Overview

Colombia is a top mining district. As an Organization for Economic Cooperation and Development (OECD) member country with a growing economy, and one of the lowest inflation rates in Latin America, it is hard to ignore how highly prospective the mining sector of this thriving and vibrant country has become.

Colombia hosts high-grade underground mines and a rich history of mining across various commodities like gold, silver and copper. With the right exploration and production company, discovering the true potential of the country’s widespread mineralized landscape could present tremendous economic potential, yield and expansive growth.

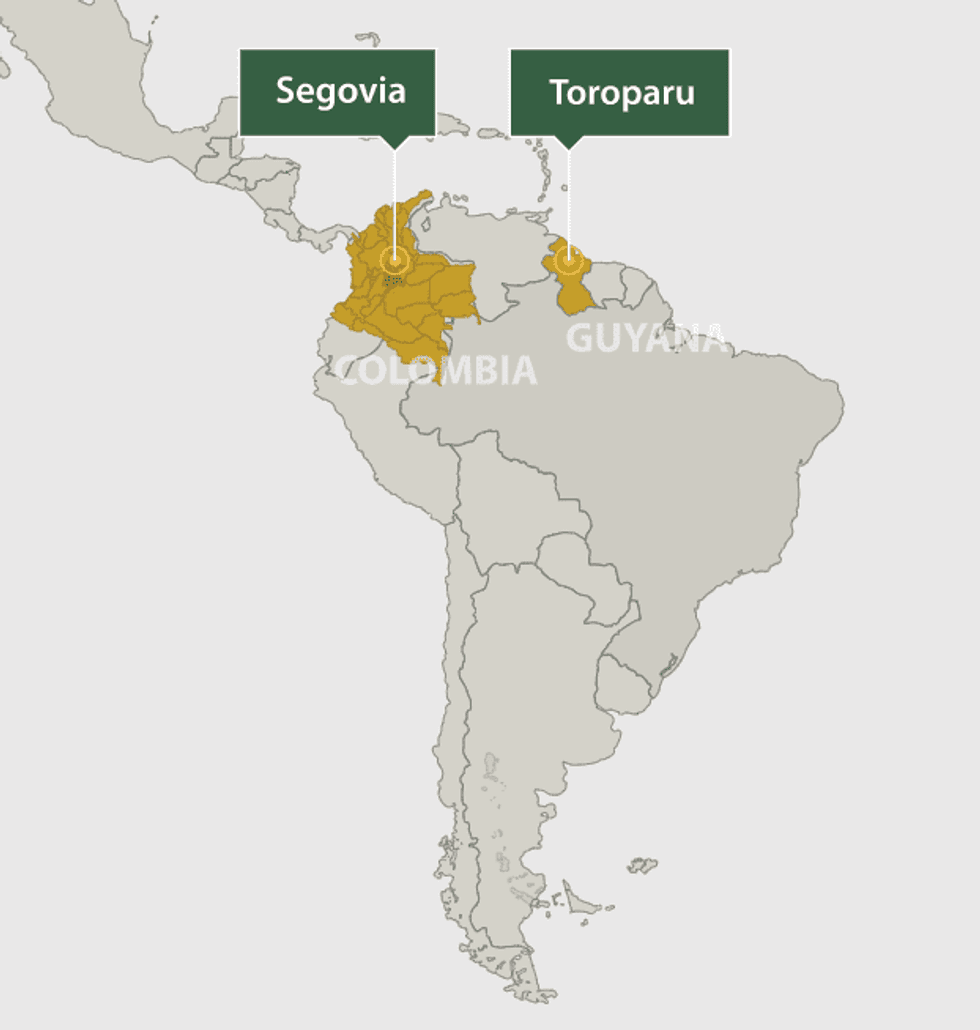

GCM Mining (TSX:GCM,OTCQX:TPRFF) is a mid-tier gold producer focused on exploring, developing and producing high-grade gold, silver and polymetallic minerals, across its high-quality project portfolio in the mining districts of Colombia and Guyana.

GCM Mining pays monthly dividends to shareholders, accordingly maintaining a range of equity interests in multiple companies. These include Aris (TSX: ARIS) , at 44.25 percent in the Marmato mine in Colombia and Denarius Metals (TSXV:DSLV) at 28.6 percent in the Lomero-Poyatos mine in Spain and the Guia Antigua and Zancudo projects in Colombia. It also holds 26 percent equity in Western Atlas Resources (TSXV:WA) in the Meadowbank mine in Nunavut, Canada.

In Colombia, GCM Mining stands as the largest underground gold and silver producer with several mines in operation at its high-grade Segovia asset, which consistently ranks in the world’s highest-grade mines. GCM Mining presents exceptional mine building and operating expertise across Latin America.

Its flagship Segovia operations is a world-class, multi-million-ounce high-grade gold mining operation that has been producing gold for more than 150 years. Located in a gold mining complex in Colombia’s Segovia-Remedios mining district in the Department of Antioquia, the project hosts production from four underground mines: Providencia, El Silencio, Sandra K and Carla. GCM Mining’s cumulative gold production from 2011 through 2020 stands at approximately 1.3 million ounces from processing 3.1 million tonnes of material at an average head grade of 13.8 g/t.

GCM Mining’s second gold operation is its Toroparu gold deposit in the Upper Puruni River region of western Guyana. The deposit lies within the Puruni Shear Corridor, a geologic feature that can be traced into the Malawi goldfields of eastern Venezuela. Toroparu presents the company with significant resource growth possibilities and exciting widespread gold exploration potential.

GCM Mining also owns approximately 27 percent equity interest in Denarius (TSXV:DSLV), a Canadian mining company with its principal focus on the Lomero Project in Spain and the Guia Antigua and Zancudo Projects in Colombia. Additional equity investments include approximately 44 percent of Aris Gold Corporation (TSX:ARIS) and an approximately 26 percent equity interest in Western Atlas Resources Inc. (TSXV:WA), which have assets in Colombia and Canada.

The next steps for the company include completing its PEA on Toroparu by year end 2021 and complying and releasing exciting drill results from ongoing significant exploration at Segovia. After modernizing its Colombian operations, GCM Mining continues to run a tight ship at Segovia.

In August 2021, GCM Mining completed an offering of US$300 million of 6.875 percent senior unsecured notes due 2026. This financing follows the company’s released balance sheet for June 2021 which revealed solid liquidity with total cash of US$57.8 million, working capital of US$59.3 million, and monthly dividend payments as outlined by GCM Mining.

Net proceeds of this offering, plus funding to come from a stream agreement with Wheaton, mean full funding of the construction of the Toroparu gold-copper project operations and no marketplace dilutive equity financings. “We are delighted with the overwhelming success of this offering, one which attracted high-quality institutional and retail investors who recognized our focus on a strong credit profile and growth through diversification,” commented Serafino Iacono, Executive Chairman of GCM Mining.

GCM Mining aims to become a dominant mid-tier gold producer. As it stands the company’s robust project portfolio put it on track to achieving positive growth trends in its corporate valuation. In 2021, GCM Mining estimates its guidance could hover upwards of 200,000 ounces of gold production with the possibility to double that yield in 24 months with the construction of Toroparu.

Company Highlights

- GCM Mining is a mid-tier Latin American gold producer focused on developing and exploring its high-quality project portfolio across top mining districts in Colombia and Guyana.

- The company’s management and leadership team brings decades of combined expertise and a proven track record of mine building and operating in Latin America.

- The flagship Segovia Operation consists of four high-quality, high-grade gold mines called El Silencio, Sandra K, Providencia and Carla, as well as significant brownfield exploration prospects, located in the Segovia-Remedios mining district of Antioquia, Colombia.

- GCM Mining’s Toroparu gold deposit in Western Guyana presents a fully-funded to start production by 2024 and has exceptional underexplored discovery potential.

- The company has additional projects and interests in Denarius, Aris Gold Corporation, and Western Atlas Resources Inc. which add to shareholder value.

- In August 2021, GCM Mining strengthened its liquidity by securing a US$300 million offering of 6.875 percent senior unsecured notes due 2026.

- GCM Mining continues to pay monthly dividends and has a strong balance sheet supported by the free cash flow generated by its Segovia operations.

Get access to more exclusive Gold Investing Stock profiles here