2016 Brought First Drop in Global Silver Mine Output in Over a Decade

According to Johann Wiebe, lead analyst for Thomson Reuters’ GFMS team, that trend is likely to continue.

Global silver mine production fell last year for the first time in 14 years, and according to Johann Wiebe, lead analyst for Thomson Reuters’ GFMS team, that trend is likely to continue.

Speaking via phone ahead of the May 11 release of the latest World Silver Survey, a collaboration between the GFMS team and the Silver Institute, he explained, “this is not going to be just a one-off event. We think there’s going to be more of a prolonged decline, or moderation in output, for silver in the coming two to three years.”

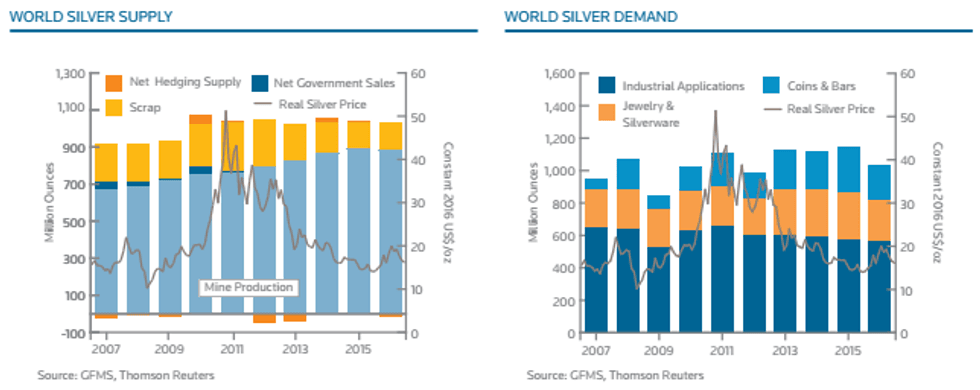

Why? Wiebe said that in total, silver mine supply sank 0.6 percent in 2016 to reach 885.8 million ounces. While output from primary silver mines grew 1 percent, most mined silver is produced as a by-product at gold and base metals mines, where production sank by a combined 15.9 million ounces. “They obviously have been focusing on margins and have had to cut back on some production,” he said.

Overall silver supply, which includes mine production, net government sales, scrap and net hedging supply, came in at 1,007.1 million ounces, down from 1,039.7 million ounces the previous year. Scrap silver supply fell to reach “a level not seen since 1996,” while delta-adjusted silver hedging by producers contracted; government sales of silver were “virtually non-existent.”

Chart via Thomson Reuters’ GFMS team.

Compared to supply, silver demand saw a much more precipitous drop in 2016, sinking 11 percent year-on-year to come in at 1,027.8 million ounces. The fall was largely the result of steep declines in demand for jewelry, silverware and coins and bars. Industrial applications, which accounted for 55 percent of silver demand last year, saw a modest drop of just 1 percent.

Commenting on the situation, Wiebe noted, “on the one hand you can say you had a strong 2015 and therefore 2016 is always going to be a little bit less strong.” Even so, he admitted that the degree to which demand dropped last year was somewhat surprising.

That’s not to say there weren’t bright spots in silver demand last year. “The ones that stood out were ethylene oxide … and obviously the massive outlier to the positive side was solar,” said Wiebe. Solar falls under the photovoltaics category, where demand increased a whopping 34 percent last year to reach a new record of 76.6 million ounces. Again, that’s a trend that Wiebe sees continuing — he noted that the US and China will be key drivers of solar demand as they strive to diversify their energy capabilities.

“There are a whole host of different applications [for silver] that will continue to be developed,” he said. “But we don’t see any of them sticking out as strongly as solar has [in terms of] creating significant demand for silver projects.”

Those supply and demand dynamics led to a 2016 silver deficit of 147.5 million ounces, the largest in three years and the third largest on record. What’s more, the situation pushed the average annual silver price up for the first time since 2011 — it rose 9.3 percent year-on-year, clocking in at $17.14. That’s also 28 percent higher than 2007, when the average annual silver price was $13.38.

Of course, some market watchers are wondering why the silver price hasn’t risen even higher. In answer to that question, Wiebe said, “the answer is very simple and straightforward: aboveground stock.”

He explained that unlike base metals, silver “has an investment component [and] is stored in almost the same form as it is refined” — notably bars, coins and the like. Continuing, he added, “there is an abundance of that material available. That is metal that can come back to the market quite quickly in the case that there is demand.” In other words, there’s rarely a chance for silver supply and demand imbalances to get out of hand.

The GFMS team at Thomson Reuters is calling for an average annual silver price of $18.17 this year. “On the fundamental side we still remain optimistic on silver’s price performance,” said Wiebe. “If you compare it to gold, we still think it’s undervalued.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.