Monarch Gold Starts Diamond Drilling Program on its McKenzie Break Property

Monarch Gold Starts Diamond Drilling Program on its McKenzie Break Property

MONARCH GOLD CORPORATION (“Monarch” or the “Corporation”) (TSX:MQR) (OTCMKTS:MRQRF) (FRANKFURT:MR7) is pleased to announce the start of a new diamond drilling program on its wholly-owned McKenzie Break gold property, located 25 kilometres north of Val-d’Or, near Monarch’s Camflo and Beacon mills.

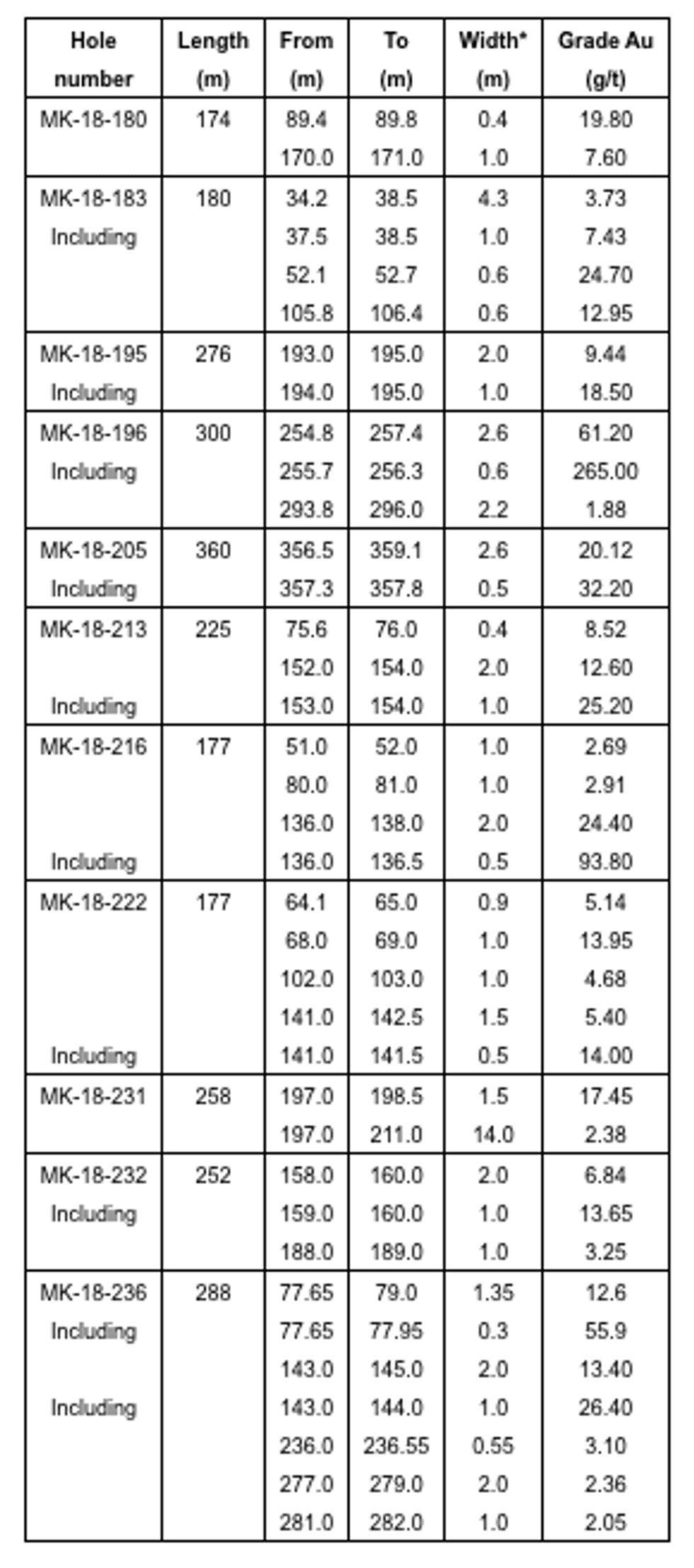

- Drilling program to follow-up on the solid high-grade results from the 2018 program, which included:

- 61.20 g/t Au over 2.6 metres, including 265.00 g/t Au over 0.6 metres in hole MK-18-196

- 24.40 g/t Au over 2.0 metres including 93.80 g/t Au over 0.5 metres in hole MK-18-216

- Visible gold observed in 17 of the 61 holes drilled

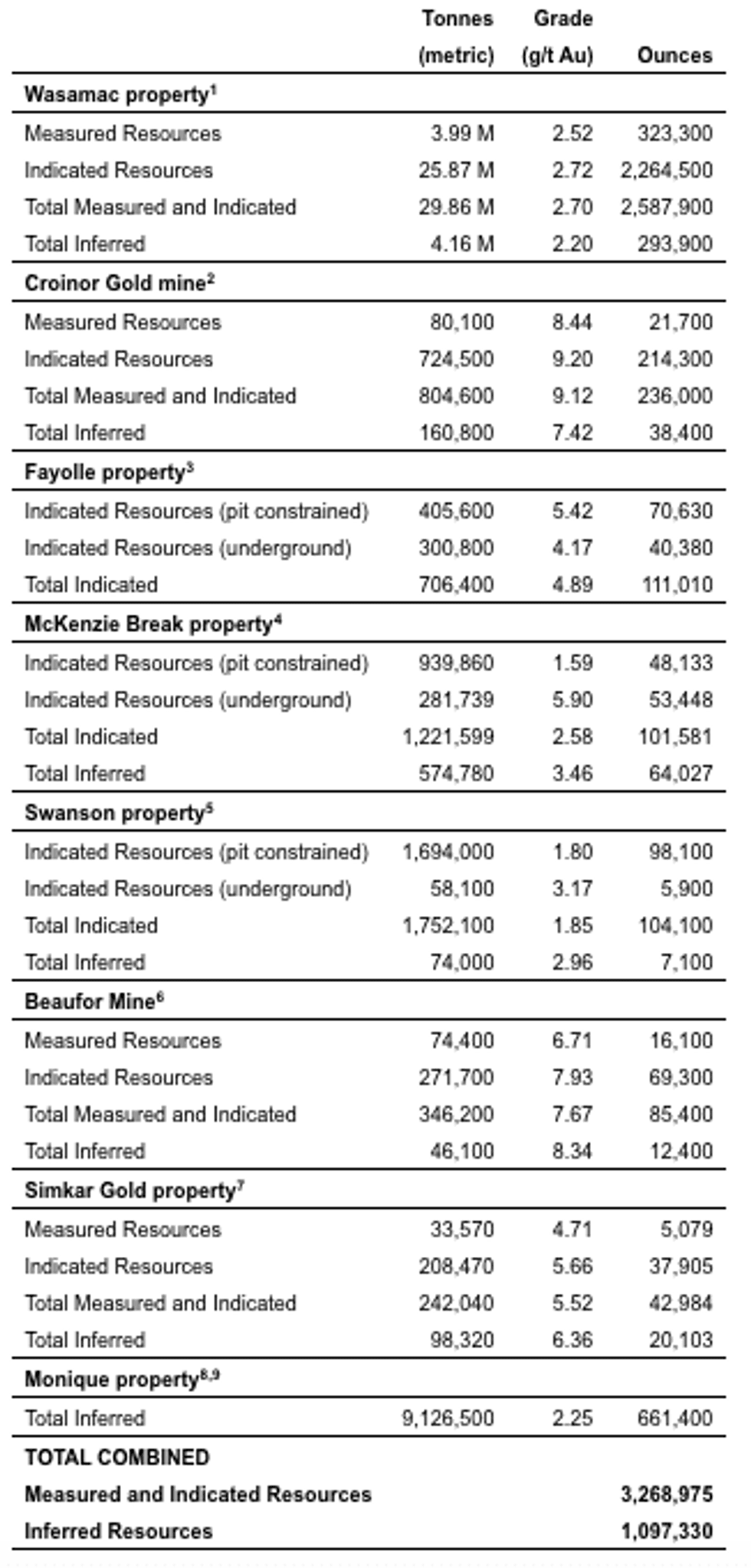

- Goal is to increase the pit-constrained and underground portions of the McKenzie Break 165,608-ounce gold resource

Drilling started on September 10 and will focus on high potential exploration targets identified by the last drilling program. Positive results around the periphery of the deposit and at depth have increased the size of the orebody. The purpose of this seven-hole, 2,670-metre drilling program is two-fold: four holes will test the new zones in the southeast sector of the deposit at depth and three holes will be drilled in the northeast sector to extend the size of the known pit-constrained resource.

The McKenzie Break property hosts a high-grade, multiple-narrow-vein gold deposit in the dioritic Pascalis batholith underlain by porphyritic diorite and mafic and felsic volcanic rocks. On June 14, 2018, the Corporation reported a NI 43-101 compliant pit-constrained resource of 48,133 ounces in the Indicated category and 14,897 ounces in the Inferred category on the property, as well as an underground resource of 53,448 ounces in the Indicated category and 49,130 ounces in the Inferred category, for a total of 165,608 ounces of gold (see press release dated June 14, 2018).

“This drilling program is part of our ongoing objective of expanding the McKenzie Break pit-constrained resource to provide feed for our Camflo and Beacon mills, while evaluating the deposit’s potential at depth. As mentioned previously, the pit-constrained resource is easily accessible as the average overburden thickness is only 5 metres deep, meaning that we could put the McKenzie Break project into production relatively quickly. Also, after looking at last year’s results, we believe that the deposit remains open at depth and along strike, which could have a positive impact on the project,” said Jean-Marc Lacoste, President and Chief Executive Officer of Monarch.

Sampling normally consists of sawing the core into equal halves along its main axis and shipping one of the halves to the ALS Minerals laboratory in Val-d’Or, Quebec for assaying. The samples are crushed, pulverized and assayed by fire assay, with atomic absorption finish. Results exceeding 3.0 g/t Au are re-assayed using the gravity method, and samples containing visible gold grains are assayed using the metallic screen method. Monarch uses a comprehensive QA/QC protocol, including the insertion of standards, blanks and duplicates.

The technical and scientific content of this press release has been reviewed and approved by Ronald G. Leber, P.Geo., the Corporation’s qualified person under National Instrument 43-101.

ABOUT MONARCH GOLD CORPORATION

Monarch Gold Corporation (TSX: MQR) is an emerging gold mining company focused on pursuing growth through its large portfolio of high-quality projects in the Abitibi mining camp in Quebec, Canada. The Corporation currently owns over 300 km² of gold properties (see map), including the Wasamac deposit (measured and indicated resource of 2.6 million ounces of gold), the Beaufor mine, Croinor Gold (see video), Fayolle, McKenzie Break and Swanson advanced projects and the Camflo and Beacon mills, as well as other promising exploration projects. It also offers custom milling services out of its 1,600 tonne-per-day Camflo mill.

Forward-Looking Statements

The forward-looking statements in this press release involve known and unknown risks, uncertainties and other factors that may cause Monarch’s actual results, performance and achievements to be materially different from the results, performance or achievements expressed or implied therein. Neither TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this press release.

Table 1 – Best drilling results from the 2018 drilling program on the McKenzie Break project

*The width shown is the core length. True width is estimated to be 90-100% of the core length.

Table 2 – Monarch combined gold resources