Geopolitical tension pushed silver prices up this summer, but now a strong dollar is taking the wind out of the white metal’s sails.

The summer months are often a quiet time for the resource sector, with many market participants taking the old adage “sell in May and go away” to heart. As a result, investors tend to look forward to September, when prices and market activity typically pick up.

Unfortunately, this year that pattern simply hasn’t held true for silver — in fact, quite the opposite has happened.

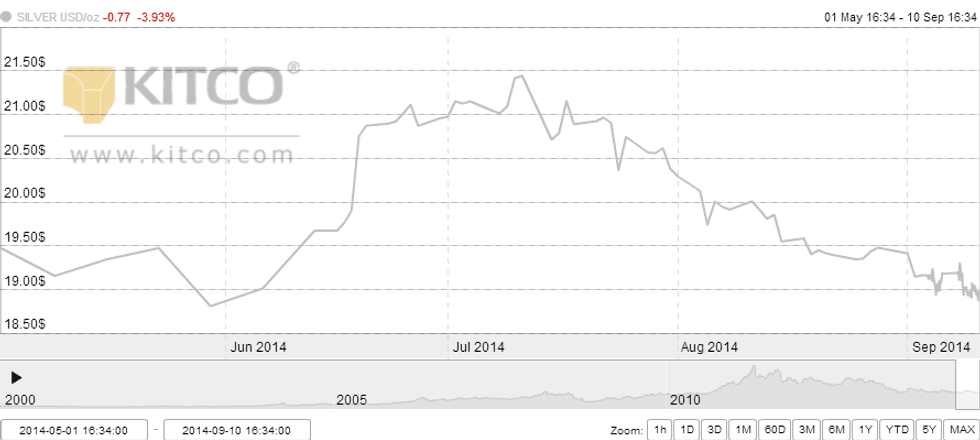

A quick glance at a the metal’s activity from May until now (see below) shows that it ended May at $18.81 per ounce, then proceeded to move upward throughout the summer, hitting a high point of $21.44 midway through July. Since then, silver has been on a steady decline, today sinking as low as $18.88 — essentially right back where it was three months ago.

Silver’s unseasonal price rise isn’t surprising given that the summer brought tension regarding conflict between Ukraine and Russia and in Iraq — after all, as a safe-haven asset, silver is a magnet for investors when geopolitical uncertainty hits. The current downward movement is also unsurprising given that the US dollar is currently on a tear.

That said, silver’s unusual behavior certainly has investors wondering what’s next for the white metal.

While longer-term predictions are scarce, Kitco’s Jim Wyckoff suggested Wednesday that silver bulls’ next upside price breakout objective is “closing prices above solid technical resistance at $19.50 an ounce.” Meanwhile, Julian Phillips states in a post for GoldSeek that the white metal is “waiting for gold to give direction.”

Silver closed today at $18.95.

Junior company news

El Tigre Silver (TSXV:ELS,OTCQX:EGRTF) on Tuesday announced “strong” assay results from the year-round exploration program at its Mexico-based El Tigre silver and gold project. Assay results from four samples of underground backfill material from the Southern vein area ranged from 1.28 grams per tonne (g/t) gold to 4.32 g/t gold and 262 g/t silver to 468 g/t silver.

Stuart Ross, president and CEO of El Tigre, commented, “[t]he exploration program continues to advance our understanding of the El Tigre vein system and we are extremely encouraged with the results,” adding, “[t]he ongoing exploration program continues to build our confidence in the potential at El Tigre. We look forward to the fall of 2014 being a bellwether period for the company.”

Wednesday, Dolly Varden Silver (TSXV:DV,OTCBB:DOLLF) said that it has started a diamond drill program of up to 8,000 meters, or 20 holes, at its British Columbia-based Dolly Varden project. The program is aimed at testing “numerous defined drill-ready epithermal and Eskay-Creek style targets,” as well as expanding known silver mineralization on the Torbrit-Red Point Corridor.

The same day, Bear Creek Mining (TSXV:BCM) released an update on the progress made on optimization studies at its Corani silver-lead–zinc deposit, commenting that trade-off studies have identified several design modifications that should enhance project performance. They “will now be carried forward into the detailed engineering,” but aren’t expected to require a new Environmental and Social Impact Study.

Corani is currently moving towards detailed engineering and permitting.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Related reading: