broader global interest in gold.

“As central banks continue to be significant buyers and geopolitical risks and global uncertainties drive investors towards the perceived safety of gold, the current environment underscores gold’s importance as a strategic asset for portfolio diversification and risk mitigation. Therefore, while there may have been a perception of western disinterest in gold, recent developments indicate a sustained and broad-based demand for the precious metal,” Cavatoni said.

Gold price momentum yet to boost stocks

Gold stocks started to gain some momentum in March, but have been slow to take off.

Tiggre attributed this lag to a misreading by investors who had expected the gold price to retreat from all-time highs.

“It’s my view that the 'smart money' in the west thought gold had spiked and its next big move would be down, so gold stocks were 'leading' gold lower. However, it’s increasingly clear that that call was wrong, and I expect to see the stocks outperform this year when those who got it wrong realize their mistake,” he said.

While upward movement is slow among gold stocks, there have been some strong gains among producers. On the TSX, Serabi Gold (TSX:SBI,OTCQX:SRBIF), Mineros (TSX:MSA,OTC Pink:MNSAF) and Galiano Gold (TSX:GAU,NYSEAMERICAN:GAU) led the way during the first quarter with gains over 60 percent.

The upward momentum from gold's high price has yet to translate for junior companies, but David Erfle, founder and editor of Junior Miner Junky, noted in a March interview with INN at Prospectors & Developers Association of Canada convention that the sector is undervalued and overdue for a reversion.

"I've never seen this much of a disconnect before while the gold price is breaking out," he said. "I've seen ... this much of a severe deficit twice before, when the gold price was threatening to break down to a much lower level."

The last two times this happened, there were huge moves for juniors within six months of the start of the reversion.

What's next for gold in 2024?

While the second quarter of the year is just beginning, the yellow metal has already made some major gains. Gold continues to make moves and has even traded above US$2,400 for the first time ever.

The new highs coincided with increasing tensions in the Middle East and fallout from an Israeli attack on international aid workers in Gaza on April 1. The start of April has also seen an escalation in the war between Russia and Ukraine, with renewed strikes on Kyiv and other targets outside Donetsk.

While gold is traditionally viewed as a safe haven during times of geopolitical tension, Tiggre said the ongoing nature of these conflicts has caused an evolution of sorts for investors. “Unless one of these conflicts spreads, I don’t think either will have much impact on gold. They are part of the new normal background level of political radiation,” he said.

For Tiggre, a key point to watch is continued buying of gold from outside of the sphere of influence, where he thinks there is a push to move away from the US dollar. He also expects a recession, which he believes will move gold higher.

“I’m still in the 'hard landing' camp. If I’m right about that, I expect gold to go even higher once that becomes evident,” he explained. Tiggre's comments came as US consumer price index data for the month of March showed a 0.4 percent gain month-on-month, coming in 0.1 percent higher than expected. These higher numbers should be considered by investors as they could cause the Fed to re-evaluate its policy and adjust its rate-cutting schedule.

For his part, Cavatoni believes continued uncertainty around geopolitical events and the macroeconomic landscape may be a tipping point for western investors. “Will those Fed rate cuts be enough to move investors back into the gold? We believe this will serve as a catalyst to bring back the western investor, even at these high prices,” he said.

If gold continues to rise in Q2, it could prove a critical time for the yellow metal and gold stocks. Producers are likely to move first, followed by companies with advanced-stage projects and lastly juniors. However, it's important for investors to remember with rate cuts uncertain, the momentum in the market now could just as easily shift into decline.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

From Your Site Articles

- Top 5 Gold Stocks on the TSX in 2023 ›

- Top 5 Junior Gold Stocks on the TSXV in 2023 ›

- Gold Price 2023 Year-End Review ›

Related Articles Around the Web

https://twitter.com/INN_Resource

https://www.linkedin.com/in/deanbelder

dbelder@investingnews.com