Investor Insight

Falco Resources presents a compelling investment opportunity with its high-margin Horne 5 gold project, strong partnerships, and advancing path to construction in Quebec’s prolific Rouyn-Noranda mining camp.

Overview

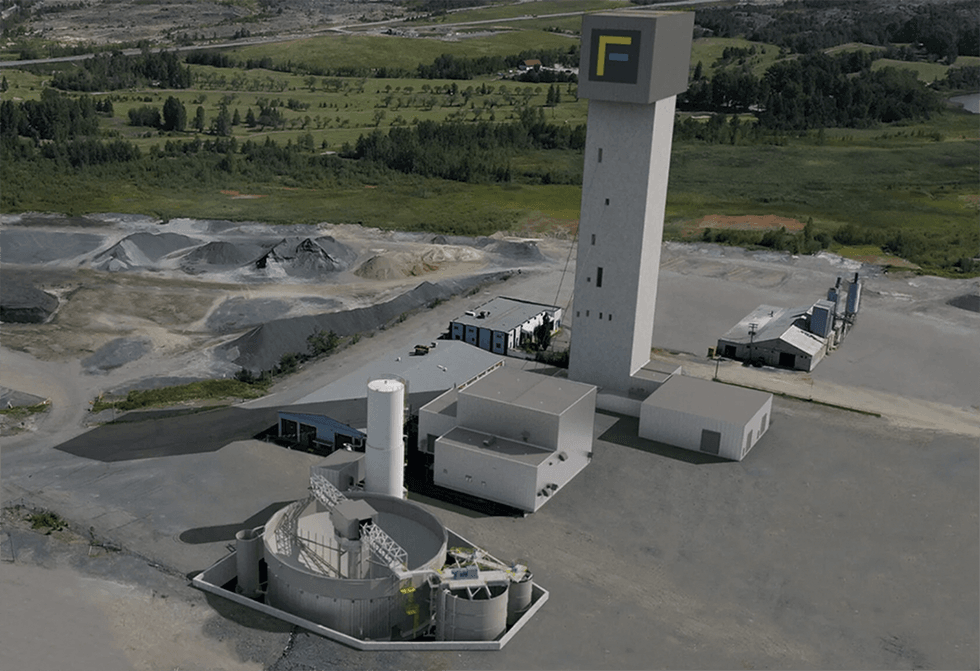

Falco Resources (TSXV:FPC) is a Canadian company focused on developing gold and base metal projects in the Rouyn-Noranda region of Quebec. Rouyn-Noranda is an established mining camp with a long history of exploration and development. The Noranda mining camp has historically produced 19 million ounces (Moz) of gold and 2.9 billion pounds (Blbs) of copper, and yet it is still under-explored for gold.

Falco’s principal property, Horne 5 project, holds 67,000 acres or nearly 67 percent of the total area of the entire mining camp and is located under the former Horne mine which produced 11.6 Moz of gold and 2.5 Blbs of copper. The 2021 feasibility study on the Horne 5 project suggests strong project economics with a total mine life of 15 years, after-tax NPV at 5 percent of US$761 million, and a payback period of 4.8 years, assuming gold prices at $1,600/oz. At the current gold prices of over $2,500/oz, the project economics will be even better.

In 2024, significant milestones for the company include the operating lease and indemnity agreement (OLIA) with Glencore (LON:GLEN) and the Horne 5 project’s environmental impact assessment (EIA) admissibility. Falco Resources' operating license and indemnity agreement (OLIA) with Glencore Canada will enable Falco to utilize a portion of Glencore's lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore canl nominate one representative to join Falco's board of directors.

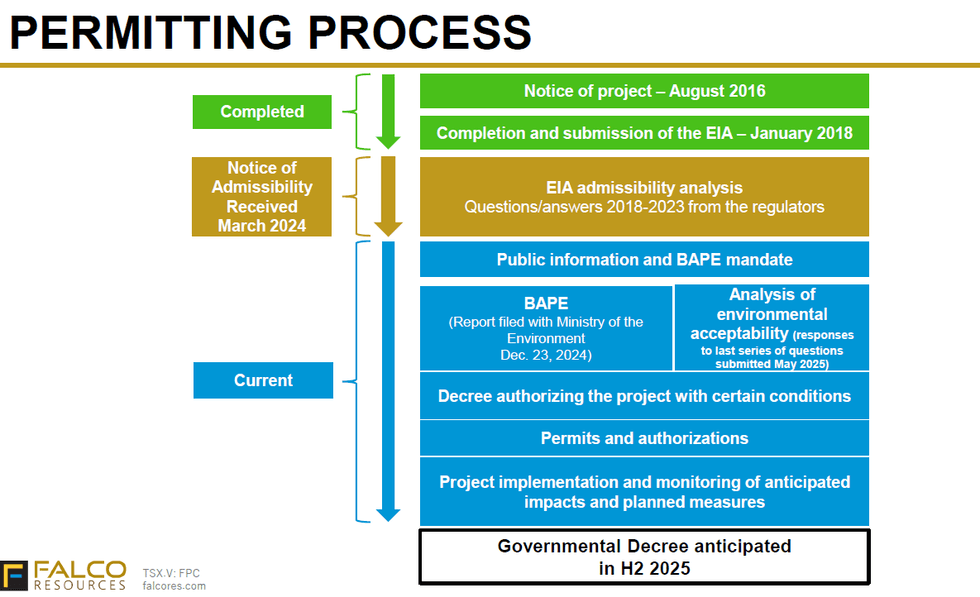

The successful completion of the OLIA, coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore, positions Falco to advance its Horne 5 project towards construction. The company is currently advancing with the permitting process for the project.

Falco is continuing with the next steps related to obtaining government permits and financing for its Horne 5 project after the report filed by the Bureau d'audiences publiques sur l'environnement (BAPE). The BAPE examined the Falco Horne 5 mining project from a sustainable development perspective, requesting additional studies and analyses. More than 90 percent of the commission's opinions related to the project have already been considered, planned or initiated.

Get access to more exclusive Gold Investing Stock profiles here