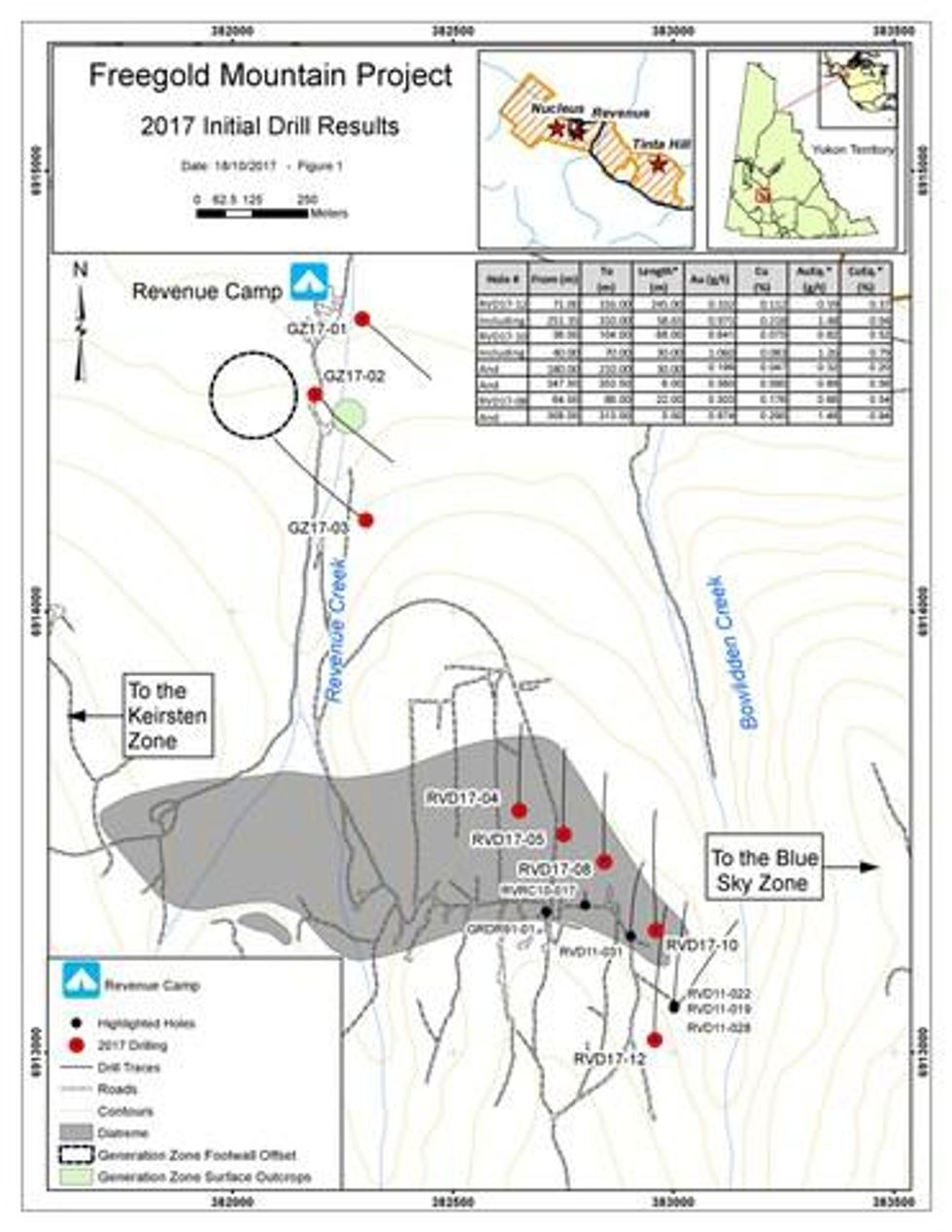

Triumph Gold Announces Multiple Diamond Drill Hole Intersections of Au-Cu Mineralization on Eastern Margin of The Revenue Diatreme Including 58.65 metres of 1.48 g/t Gold Equivalent* @ 0.971 grams/tonne Au and 0.22% Cu

Triumph Gold Corp., (TSX-V: TIG) (OTCMKTS: NFRGF) (“Triumph Gold” or the “Company”) is pleased to announce that diamond drilling along the relatively underexplored eastern margin of the Revenue diatreme has been rewarded with multiple intersections of copper, gold, silver +/- molybdenum mineralization.

Hole # | Easting** | Northing** | Azimuth | Inclination | Depth (m) |

RVD17-04 | 382650 | 6913549 | 000 | -60 | 411.48 |

RVD17-05 | 382751 | 6913495 | 000 | -60 | 399.27 |

RVD17-08 | 382843 | 6913433 | 000 | -60 | 409.96 |

RVD17-10 | 382960 | 6913277 | 000 | -50 | 388.62 |

RVD17-12 | 382957 | 6913029 | 000 | -50 | 422.91 |

Three drill holes that collared farthest to the east intersected strong Cu-Au mineralization (Table 2). Highlights include:

Table 2: Length*** Weighted Drill Intercepts – Eastern Revenue Diatreme – 2017 Diamond Drill Program

Hole # | From (m) | To (m) | Length* (m) | Au (g/t) | Ag (g/t) | Cu (%) | Mo (%) | AuEq.* (g/t) | CuEq.* (%) |

RVD17-12 | 71.00 | 316.00 | 245.00 | 0.332 | 3.08 | 0.112 | 0.008 | 0.59 | 0.37 |

Including | 251.35 | 310.00 | 58.65 | 0.971 | 7.38 | 0.218 | 0.014 | 1.48 | 0.94 |

RVD17-10 | 36.00 | 104.00 | 68.00 | 0.641 | 1.86 | 0.075 | 0.007 | 0.82 | 0.52 |

Including | 40.00 | 70.00 | 30.00 | 1.060 | 2.16 | 0.083 | 0.007 | 1.26 | 0.79 |

And | 180.00 | 210.00 | 30.00 | 0.199 | 3.45 | 0.047 | n/a | 0.32 | 0.20 |

And | 347.50 | 353.50 | 6.00 | 0.560 | 6.98 | 0.090 | 0.020 | 0.89 | 0.56 |

RVD17-08 | 64.00 | 86.00 | 22.00 | 0.503 | 2.93 | 0.176 | 0.007 | 0.86 | 0.54 |

And | 308.00 | 313.00 | 5.00 | 0.874 | 10.88 | 0.290 | n/a | 1.48 | 0.94 |

Other notable historic intersections near the eastern portion of the diatreme include RVD11-19 (70.48m @ 1.489 g/t Au, 0.22% Cu), RVD11-022 (55.45m @ 0.418 g/t Au, 0.19% Cu), GRDR91-01 (95.71m @ 0.681 g/t Au, 0.29% Cu), RVD11-031 (37.3m @ 0.645 g/t Au, 0.22% Cu) and RVRC10-017 (47.24m @ 0.633 g/t Au, 0.15% Cu).

Geological highlights of the drill program include:

- Identification of an oxidized breccia/deep-weathering zone with significant gold from the bedrock surface to 68m depth (RVD17-10; 68m @ 0.64 g/t Au). This intersection is in an area that has not been explored for near surface mineralization, in part due to absence of a gold in soil anomaly, which is now attributed to thick overburden. Samples from this interval are being sent for metallurgical testing to determine if gold can be extracted via cyanide leach.

- In RVD17-12, a broad intersection (approximately 180 metres long) of porphyry style stockwork veining with potassic and phyllic alteration, adjacent to, and beneath the surface expression of, the Revenue diatreme.

- The intersection of a high-grade breccia zone in RVD17-12 (58.65m @1.48 g/t Au eq.), which is interpreted to be a continuation of hydrothermal breccias encountered in RVD11-22 and RVD11-28, defining at least 120 meters strike-length of high grade mineralization that is open at depth and contained within a broad lower grade envelope.

- At least three types of superimposed mineralization, including:1) Early porphyry style mineralization;

2) Late hydrothermal breccias and replacement style mineralization; and

3) Near surface enrichment of gold.

Paul Reynolds, Triumph Gold’s President and CEO, states: “We are very encouraged by these results. Each of the styles of mineralization encountered at Revenue could be a stand-alone target, but along the eastern margin of the Revenue diatreme, where we have discovered that they are superimposed, there is an exceptional opportunity to explore for a high-grade, near-surface Au-Cu resource.”

Tony Barresi, VP Exploration, commented: “A major objective of the 2017 drill program near Revenue was to demonstrate through broad step outs that the Revenue diatreme was only one part of a very large porphyry-related mineralizing system. The idea was tested with drilling at the Generation Zone, Blue Sky Zone, and Keirsten Zone which extend approximately 1 km to the north, east and west of the Revenue diatreme, respectively. In this news release we have documented results from drilling along the eastern margin of the diatreme, where we encountered strong porphyry style mineralization beneath the diatreme, suggesting that the diatreme was emplaced within a corridor of pre-existing porphyry style mineralization. We also document weak porphyry mineralization at the Generation Zone, over 1 km to the north. In future news releases, as results from the Blue Sky and Keirsten zones become available, we expect to be expanding on the story of our discovery of broad porphyry mineralization at Revenue.”

Drill holes RVD17-05 and RVD17-04 (Table 1, Figure 1) are 100 and 200 metre step outs (respectively) to the northwest of RVD17-08 and the prospective eastern margin of the diatreme. They intersected copper and gold mineralization but the intersections are considerably shorter and/or lower grade than the drill holes farther east (Table 3):

Table 3: Length*** Weighted Drill Intercepts – East-Central Revenue Diatreme – 2017 Diamond Drill Program

Hole # | From (m) | To (m) | Length*** (m) | Au (g/t) | Ag (g/t) | Cu (%) | Mo (%) | AuEq.* (g/t) | CuEq.* (%) |

RVD17-04 | 2.64 | 8.00 | 5.36 | 0.273 | 0.46 | 0.014 | n/a | 0.30 | 0.19 |

And | 192.00 | 209.00 | 17.00 | 0.158 | 1.76 | 0.098 | 0.013 | 0.40 | 0.25 |

And | 316.62 | 319.20 | 2.58 | 0.306 | 6.26 | 0.310 | 0.004 | 0.90 | 0.57 |

RVD17-05 | 113.00 | 115.00 | 2.00 | 0.648 | 6.70 | 0.269 | 0.005 | 1.19 | 0.75 |

And | 341.00 | 365.76 | 24.76 | 0.129 | 0.99 | 0.044 | 0.004 | 0.23 | 0.15 |

Including | 364.00 | 365.76 | 1.76 | 0.545 | 1.20 | 0.055 | 0.003 | 0.66 | 0.42 |

Generation Zone Drill Results

The Generation Zone was recognized in 2016 as a porphyry exploration target based on dense mineralized stockwork and alteration in limited surface outcrop and corresponding induced-polarization chargeability highs at depth. Exploration in 2017 included three diamond drill holes totalling 1,284 metres (Table 4, Figure 1). All three drill holes encountered diffuse zones of low grade porphyry style mineralization (Table 5). A follow-up structural geology study was conducted by independent consultant Stefan Kruse Ph.D., P.Geo., to determine if there is a structural explanation for the presence of rocks affected by a vigorous hydrothermal system at surface, but not at depth. The study concluded, based on limited structural observations, that an east dipping normal fault may underlie the Generation Zone and truncate the strongly altered and well mineralized zone seen at surface. According to this model a depth-extension of the Generation Zone would be off-set to the west of the surface exposures and 2017 drilling (Figure 1).

Table 4: Location and Orientation of 2017 Diamond Drill Holes Testing the Generation Zone

Hole # | Easting** | Northing** | Azimuth | Inclination | Depth (m) |

GZ17-01 | 382294 | 6914664 | 128 | -60 | 388.01 |

GZ17-02 | 382187 | 6914493 | 128 | -55 | 398.98 |

GZ17-03 | 382302 | 6914207 | 308 | -55 | 496.82 |

Table 5: Length*** Weighted Drill Intercepts – Generation Zone – 2017 Diamond Drill Program

Hole # | From (m) | To (m) | Length*** (m) | Au (g/t) | Ag (g/t) | Cu (%) | AuEq.* (g/t) | CuEq.* (%) |

GZ17-01 | 262.00 | 290.00 | 28.00 | 0.108 | 0.54 | 0.027 | 0.16 | 0.10 |

Including | 272.00 | 274.00 | 2.00 | 0.916 | 0.60 | 0.023 | 0.96 | 0.60 |

GZ17-02 | 346.00 | 378.00 | 32.00 | 0.119 | 0.65 | 0.030 | 0.18 | 0.11 |

Including | 358.07 | 360.00 | 1.93 | 1.470 | 3.60 | 0.096 | 1.67 | 1.06 |

GZ17-03 | 4.12 | 375.00 | 370.88 | 0.030 | 0.26 | 0.019 | 0.06 | 0.04 |

And | 457.00 | 496.82 | 39.82 | 0.006 | 0.30 | 0.024 | 0.05 | 0.03 |

Notes:

* Copper and Gold Equivalent [CuEq, AuEq] are used for illustrative purposes, to express the combined value of copper, gold silver and molybdenum as a percentage of either copper or gold. No allowances have been made for recovery losses that would occur in a mining scenario. CuEq and AuEq are calculated on the basis of US$3.10 per pound of copper, US$1,305 per troy ounce of gold,US$17.40 per troy ounce of silver and US$7.00 per pound of molybdenum oxide.

** Coordinates are given in North American Datum 83 (NAD83), Zone 8.

*** Length refers to drill hole intercept. True widths have not been determined.

Methods and Qualified Person

Drill core samples ranged between 1 and 2 metres length and were cut at Triumph’s core logging facility on the Freegold Mountain Property (Revenue Camp; Figure 1). The samples were analyzed by ALS Global of Vancouver, British Columbia. They were prepared for analysis according to ALS method PREP35: each sample was crushed to 70% passing 2mm and a 250g split was pulverized to better than 95% passing 106 micron mesh. Gold was tested by fire assay with atomic absorption finish on a 30g nominal sample (method Au-AA23), and samples that tested over 10 g/t Au were retested using fire assay with a gravimetric finish (method Au-GRA21). An additional 35 elements were tested by ICP-AES using an Aqua Regia digestion (method ME-ICP41), over limit samples for copper were retested using the same technique but with assay grade Aqua Regia digestion and a higher range of detection (method ME-OG46). Quality assurance and control (QAQC) is maintained at the lab through rigorous use of internal standards, blanks and duplicates. An additional QAQC program was administered by Triumph Gold: at minimum one in ten samples submitted by Triumph Gold was a blank or certified reference standard. QAQC samples that returned unacceptable values triggered investigations into the results and reanalyses of the samples that were tested in the batch with the failed QAQC sample.

The technical content of this news release has been reviewed and approved by Tony Barresi, Ph.D., P.Geo., VP Exploration for the company, and qualified person as defined by National Instrument 43-101.

About Triumph Gold Corp.

Triumph Gold Corp. is a growth oriented Canadian-based precious metals exploration and development company. Triumph Gold Corp. is focused on creating value through the advancement of the district scale Freegold Mountain project in Yukon. For maps and more information, please visit our website www.triumphgoldcorp.com

On behalf of the Board of Directors

Signed “Paul Reynolds”

Paul Reynolds, President & CEO

For further information please contact: |

|

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking information, which involves known and unknown risks, uncertainties and other factors that may cause actual events to differ materially from current expectation. Important factors – including the availability of funds, the results of financing efforts, the completion of due diligence and the results of exploration activities – that could cause actual results to differ materially from the Company’s expectations are disclosed in the Company’s documents filed from time to time on SEDAR (see www.sedar.com). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The company disclaims any intention or obligation, except to the extent required by law, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Click here to connect with Triumph Gold Corp., (TSXV:TIG,OTCMKTS:NFRGF) for an Investor Presentation

Source: www.newswire.ca