Rokmaster Makes First Option Payment in Connection with Option to Acquire 100 Percent of the Revel Ridge Gold-Polymetallic Project

Rokmaster Resources has received regulatory approval to pay, and has now paid, the first option payment of $200,000 due under its Option Agreement.

Rokmaster Resources Corp. (“Rokmaster” or the “Company”) (TSXV:RKR, OTC Pink:RKMSF, Frankfurt:1RR) is pleased to announce that further to its news release of December 30, 2019, it has received regulatory approval to pay, and has now paid, the first option payment of $200,000 due under its Option Agreement dated December 23, 2019 with Huakan International Mining Inc. (“Huakan”) and Huakan’s shareholders pursuant to which Huakan granted to Rokmaster an option to acquire a 100% interest in the Revel Ridge (formerly the J&L) Property (the “Revel Ridge Project”).

Revel Ridge Project – Updated Mineral Resource Estimate and Technical Report

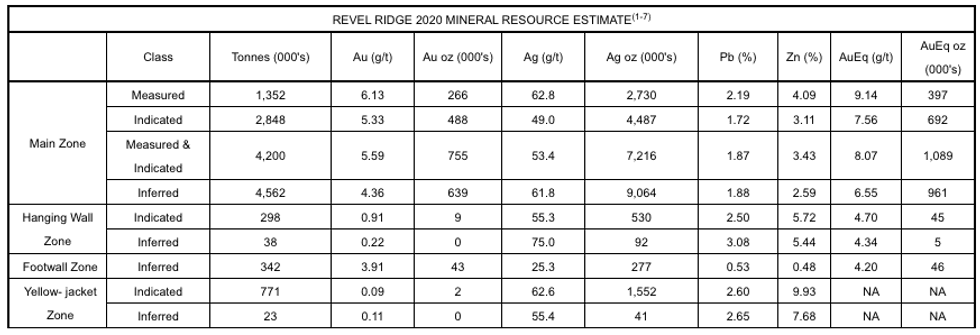

In connection with Rokmaster’s submission to the TSX Venture Exchange, an updated Mineral Resource Estimate for the Revel Ridge Project was prepared (effective date: January 29, 2020) for the Main and Hanging Wall Zones. Such zones are now estimated to contain 1,134,000 Measured and Indicated gold equivalent ounces (“AuEq”), with 1,012,000 Inferred gold equivalent ounces in the Main, Hanging Wall and Footwall Zones. The Indicated Mineral Resource Estimate for the separate Yellowjacket silver-zinc rich zone is now 771,000 tonnes containing 9.93% zinc, 2.6% lead and 62.6 grams per tonne silver. Please see the Table below:

Note: k= thousands, koz = thousands of ounces

1) Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

2) The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

3) The Mineral Resources in this estimate were calculated using the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”), CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by CIM Council.

4) The following parameters were used to derive the NSR block model cut-off values used to define the Mineral Resource:

- December 31, 2019 US$ two-year trailing avg. metal prices: Pb $0.96/lb, Zn $1.24/lb,

Au $1,331.00/oz, Ag $15.95/oz - Exchange rate of US$0.76 = CDN$1.00

- Process recoveries of Pb 74%, Zn 75%, Au 91%, Ag 80%

- Smelter payables of Pb 95%, Zn 85%, Au 96%, Ag 91%

- Refining charges of Au US$10/oz, Ag US$0.50/oz

- Concentrate freight charges of C$65/t and Smelter treatment charge of US185/t

- Mass pull of 5% and 8% concentrate moisture content

- December 31, 2019 US$ two-year trailing avg. metal prices: Pb $0.96/lb, Zn $1.24/lb,

5) NSR cut-off of CDN$110 per tonne was derived from $75/t mining, $25/t processing, $10/t G&A.

6) AuEq= Au g/t + (Ag g/t x 0.011) + (Pb % x 0.422) + (Zn % x 0.455). This formula incorporates Ag, Pb and Zn metallurgical recoveries, smelter payables and refining charges that were reflected in the 2012 Preliminary Economic Assessment

7) Above parameters derived from 2012 Preliminary Economic Assessment and other similar benchmarked projects

For additional information, please refer to the technical report titled: “Updated Technical Report on the Revel Ridge Property (Formerly J&L Property), Revelstoke Mining Division, British Columbia, Canada” dated February 25, 2020 with an effective date of January 29, 2020, which the Company has concurrently filed on SEDAR.

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements as set out in National Instrument 43-101 and Eugene Puritch, P. Eng., FEC, CET, president of P&E Mining Consultants Inc., who is independent of Rokmaster, supervised the preparation of the information that forms the basis for the technical information in this news release.

On behalf of the Board of Directors of

ROKMASTER RESOURCES CORP.

“John Mirko”

John Mirko, President & Chief Executive Officer

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) nor any other regulatory authority accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release may contain forward-looking information within the meaning of applicable securities laws (“forward-looking statements”). Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” ‘projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Information inferred from the interpretation of drilling results may also be deemed to be forward-looking statements, as it constitutes a prediction of what might be found to be present when and if a project is actually developed. These forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking statements, including, without limitation: risks related to fluctuations in metal prices;; changes in planned work resulting from weather, logistical, technical or other factors; the possibility that results of work will not fulfill expectations and realize the perceived potential of the Company’s properties; risks related to the Armex litigation; risk of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in the work program; the risk of environmental contamination or damage resulting from Rokmaster’s operations and other risks and uncertainties. Any forward-looking statement speaks only as of the date it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.