The Silver Institute says in a new report that the white metal will see price volatility this year after falling half a percent in 2017.

The Silver Institute has released a new report that examines trends that will influence the market this year.

It notes that the silver price fell by half a percent in 2017 to average $17.05 per ounce, and says the white metal is in for a “volatile ride” in 2018.

Why? The international non-profit association says short covering at the start of the year has already propelled the silver price above its 2017 average. Meanwhile, silver’s price ratio with gold currently sits at about 72; that means there’s “plenty of room” for it to migrate towards its long-term average of about 64.

Additionally, the Silver Institute sees silver benefiting as risk-hedging investors spark robust gold investment. It suggests that investors “buy silver instead of gold if they cannot afford the latter.”

Silver Institute: Solar demand to shine

Industrial demand comprised 60 percent of all silver demand in 2017, and that amount is expected to grow in 2018. The Silver Institute expects the metal to continue to be important for industries moving towards electrification because it is the best conductor of both heat and electricity.

Global demand for solar panels has increased demand for silver in photovoltaic applications, and it rose to an estimated 92 million ounces in 2017. The group expects that growth to continue, and sees it reaching a record in 2018 on uptake from individual households, particularly in China.

Jewelry demand, which accounts for approximately one-fifth of total silver demand, is expected to rise by 4 percent in 2018, up from a 1-percent rise in 2017. India had a “strong year” in 2017, with silver imports almost doubling from 2016, to 183 million ounces, due to healthy demand and the implementation of a Goods and Services Tax. In 2018, the Silver Institute “expect[s] silver demand from jewelry fabricators to remain strong, pushing imports to approximately 180 Moz.”

Coin demand almost halved, reaching 73 million ounces in 2017, with weakness concentrated in the US. A buoyant stock market making equity and bonds more “expensive,” plus interest in cryptocurrencies, diverted some capital away from precious metals. With a breather in bitcoin investment at the start of 2018, the group expects some investment to flow back into precious metals this year.

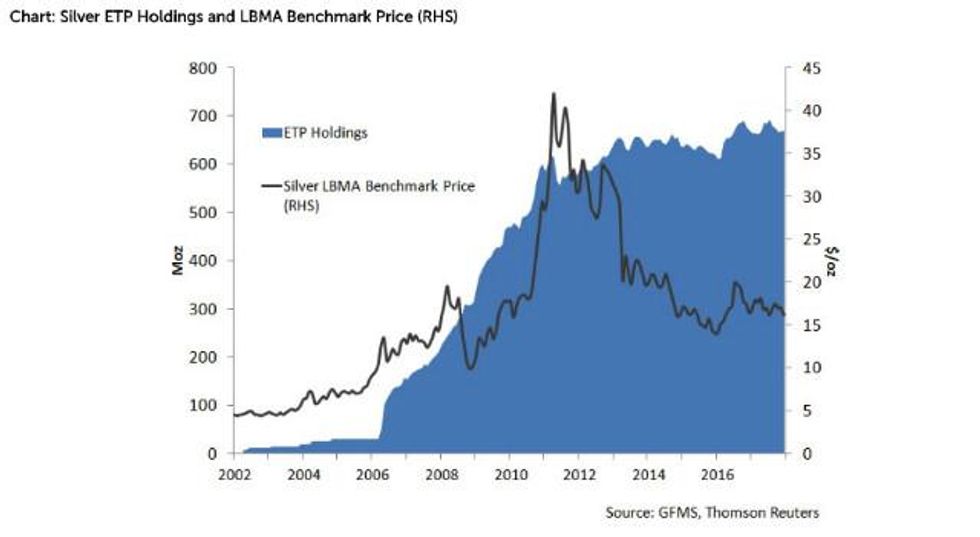

Silver exchange-traded-products (ETP) holdings reached a record at the end of 2017 of 670 million ounces, and have been relatively stable since their introduction in 2002. The institute expects ETP holdings to rise by about 3 percent in 2018.

Chart via the Silver Institute.

Silver Institute: Expect slight 2018 deficit

Global silver mine output fell 1 percent in 2016 after 14 years of consecutive growth, and sank 2 percent in 2017 to reach 870 million ounces. Silver mine output is expected to be constrained in 2018 due to production disruptions in South Africa and a decline in CAPEX among primary producers.

A recovery in base metals prices is expected to provide some support to by-product producers “capitalizing on the trend.” Silver scrap, which has been on the decline since 2011, is expected to stabilize in 2018 to about 150 million ounces, equating to 15 percent of total silver supply.

The Silver Institute says investors can expect the market to be in a slight deficit this year. It’s anticipated that silver will be drawn down from aboveground stocks to serve the shortfall. The group considers the anticipated drawdown to be a “welcome development,” as aboveground stocks rose 9 percent last year in the face of weak physical demand from the US and Asia.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.