Precious metals appear to be at or near an inflection point and look due to reverse into an upward sloping trajectory imminently.

In conjunction with a material inflection point for the US dollar, precious metals appear at the demarcation of a significant delineation as well.

As is typical, there exists an inverse correlation between a strong US dollar and weak commodities prices. Occasionally, precious metals can decouple from that dynamic and can exhibit a sustained positive correlation, but for the time being, that is not yet the case. There are signs percolating through various asset classes that inflation may be on the verge of asserting itself which is a precondition for gold, silver and the dollar to all move in the same direction. Time will tell if that proves to be the case, but for the time being it is status quo.

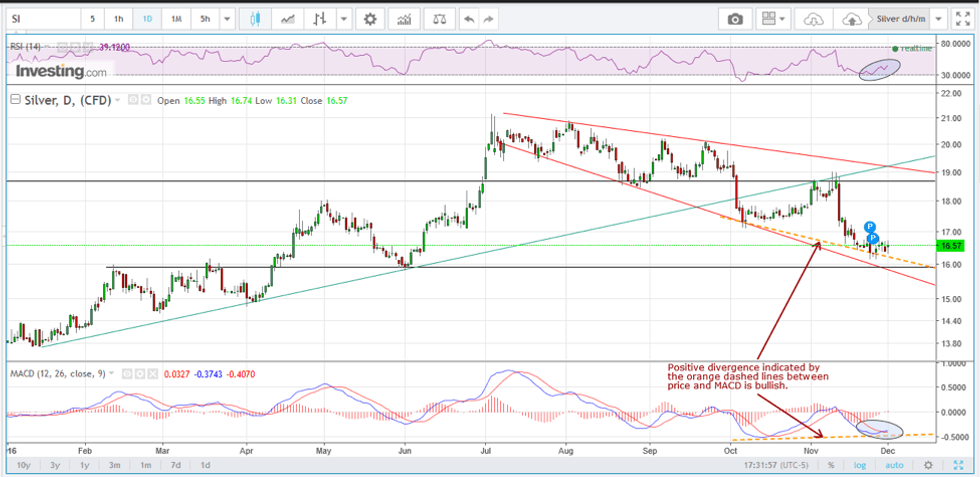

The daily chart below is showing indications that the recent corrective action in silver has almost run its course and a reversal may be at hand. RSI (relative strength index) has turned positive, as has MACD (moving average convergence divergence). Furthermore, MACD has diverged positively from price putting in a higher low coincident with a lower low on price.

This typically indicates that sellers are becoming exhausted and a reversal is imminent. The fact that this is occurring in the vicinity of support at $15.85 gives me confidence that this is the most likely scenario. Only a confirmed breach of support would negate that outlook. Looking forward, it is probable that silver trades in a range sandwiched between support at $15.85 and resistance at $18.65 before asserting itself further.

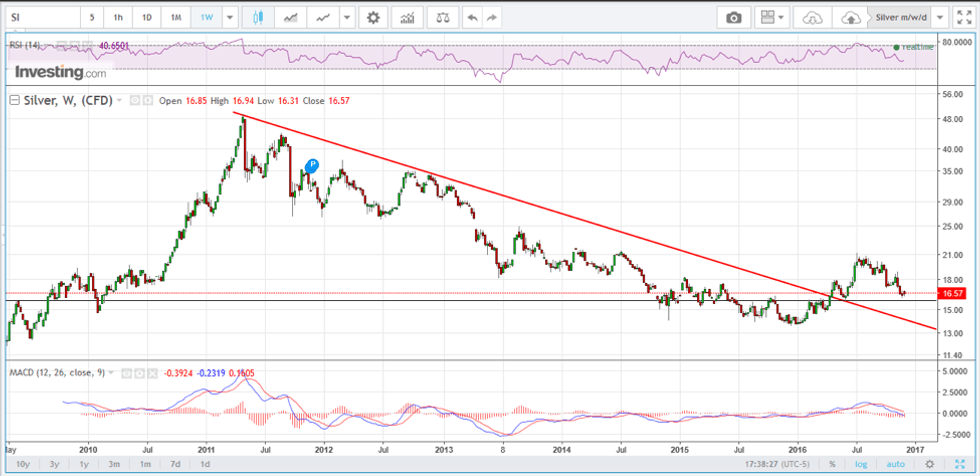

The weekly chart tells a similar story, but RSI and MACD have not yet turned positive and the divergence between price and MACD does not display the same conviction prominent in the daily.

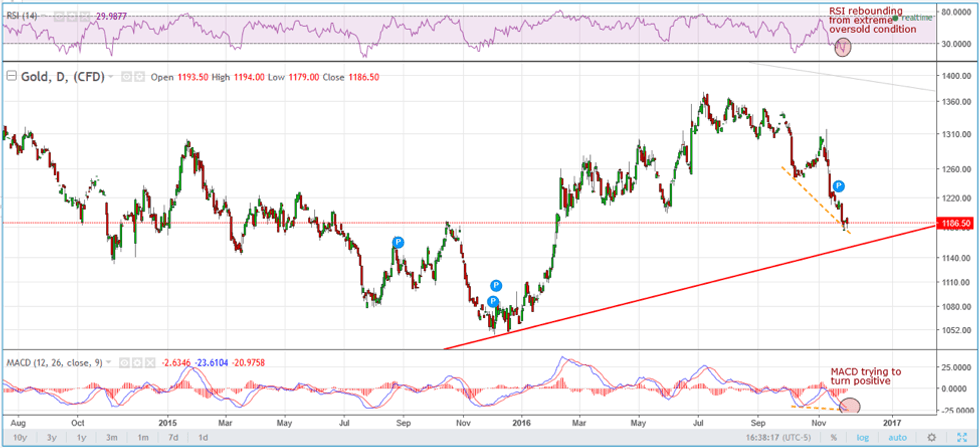

The daily chart of gold is a little less clear than the silver chart, but RSI is rebounding from a severely oversold condition and MACD is also attempting to curl up.

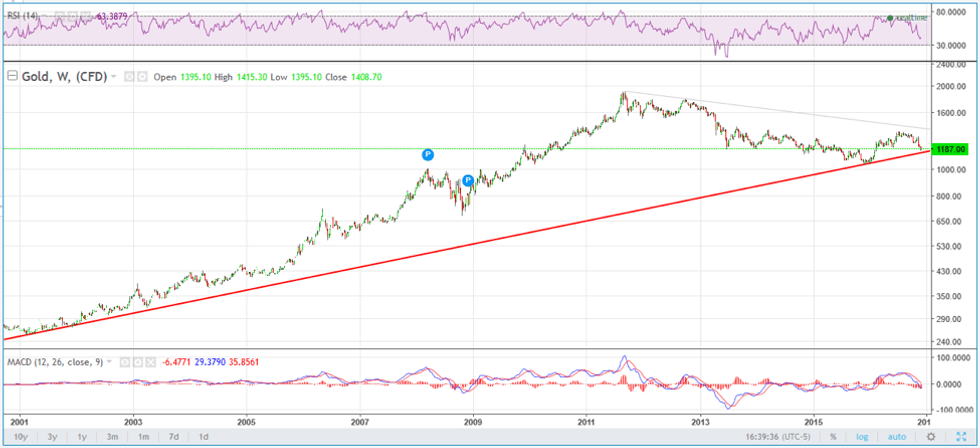

The weekly chart goes one step further to indicate that the price of gold is converging on a trend line that dates right back to the genesis of the near 15 year bull market in gold.

Further augmenting the bull case is RSI and MACD at the low end of the range. Provided this support level holds near the $1,150 level, it would be safe to assume that prices strengthen from here and it would be a serious blow to the bulls if that level were to give way.

Conclusion

Precious metals appear to be at or near an inflection point and look due to reverse into an upward sloping trajectory imminently. Whether this is coincident with a reversal in the US dollar or is coincident with inflationary pressures and a stronger US dollar is yet to be determined.

Terry Yaremchuk is an Investment Advisor and Futures Trading representative with the Chippingham Financial Group. Terry offers wealth management and commodities trading services. Specific questions regarding a document can be directed to Terry Yaremchuk. Terry can be reached at tyaremchuk@chippingham.com.

This article is not a recommendation or financial advice and is meant for information purposes only. There is inherit risk with all investing and individuals should speak with their financial advisor to determine if any investment is within their own investment objectives and risk tolerance.

All of the information provided is believed to be accurate and reliable; however, the author and Chippingham assumes no responsibility for any error or responsibility for the use of the information provided. The inclusion of links from this site does not imply endorsement.