Drill Tracker Weekly: Merrex Gold Intersects High-grade Silver at Diakha

Diamond drilling has confirmed results from reverse-circulation drilling and has extended mineralization to depth.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

Merrex Gold (TSXV:MXI)

Price: $0.175

Market cap: $18 million

Cash estimate: $0.7 million

Project: Diakha

Country: Mali

Ownership: 50 percent

Reserves: N/A

Project status: Resource expected Q4/2015

- The Merrex / IAMGOLD (TSX:IMG) 50/50 joint venture announced additional results from the final 17 diamond drill holes from the Diakha target, on the Siribaya project in western Mali.

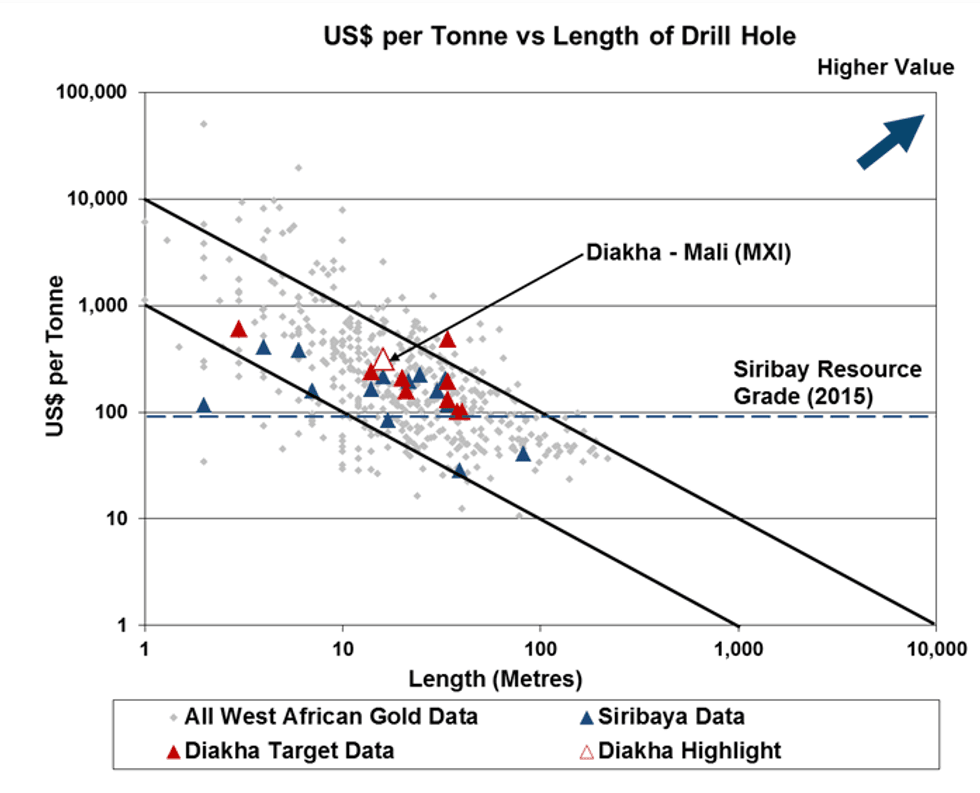

- Highlights from the diamond drill program has confirmed results from the reverse circulation (RC) drilling and extended the mineralization to depth. Highlights include 16 metres grading 7.76 g/t Au including a high-grade interval of 11 metres of 10.61 g/t Au. In August, the joint venture reported the highest-grade results to date with 34 metres grading 11.99 g/t including 18.0 metres of 18.10 g/t Au starting at 138 metres depth.

- The diamond drilling is expected to provide better geological information prior to completing a maiden resource estimate towards the end of 2015. The drilling has extended the high-grade mineralization to at least 250 metres vertical with the zone remaining open at depth. Mineralization is hosted in a sandstone horizon with disseminated sulphide and albite-hematite-chlorite alteration with a notable lack of quartz veining.

- The Diakha target is located approximately 20 kilometres to the west of the Company’s resource on the main Siribaya deposit. Diakha is approximately 10 kilometres south of IAMGOLD’s 1.1 million ounce Boto deposit, and 23 kilometres south of the B2Gold’s (TSX: BTO) recently acquired 5.1 million ounce Fekola deposit. The Fekola project was acquired by B2Gold for USD$570 million in June 2014. Merrex also has an exploration permit in application in Guinea, which occurs along the mineralized trend between the Diakha and Boto deposits.

- In January 2015, the Company made an agreement in principle with IAMGOLD to exchange a debt of approximately $2.5 million owed to IAMGOLD for shares at a price to be determined.

Discovery history: Initial RC drilling April 2014 — 2.0 metres @ 7.7 g/t Au. Significant discovery July 2014 — 34 metres @ 3.22 g/t Au.

Current drilling: 16 metres @ 7.76 g/t Au; 34 metres @ 11.99 g/t Au (August 2015) including 18 metres @ 18.10 g/t Au

Risk Analysis

Data contained in DRILL TRACKER WEEKLY is based on early stage exploration activity. The results are obtained at the very early stages of exploration and therefore, individual results may not be reproducible with additional trenching or drilling, nor may the results ultimately lead to the discovery of an economic deposit. Delineation of a resource body requires an extensive data gathering exercise according to guidelines set out in National Instrument 43-101 before investors can be reliably assured of a competent body of mineralization that may be of economic interest. DRILL TRACKER WEEKLY is designed to highlight individual trench or drill results, which stand out as being materially anomalous and are particularly worth of note – a type of early warning flag for a particular property that warrants further attention. Hence, DRILL TRACKER WEEKLY does not provide a recommendation to buy, sell or hold a specific equity – it is an information reference source to help quantify the meaning and relevance of early stage exploration results.

Relevant Disclosures Applicable to: Drill Tracker Weekly

- The research analyst or a member of the research analyst’s household owns and/or has options to acquire shares of the subject issuer. At the date of this release the author, Wayne Hewgill, owns shares in the following companies in this report. Fission Uranium (TSXV.FCU)

Analyst Certification

I, Wayne Hewgill certify that the information in this report is sourced through public documents that are believed to be reliable but accuracy and completeness as represented in this report cannot be guaranteed. The author has not received payment from any of the companies covered in this report. This report makes no recommendations to buy, sell or hold. Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.