Xtra-Gold Intersects 61.57 m of 2.42 g/t Gold, Including 21.5 m of 5.13 g/t Gold, in New Fold-Limb Shoot at Double 19 Deposit, Kibi Gold Project, Ghana

Xtra-Gold Resources Corp. (TSX: XTG) (OTCQB: XTGRF)(“Xtra-Gold” or the “Company”), is pleased to announce assay results for an additional 13 drill holes from its current resource expansion target generation program within the Zone 2 – Zone 3 maiden mineral resource footprint area, on the Company’s wholly-owned Kibi Gold Project

Xtra-Gold Resources Corp. (TSX:XTG) (OTCQB: XTGRF)(“Xtra-Gold” or the “Company”), is pleased to announce assay results for an additional 13 drill holes from its current resource expansion target generation program within the Zone 2 – Zone 3 maiden mineral resource footprint area, on the Company’s wholly-owned Kibi Gold Project, located in the Kibi – Winneba greenstone belt (the “Kibi Gold Belt”), in Ghana, West Africa. The 13 diamond core boreholes totaling 2,269.5 metres were completed by the Company’s in-house drilling crews from early August to late September 2020; with a total of 58 holes (7,760.5 metres) drilled to date since the program’s initiation in September 2019.

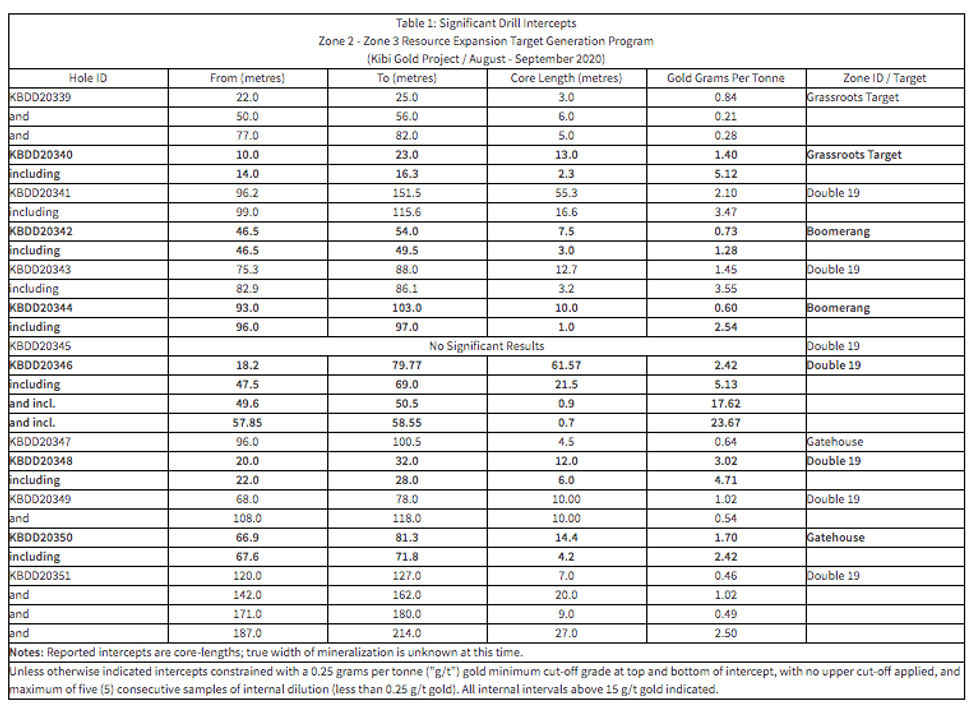

Assay results reported are provided in Table 1 below and include the following highlights:

- 61.57 metres grading 2.42 grams per tonne (“g/t”) gold, including 5.13 g/t gold over 21.5 metres, from down-hole depth of 18.2 metres in #KBDD20346; new fold limb gold shoot on NW flank of Double 19 deposit fold structure;

- 55.3 metres grading 2.1 g/t gold, including 3.47 g/t gold over 16.6 metres, from down-hole depth of 96.2 metres in #KBDD20341; and 20.0 metres grading 1.02 g/t gold and 27.0 metres grading 2.5 g/t gold from down-hole depths of 142 metres and 187 metres respectively in #KBDD20351; extending Double 19 fold hinge gold shoot approximately 115 metres down plunge from previous drilling;

- 14.4 metres grading 1.7 g/t gold, including 2.42 g/t gold over 4.2 metres, from a down-hole depth of 66.9 metres in #KBDD20350; 150 metre step-out hole on Gatehouse Zone.

James Longshore, President and CEO remarked, “We are very satisfied with the results of this initial phase of resource expansion drilling at the Double 19 deposit. These results have confirmed the down plunge continuity of the central fold hinge gold shoot, outside the scope of the current inferred mineral resource, as well as impactfully increased the resource expansion potential along the limbs of the fold structure. Considerable insight has been gained into the litho-structural controls of the Zone 2 – Zone 3 gold mineralization over the last few years, with the evolving geological model providing enhanced drill targeting to further maximize the Kibi Gold Project’s economic potential.”

The Double 19 deposit has a current inferred mineral resource of 48,000 ounces of gold (0.61 million tonnes at an average grade of 2.43 g/t gold). The Double 19 deposit, located in Zone 3, along with the Big Bend, East Dyke, South Ridge and Mushroom deposits in Zone 2, form part of a maiden mineral resource estimate (October 26, 2012) on the Company’s Kibi Gold Project. In aggregate, these five gold deposits lying within approximately 1.6 kilometres of each other are estimated to encompass an indicated mineral resource of 3.38 million tonnes grading 2.56 g/t gold for 278,000 ounces of contained gold and an additional inferred mineral resource of 2.35 million tonnes grading 1.94 g/t gold for 147,000 ounces of contained gold (@ base case 0.5 g/t cut-off). The Zone 2 – Zone 3 maiden mineral resource represents the first ever mineral resource generated on a lode gold project within the Kibi Gold Belt. Gold mineralization is characterized by auriferous quartz vein sets hosted in Belt-type granitoids geologically analogous to other “Granitoid-hosted” gold deposits of Ghana, including Kinross Gold’s Chirano and Newmont Mining’s Subika deposits in the Sefwi gold belt. The above mineral resource estimate was filed in accordance with National Instrument 43-101 (NI 43-101) requirements with the Technical Report entitled “Independent Technical Report, Apapam Concession, Kibi Project, Eastern Region, Ghana“, prepared by SEMS Explorations and dated October 31, 2012, filed under the Company’s profile on SEDAR at www.sedar.com.

The present drill results correspond to the latest 13 boreholes (2,269.5 metres) of an ongoing exploration initiative geared towards the generation of new resource expansion targets within the Zone 2 – Zone 3 maiden mineral resource footprint area of the Kibi Gold Project. With the drilling designed to follow up on early stage gold shoots / showings discovered by previous drilling / trenching efforts (2008 – 2012) and to test prospective litho-structural gold settings identified by recently completed 3D geological modelling. The diamond core boreholes ranging in length from 95.5 metres to 384.0 metres were completed by the Company’s in-house drilling crews on an intermittent basis from early August to late September 2020. Holes reported today encompass #KBDD20339 – #KBDD20351, including: 7 holes (1,422.5 metres) on the Double 19 deposit; 2 holes (336 metres) on the Boomerang zone; 2 holes (279 metres) on the Gatehouse zone; and 2 holes (232 metres) on a grassroots target. Exploration significant auriferous intercepts are presented in Table 1 above and a drill / compilation plan with collar details depicted in Figure 1, available at:

(Figure 1 Zone 2 – Zone 3 Drill Plan October 20 2020)

Recent detailed 3D litho-structural modelling indicates that the gold mineralization outlined to date at the Double 19 deposit is emplaced along the hinge zone of a NE-plunging fold structure. Previous drilling was geared primarily to delineate the fold-hinge gold shoot with drill hole orientation / attitude not optimal for the targeting of potential mineralization shoots developed along the limbs of the fold structure. The present Double 19 resource expansion drilling included five holes (1,156.5 metres) designed to further define the northeastern extremity and down plunge extension of the fold hinge gold shoot and two holes (266 metres) targeting potential mineralization along the northwest limb of the fold structure.

Resource expansion drilling efforts targeting the northeast extremity of the fold hinge gold shoot yielded the following mineralized intercept highlights. Hole #KBDD20341 corresponding to a NW-trending (-75o) borehole collared 50 metres northeast of the previous north-easternmost drill section returned 55.3 metres grading 2.1 g/t gold, including 3.47 g/t gold over 16.6 metres, from a down-hole depth of 96.2 metres; approximately 90 metres down plunge from the previous drilling. #KBDD20351 consisting of a SW-trending (-75o) borehole targeting the down plunge extension of the NE-trending fold hinge shoot, approximately 25 metres down plunge of the #KBDD20341 auriferous intercept, returned four individual mineralized intervals (7 metres – 27 metres) over a 94 metre core-length from a down-hole depth of 120 metres, including mineralized intercept highlights of 20.0 metres grading 1.02 g/t gold and 27.0 metres grading 2.5 g/t gold; extending the hinge zone gold shoot approximately 115 metres down plunge from previous drilling.

Hole #KBDD20346 designed to follow up on a 2012 mineralized intercept of 4.0 metres grading 5.85 g/t gold in #KBDD12201 (see the Company’s news release of April 24, 2012) and to test for potential mineralization developed along the northwest limb of the fold structure returned 61.57 metres grading 2.42 g/t gold, including 5.13 g/t gold over 21.5 metres, from a down-hole depth of 18.2 metres. This newly identified, apparent fold limb-controlled gold mineralization extending a minimum of 50 metres below the central fold hinge gold shoot significantly increases the resource expansion potential along the northwestern limb of the Double 19 deposit fold structure.

Today’s drilling results include two step-out boreholes on the Gatehouse Zone located approximately 500 metres southeast of the Zone 2 gold resource footprint area (#KBDD20347 & #KBDD20350). The Gatehouse Zone was originally identified by a 2011 scout trench targeting a gold-in-soil anomaly with a coincidental Induced Polarization (IP) / Resistivity geophysical signature. The target was subsequently tested by a two hole scissor drill pattern in 2012 with the boreholes yielding mineralized intercepts of 11.0 metres grading 1.46 g/t gold, including 3.36 g/t gold over 2.0 metres, from a down-hole depth of 182 metres in #KBDD12186 and 12.0 metres grading 0.95 g/t gold, including 1.52 g/t gold over 4.5 metres, from a down-hole depth of 31.6 metres in #KBDD12188 (see the Company’s news release of April 4, 2012).

The present Gatehouse Zone drilling targeted the southwestern strike-extension of the host granitoid body with hole #KBDD20350 corresponding to a 150 metre step-out from the 2012 gold intercepts returning 14.4 metres grading 1.7 g/t gold, including 2.42 g/t gold over 4.2 metres, from a down-hole depth of 66.9 metres. #KBDD20347 collared 50 metres northeast of #KBDD20350 yielded 4.5 metres grading 0.64 g/t gold from a down-hole depth of 96 metres. To date typical Kibi-type (Zone 2) Granitoid-hosted gold mineralization has been traced over an approximately 250 metre strike length and to a 165 metre vertical depth on the Gatehouse Zone.

At the recently defined Boomerang Zone, hole #KBDD20344 designed to undercut the auriferous zone delineated by the original #KBDD20335 / #KBDD20338 drill fence, yielded a mineralized intercept of 10.0 metres grading 0.60 g/t gold, including 2.54 g/t gold over 1.0 metre, from a down-hole depth of 93.0 metres; approximately 50 metres down plunge of the lower #KBDD20338 gold intercept. With the previously reported #KBDD20335 returning a mineralized intercept of 43.5 metres grading 1.21 g/t gold, including 2.16 g/t gold over 7.5 metres and 4.3 g/t gold over 6.0 metres, from a down-hole depth of 3.0 metres and #KBDD20338 yielding 24.0 metres grading 1.35 g/t gold, including 1.99 g/t gold over 9.0 metres, from down-hole depth of 56.5 metres (see the Company’s news release of September 8, 2020). Gold mineralization at the Boomerang Zone has been traced to date over an approximately 80 metre down plunge distance from surface along an apparent NE-plunging fold structure. Trenching is currently ongoing to further define the geometry / attitude of the host granitoid body and of the gold-bearing vein system to guide upcoming follow up drilling.

QA/QC

Yves P. Clement, P. Geo, Vice President, Exploration for Xtra-Gold is acting as the Qualified Person in compliance with National Instrument 43-101 (“NI 43-101”) with respect to this announcement. He has prepared and or supervised the preparation of the scientific or technical information in this announcement and confirms compliance with NI 43-101. All samples in this news release were analyzed by standard fire assay fusion with atomic absorption spectroscopy finish at the ISO 17025:2005 accredited Intertek Minerals Limited’s laboratory in Tarkwa, Ghana. Xtra-Gold has implemented a rigorous quality assurance / quality control (QA/QC) program to ensure best practices in sampling and analysis of drill core, trench channel, and saw-cut channel samples, the details of which can be viewed on the Company’s website at www.xtragold.com.

About Xtra-Gold Resources Corp.

Xtra-Gold is a gold exploration company with a substantial land position in the Kibi Gold Belt. The Kibi Gold Belt, which exhibits many similar geological features to Ghana’s main gold belt, the Ashanti Belt, has been the subject of very limited modern exploration activity targeting lode gold deposits as virtually all past gold mining activity and exploration efforts focused on the extensive alluvial gold occurrences in many river valleys throughout the Kibi area.

Xtra-Gold holds 5 Mining Leases totaling approximately 226 sq km (22,600 ha) at the northern extremity of the Kibi Gold Belt. The Company’s exploration efforts to date have focused on the Kibi Gold Project located on the Apapam Concession (33.65 sq km), along the eastern flank of the Kibi Gold Belt. The Kibi Gold Project (Zone 2 – Zone 3) maiden mineral resource estimate produced by Xtra-Gold in October 2012 represents first ever mineral resource generated on a lode gold project within the Kibi Gold Belt. The NI 43-101 Technical Report entitled “Independent Technical Report, Apapam Concession, Kibi Project, Eastern Region, Ghana“, prepared by SEMS Explorations and dated October 31, 2012, is filed under the Company’s profile on SEDAR at www.sedar.com.

Forward-Looking Statements

The TSX does not accept responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. This news release includes certain “forward-looking statements”. These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management’s expectations. Forward- looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company’s mineral properties, and the Company’s financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. These and other factors should be considered carefully, and readers should not place undue reliance on the Company’s forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities laws.

Cautionary Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy, and Petroleum 2014 Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and mineral resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.