White Gold Corp. Encounters Significant Mineralization at Ryan’s Surprise Discovery 2km West of Golden Saddle

White Gold Corp. (TSXV:WGO, OTC:WHGOF, FRA:29W) is pleased to announce diamond drill results from its flagship White Gold Property.

White Gold Corp. (TSXV:WGO, OTC:WHGOF, FRA:29W) (the “Company”) is pleased to announce diamond drill results from its flagship White Gold Property, including the Golden Saddle & Arc deposits and the Ryan’s Surprise discovery, as well as positive metallurgical test results on its Arc deposit that indicate the mineralization is non-refractory and a strong global recovery of 85.2%. This phase of diamond drilling was designed to target previously underexplored portions of the Golden Saddle & Arc deposits and surrounding area, as well as the Ryan’s Surprise discovery, located less than 2km west of the Golden Saddle deposit. The ongoing fully-funded $13 million 2019 exploration program backed by partners Agnico Eagle Mines Limited (TSX: AEM, NYSE: AEM) and Kinross Gold Corp (TSX: K, NYSE: KGC) includes diamond drilling on the Vertigo target (JP Ross property), Golden Saddle & Arc deposits (White Gold property) as well as soil sampling, prospecting, GT Probe, trenching and RAB/RC drilling on various other properties across the Company’s expansive and package located in the prolific White Gold District, Yukon, Canada.

Highlights Include:

- Significant mineralization encountered on Ryan’s Surprise discovery, 2km west of Golden Saddle. Hole WHTRS19D012 encountered two distinct zones including 2.66 g/t Au over 11.00m from 93.00m depth and 2.10 g/t Au over 31.78m from 142.22m depth, including 4.23 g/t Au over 3.06m.

- Drill results from the Ryan’s Surprise expanded on 2018 discovery drill holes, adding down-dip mineralization and demonstrating the presence of multiple gold zones in addition to those previously modelled.

- Drilling on the Arc produced some of the best grades to date, and significantly extended mineralization 300m to the east to a length of 1,300m, an increase of approximately 23% and infilled significant gaps in the geological model.

- Preliminary metallurgical testing on the Arc deposit indicates that mineralization is non-refractory and a strong global recovery of 85.2%.

- Extended high-grade mineralization at Golden Saddle deposit in multiple directions. Deposit continues to be open along strike and at depth.

- Additional drill results for the Vertigo discovery and the QV deposit are forthcoming and will be released in due course.

- Regional exploration activity is ongoing across the White Gold, JP Ross and Hen properties (including Titan target), with related soil sampling, prospecting, GT Probe sampling, trenching and RAB/RC drill results to be released in due course.

Images to accompany this news release can be found at https://whitegoldcorp.ca/investors/exploration-highlights/.

“We are extremely pleased with the results to date on our flagship White Gold property where we have continued to demonstrate success on all fronts. The latest diamond drill results continue to demonstrate the continuity of near surface mineralization on the Golden Saddle and Arc deposits and surrounding areas. With every drill hole encountering mineralization, and newly identified targets displaying similar characteristics to the Golden Saddle and Arc, we are more confident than ever in our ability to define substantial additional near surface, high-quality mineralization on this property in close proximity to our growing flagship deposits, with the significant new mineralization encountered on Ryan’s Surprise being just one such example,” stated Jodie Gibson, VP of Exploration, “The positive metallurgical results on Arc also present a tremendous new opportunity to significantly increase our resources, with some of our largest and most underexplored targets having not been considered high priority until the receipt of these recent results. We continue to be very active on several new targets across various properties and are looking forward to the balance of these results.”

Ryan’s Surprise Discovery

Drill results from the Ryan’s Surprise expanded on last year’s discovery drill holes, adding down-dip mineralization and demonstrating the presence of multiple significant gold zones in addition to those previously modelled which remains open in multiple directions.

The Ryan’s Surprise target is located approximately 2.0km WSW from the centre of the Golden Saddle deposit. Significant mineralization was first encountered by the Company in 2018, including holes WHTRYN18RC0001 which intersected 20.64 g/t Au over 6.10m from 83.82m depth and WHTRYN18RC0002 which intersected 5.02 g/t Au over 13.17m from 121.92m depth. Previous drilling was directed from north to south on an interpreted steeply northerly dipping structure. Further assessment and interpretation of this data by the Company determined that the zone may actually be steeply dipping to the south. Accordingly, it was decided to test this interpretation with 2 northerly dipping diamond holes to explore the potential for multiple mineralized structures in the area.

The mineralization encountered to date is partially oxidized and is brecciation and stockwork quartz veining and fracture controlled to disseminated pyrite in weakly to strongly sericite altered quartz biotite gneiss, biotite schist, and amphibolite. The mineralization shows a strong association with elevated arsenic and has similarities to both the Golden Saddle and Arc and may represent a new style of mineralization previously unrecognised on the property. To date the Ryan’s Surprise has returned some of the best drill results outside of the Golden Saddle and Arc, and is a strong target for additional drilling.

Drilling Highlights:

WHTRS19D011

This hole was drilled at an azimuth of 000° and a dip of -60 to a depth of 176m and crossed WHTRYN18RC001. A mineralized zone was intersected which ran for 8.70m at a grade of 1.05 g/t Au from 128.65m depth, including 8.22 g/t Au over 1.0m representing down-dip mineralization from WHTRYN18RC001.

WHTRS19D012

Located 125m southwest of x011 this hole was also drilled to 176m depth at an azimuth of 000° and a dip of -60 and is on the same section as WHTRYN18RC002 which intersected 4.46 g/t Au over 13.72m. xD0012 intersected two zones including an upper zone of 2.6 g/t Au over 11.00m from 93.00m, including 4.23 g/t Au over 3.06m from 93m depth. Deeper in the hole a series of zones were intersected that averaged 2.10 g/t Au over 31.78m from 142.22m. Within this and separated by unmineralized intervals were 2.85 g/t Au over 4.14 m from 142.33m, 2.39 g/t Au over 4.26m from 154.00m, and 2.83 g/t Au over 11.50m from 162.50m, including 5.93 g/t Au over 2.07m from 168.66m representing down-dip mineralization from WHTRYN18RC002.

Arc Deposit

Metallurgical test work on the Arc indicates that mineralization is non-refractory and strong global recovery of 85.2%. Drill results from the Arc were among the highest grades encountered on the deposit, with several intercepts grading higher than the grades reported in the 2019 technical report. The reported holes also significantly extended the footprint of the deposit 300m to the east to a length of 1,300m, an increase of approximately 23% and infilled significant gaps in the geological model.

Nine holes were completed on the Arc in 2019. Located immediately south and southeast of the Golden Saddle, the Arc contributed an estimated 17,000 Indicated ounces (562,000 tonnes at 0.98 g/t Au) and 194,500 Inferred ounces (5,186,000 tonnes at 1.17 g/t Au) to the Company’s 2019 resource update.

2019 drilling consisted of a first phase of 7 holes (WHTAR19D029 – 035) totalling 1,424m drilled aimed at extending the known zones, mainly to the east, and infilling large gaps within the existing resource areas in order to gain additional geological knowledge of the deposit, as well as to obtain potential gains in the quality and extent of resources. Later two additional holes were drilled in the Arc area targeting the surface geochemistry expression of a potential lower Arc lens (WHTAR19D036 – 037).

Based on the 2019 results, the mineralized footprint of the Arc has been significantly extended eastward through holes 29 & 30, along with historic hole WD-014, which extend the strike of the Arc an additional 300m to the east, to a length of 1,300m, an increase of approximately 23%. The current interpretation is that this mineralization corresponds to an extension of the lower Arc zone, a subparallel zone to the Arc which is poorly defined in historic drilling. Additionally, on the western end of the deposit area, hole WHTAR19D034, located 850m west of hole xD030, infilled a 150-metre gap between historic holes WD-075 and WD-088, and intercepted a higher grade than typical Arc intersections, indicating the potential to increase resource grade with additional infill drilling.

Limited and widely spaced historic drilling on the Arc has defined two E-W trending, north dipping, zones of mineralization at least 1,300m along strike and up to 400m down-dip. Mineralization on the Arc is hosted within breccia zones with secondary stockwork quartz veining and pyrite mineralization. These zones are hosted within a meta-sedimentary package consisting dominantly of biotite rich, locally graphitic, quartzites and schist. The mineralization shows a strong association with elevated As & Sb, though it should be noted that there are broad zones within the Arc with strongly elevated As & Sb without gold mineralization, indicating the gold is associated with a secondary event. Initial metallurgical testing on the Arc by Underworld Resources indicated recoveries on the Arc up to 85%.(1)

Preliminary follow-up metallurgical work by the Company in 2018 & 2019 indicates mineralization on the Arc responds well to a combination of gravity concentration (7.4% recoveries), followed by an Alkaline Atmospheric Oxidation (AAO) pre-treatment and flotation (81.5% to 87.5% recoveries) with a global recovery of 85.2%. The test work also indicated that graphite within the Arc shows negligible pre-robbing behavior and that the gold mineralization is not encapsulated within sulfide minerals (pyrite or arsenopyrite) and as such indicates the mineralization to be non-refractory in nature. This preliminary work was completed on a single composite of Arc mineralization from half drill core at the COREM Technical Services facility in Quebec. While the results are preliminary, they confirm excellent potential for strong recoveries in the Arc. More detailed metallurgical test work will be completed on the Arc in upcoming seasons.

(1) See Underworld Resources News Release dated January 5, 2010. Available on SEDAR.

Drilling Highlights:

WHTAR19D030

Hole x030 was drilled just outside the Arc Main lens at the east end of the 2019 resource pit, aimed at expanding the Arc zone to the east. The hole returned 3.64 g/t Au over 5.40m from 132m, including 14.30 g/t Au over 1.30m from 134m and represent higher grades that average in the area. The mineralization intercepted in holes 29 & 30, along with historic hole WD-014 are interpreted to be eastern extensions of the lower Arc zone, and together extend the Arc zone over 300m to the east.

WHTAR19D031

Hole x031 is located 175m to the northwest of x030, splitting a gap of ~160m between historic holes WD-039, WD-042 and WD-081. The hole intersected the zone where expected and returned 1.28 g/t Au over 16.00m from 102.00m.

WHTAR19D034

Hole x034 is located 850m west of hole x030, filling in a 150 metres gap between historic holes WD-075 and WD-088. The main zone was successfully intersected and returned a 10.09m intercept of 2.92g/t Au from 65.18m, including 3.67 g/t Au over 6.00m from 68m. This is a much higher grade than most Arc intersections and indicates the potential to increase resource grade with additional infill drilling.

Golden Saddle Deposit

Drill results from the Golden Saddle deposit expanded the previously modelled mineralization downdip on the western portion of the deposit, added near surface mineralization in previously unmodelled areas and locally increased thickness of the known mineralization.

The Golden Saddle deposit, including the GS Main, GS Footwall and GS West zones, consists of a series of subparallel zones trending NE-SW and dipping to the NW at approximately 55 degrees with mineralization occurring along faults, fractures and breccia zones in an overall normal to strike-slip structural regime. Together, the zones define mineralization over 1,500m strike length and up to 725m down dip. This includes a continuous high-grade core of mineralization >3 g/t Au on the GS Main that is up to 50m true-thickness and traceable over 500m of strike length from surface up to 530m down-dip.

The results for 3 additional Golden Saddle holes as well as the remainder of previously released hole WHTGS19D0212 have been received. Two holes targeted the downdip extension of the GS Main lens on the western edge of the deposit, and the third was infill targeting the GS Main and GS Footwall lenses.

Drilling Highlights:

WHTGS19D0212

As previously released, hole x212 was an infill hole on the eastern side of the GS main targeting where the current model was believed to be underestimating the width of the zone and confirmed this interpretation returning 4.85 g/t Au over 27.45m from 37.55m depth; including 6.58 g/t Au over 9m from 51m depth. A second zone of mineralization, correlating with a GS Footwall lenses, was intercepted at 211m depth and returned 1.37 g/t Au over 12.00m, including 2.41 g/t Au over 4.00m from 212m.

WHTGS19D0214

Hole x214 is located 341m to the north of x212, targeting the near surface extension of the GS Main and GS Footwall zones. The GS Main was intersected at shallow depth, returning a 5.40m intercept grading 3.83 g/t Au from 18.00m depth. The intersection was in a previously unmodelled area and will expand the GS Main approximately 30m in this area. An additional zone corresponding with the GS Footwall was also intercepted in the hole and returned 2.08 g/t Au over 13.00m from 192m depth.

Drilling Highlights:

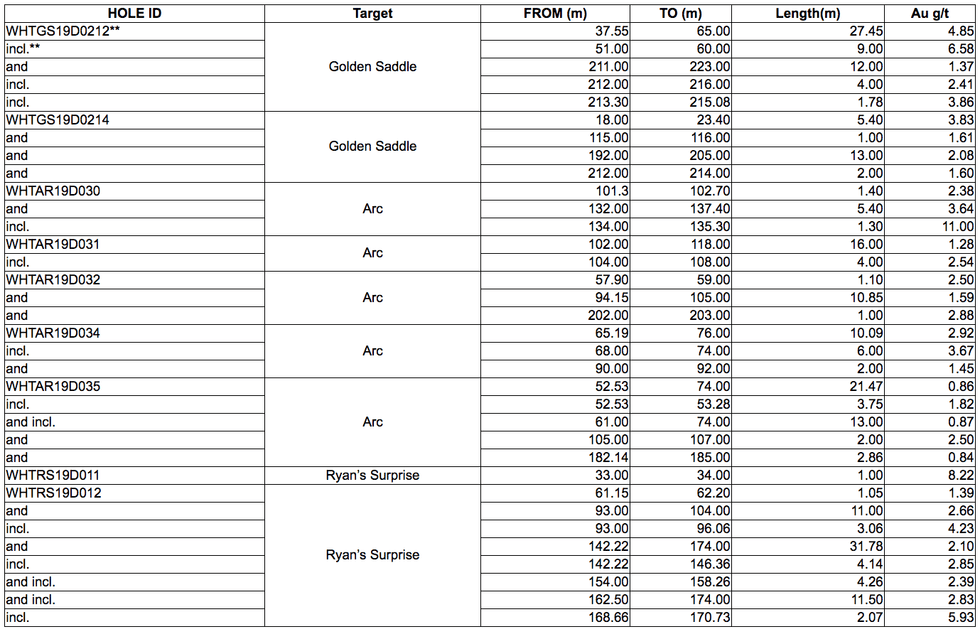

Individual assays for the reported results ranged from trace to 11.00 g/t Au. True thickness for intercepts reported in the Golden Saddle and Arc are estimated at 85 – 95% true thickness, and there is not enough information to determine true thickness on the Ryan’s Surprise at this time. The most significant drill results included in this release are included in the table below:

* True thickness estimated at 80 – 95% of the reported intervals, and there is not enough information to determine true thickness on the Ryan’s Surprise at this time.

** Top portion of hole reported in Company’s News Release dated August 8, 2019, available on SEDAR.

QA/QC

The analytical work for the 2019 drilling program will be performed by ALS Canada Ltd. an internationally recognized analytical services provider, at its Vancouver, British Columbia laboratory. Sample preparation was carried out at its Whitehorse, Yukon facility. All RC chip and diamond core samples will be prepared using procedure PREP-31H (crush 90% less than 2mm, riffle split off 500g, pulverize split to better than 85% passing 75 microns) and analyzed by method Au-AA23 (30g fire assay with AAS finish) and ME-ICP41 (0.5g, aqua regia digestion and ICP-AES analysis). Samples containing >10g/t Au will be reanalyzed using method Au-GRAV21 (30g Fire Assay with gravimetric finish).

The reported work will be completed using industry standard procedures, including a quality assurance/quality control (“QA/QC”) program consisting of the insertion of certified standard, blanks and duplicates into the sample stream.

About White Gold Corp.

The Company owns a portfolio of 22,040 quartz claims across 35 properties covering over 439,000 hectares representing over 40% of the Yukon’s White Gold District. The Company’s flagship White Gold property has a mineral resource of 1,039,600 ounces Indicated at 2.26 g/t Au and 508,700 ounces Inferred at 1.48 g/t Au. Mineralization on the Golden Saddle and Arc is also known to extend beyond the limits of the current resource estimate. Regional exploration work has also produced several other prospective targets on the Company’s claim packages which border sizable gold discoveries including the Coffee project owned by Newmont Goldcorp Corporation with a M&I gold resource(2) of 3.4M oz and Western Copper and Gold Corporation’s Casino project which has P&P gold reserves(2) of 8.9M oz Au and 4.5B lb Cu. For more information visit www.whitegoldcorp.ca.

(2) Noted mineralization is as disclosed by the owner of each property respectively and is not necessarily indicative of the mineralization hosted on the Company’s property.

Qualified Person

Jodie Gibson, P.Geo., Vice President of Exploration for the Company is a “qualified person” as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, and has reviewed and approved the content of this news release.

Cautionary Note Regarding Forward Looking Information

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “proposed”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, the Company’s objectives, goals and exploration activities conducted and proposed to be conducted at the Company’s properties; future growth potential of the Company, including whether any proposed exploration programs at any of the Company’s properties will be successful; exploration results; and future exploration plans and costs and financing availability.

These forward-looking statements are based on reasonable assumptions and estimates of management of the Company at the time such statements were made. Actual future results may differ materially as forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to materially differ from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors, among other things, include:; expected benefits to the Company relating to exploration conducted and proposed to be conducted at the Company’s properties; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Company’s properties; business integration risks; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; title to properties; and those factors described in the most recently filed management’s discussion and analysis of the Company. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements and information. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward-looking information, will prove to be accurate. The Company does not undertake to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither the TSX Venture Exchange (the “Exchange”) nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this news release.