Nexus Gold Options Interest in Rakounga Gold Project for $2.25 Million in Cash and Work Commitments

Nexus Gold Corp. is pleased to announce that it has entered into a property option agreement with Kruger Gold Corp.

Nexus Gold Corp. (“Nexus” or the “Company”) (TSXV:NXS, OTC:NXXGF, FSE:N6E) is pleased to announce that it has entered into a property option agreement (the “Option Agreement”) with Kruger Gold Corp. (“Kruger”), a privately held arms’-length company, pursuant to which the Company has agreed to grant Kruger the right to acquire a seventy-five percent interest in the Rakounga Gold Project, located in Burkina Faso, West Africa (the “Rakounga Project”).

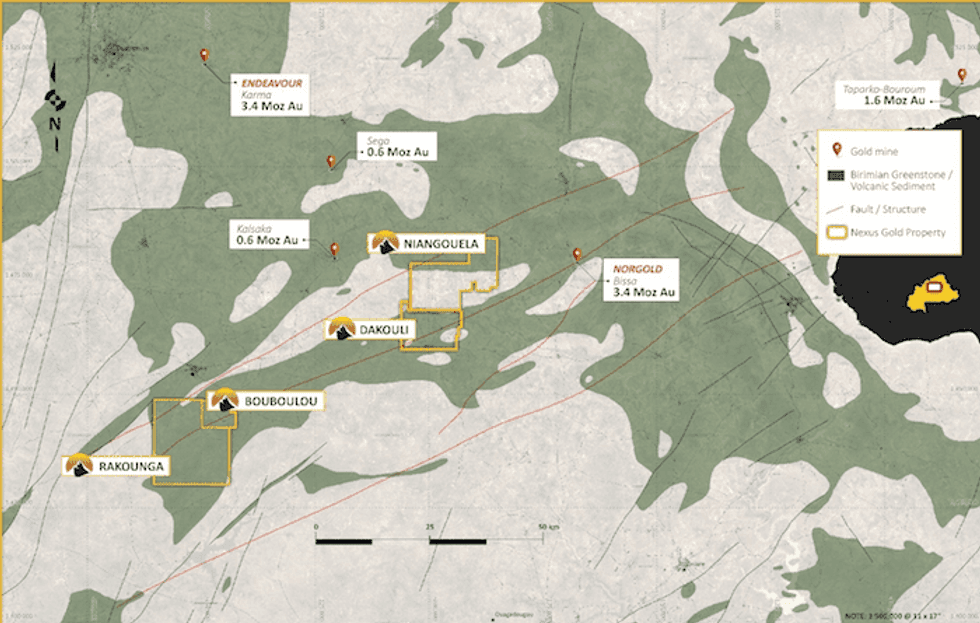

The Rakounga Project consists of an exploration permit totaling a 250 square kilometer area, adjacent to the Company’s Bouboulou gold concession, and has been the subject of prior exploration work by the Company.

Kruger can acquire the interest in the Rakounga Project by completing a series of cash payments totaling Cdn$1,000,000 and incurring expenditures of at least Cdn$1,250,000 in the development of the Rakounga project over a five-year term. During the term, Kruger will assume responsibility for all operations being conducted on the Rakounga Project.

“The option with Kruger Gold represents an important milestone for Nexus as it demonstrates the ability to monetize projects in our portfolio,” said President and CEO, Alex Klenman. “The incubation and monetization of select projects is a strategic objective for us. By generating income streams we can adopt a more self-sustaining business model, one that puts us in a better position to concentrate more of our resources on exploration efforts at our flagship projects,” continued Mr. Klenman.

The Company continues to control the Rakounga Project through a property option agreement (the “Underlying Option”) entered into with the underlying owner of the project, Belemyida SA (the “Underlying Owner”). During the term of the Option Agreement, the Company will remain responsible for maintaining the Underlying Option in good standing. In connection with the entering into of the Option Agreement, the Company has reached an agreement with the Underlying Owner to amend certain remaining cash payments and share issuances required pursuant to the Underlying Option. In order to complete the acquisition of the Rakounga Project, the Company will now be required to pay US$370,000, in a series of payments ending on November 30, 2024, and issue 750,000 common shares, in a series of share issuances ending on August 30, 2021. These amounts do not include previous payments and share issuances made to the Underlying Owner under the original terms of the Underlying Option.

Completion of the amendment to the Underlying Option remains subject to the approval of the TSX Venture Exchange. The transaction contemplated by the Option Agreement cannot proceed until such approval has been obtained. All securities issuable to the Underlying Owner, in connection with the Underlying Option, will be subject to a four-month-and-one-day statutory hold period in accordance with applicable securities laws.

The Rakounga Project is subject to a one percent net smelter returns royalty in favour of the Underlying Owner, as well as a further one percent royalty in favour of Sandstorm Gold Ltd. (“Sandstorm”). Pursuant to the terms of the Option Agreement, following the acquisition of an interest in the Rakounga Project, Kruger has agreed to take responsibility for a portion of the royalties based on its proportionate interest in the project. The assumption of royalty obligations owing to Sandstorm remains subject to the finalization of a royalty acknowledgment agreement to be entered into between Sandstorm and Kruger.

Figure 1: Rakounga Gold Project lower left, located along active gold belts and proven mineralized trends

About the Company

Nexus Gold is a Canadian-based gold development company with an extensive portfolio of nine exploration projects in West Africa and Canada. The Company’s West African-based portfolio totals over 560-sq kms (56,000+ hectares) of land located on active gold belts and proven mineralized trends, while it’s 100%-owned Canadian projects include the McKenzie Gold Project in Red Lake, Ontario, the New Pilot Project, located in British Columbia’s historic Bridge River Mining Camp, and three prospective gold-copper projects (3,300-ha) in the Province of Newfoundland. The Company is focusing on the development of several core assets while seeking joint-venture, earn-in, and strategic partnerships for other projects in its growing portfolio.

For more information please visit www.nexusgoldcorp.com.

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

Source