IEA: Renewables Resilient to COVID-19, Investor Appetite Remains Strong

In its Renewables 2020 report, the IEA says the renewables industry has adapted quickly to the challenges of the COVID-19 crisis.

The coronavirus pandemic has hit industries across the globe, but renewables markets, especially electricity-generating technologies, have shown resilience to the crisis.

According to the International Energy Agency’s (IEA) latest report, renewables used for generating electricity will grow by almost 7 percent in 2020, which is in sharp contrast to all other fuels.

“Global energy demand is set to decline 5 percent — but long-term contracts, priority access to the grid and continuous installation of new plants are all underpinning strong growth in renewable electricity,” it reads. “The net result is an overall increase of 1 percent in renewable energy demand in 2020.”

Even though the economic landscape remains uncertain, investor appetite for renewables remains strong, the IEA states. Driven by China and the US, net installed renewable capacity will grow by nearly 4 percent globally in 2020, reaching almost 200 gigawatts.

“Higher additions of wind and hydropower are taking global renewable capacity additions to a new record this year, accounting for almost 90 percent of the increase in total power capacity worldwide,” explains the recently released report.

Meanwhile, solar photovoltaic (PV) growth is expected to remain stable as a faster expansion of utility-scale projects compensates for a decline in rooftop additions caused by individuals and companies reprioritizing their investments.

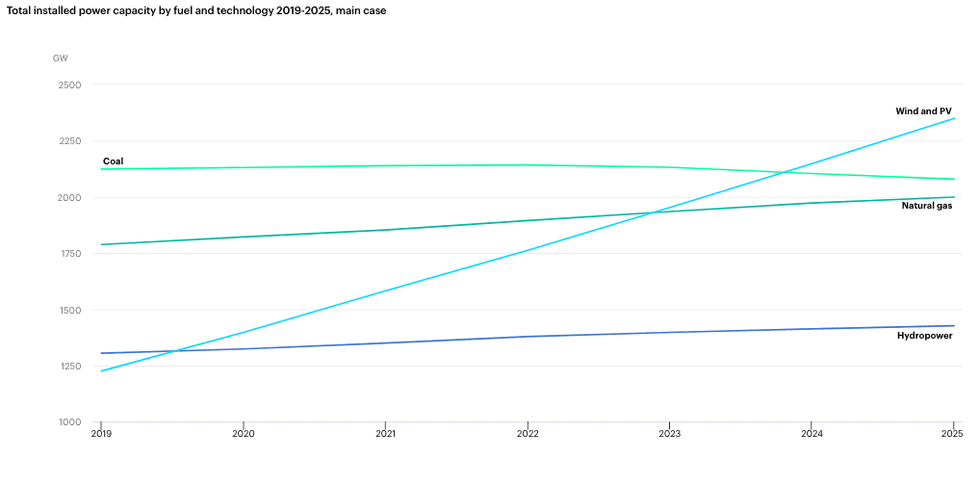

Chart via the IEA.

In its report, the agency also points out that the renewables industry has adapted quickly to the challenges of the COVID-19 crisis, with a faster-than-expected recovery in Europe, the US and China.

“We have revised the IEA forecast for global renewable capacity additions in 2020 upwards by 18 percent from our previous update in May,” it says.

Despite being resilient to the pandemic crisis, renewables might not be resilient to policy uncertainties.

“The expiry of incentives in key markets and the resulting policy uncertainties lead to a small decline in renewables capacity additions in 2022 in our main forecast,” states the report.

That said, economic stimulus measures focused on clean energy could also directly or indirectly support renewables, with the IEA estimating around US$108 billion will be spent with the aim of targeting economic growth with a focus on clean energy.

“These measures can support renewables by providing additional financial support either directly — or indirectly through areas such as buildings, grids, electric vehicles and low-carbon hydrogen,” it says.

For the IEA, even though the coronavirus pandemic has brought many challenges worldwide, the fundamentals of renewable energy expansion have not changed.

According to its forecast, total installed wind and solar PV capacity is on course to surpass natural gas in 2023 and coal in 2024, becoming the largest source of electricity generation worldwide by 2025.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.