A report prepared for the Silver Institute by CRU Consulting states that total silver industrial demand is set to grow 27 percent through to 2018 from 2013 levels. That equates to an additional 142 million ounces of silver demand.

The US Mint announced Tuesday afternoon that it’s recorded a new sales record for American Eagle silver bullion coins, but recent news from the Silver Institute indicates that it’s not just investors who are increasing their uptake of the white metal.

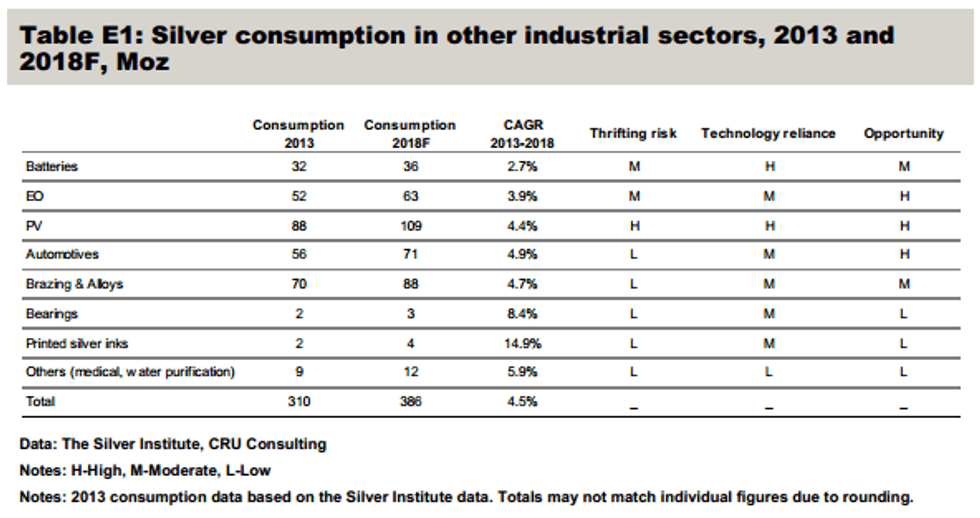

A report prepared for the organization by CRU Consulting states that total silver industrial demand is set to grow 27 percent through to 2018 from 2013 levels. That equates to an additional 142 million ounces of silver demand. The electrical and electronics sector will account for half of that growth, while the rest will come from other applications.

CRU breaks down silver industrial demand growth as follows:

Furthermore, the firm looks in detail at four applications for which it has particularly high expectations: batteries, ethylene oxide (EO), anti-bacterial and bearings. Here’s a brief look at what has CRU so excited about those sectors:

- Batteries: CRU describes itself as “reasonably bullish about silver demand in batteries,” though it does note that technological factors could impact the sector. For instance, while silver-zinc batteries could eventually replace lithium-ion batteries in “many expensive electronic devices,” that’s dependent on scientists figuring out how to extend their life.

- EO: Silver is used as a catalyst in the production of EO, products of which are used to make things like anti-freeze, polyester and solvents. Some EO is also used in the sterilization of healthcare products. Silver used in this arena is almost totally recoverable, but as “EO capacity is forecast to continue to grow,” CRU nevertheless sees opportunity in this arena.

- Anti-bacterial: Silver has long been valued for its anti-bacterial properties, and CRU doesn’t see that letting up any time soon. However, some risks are attached to this source of demand — the firm states that the increasing use of nanosilver in anti-bacterial applications has led to concerns about how it could impact the environment and human health.

- Bearings: According to CRU, silver-coated bearings “are used extensively throughout industry for heavy-duty equipment and hi-tech applications.” While the firm sees demand from this area rising slowly, silver is “as yet unsubstitutable” in bearings, so prospects are good.

No word on what this anticipated uptick in industrial silver demand may mean for prices, but it’s certainly some food for thought for investors concerned about the white metal’s current low price.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.