Japan Gold Announces Country-Wide Alliance with Barrick Gold Corporation & Acquires Six New Projects in the Southern Kyushu Epithermal Gold Province

Japan Gold Corp. announces a country-wide alliance with Barrick Gold Corporation.

Japan Gold Corp. (TSXV:JG, OTCQB:JGLDF) (the “Company”) is pleased to announce the formation of a country-wide alliance with Barrick Gold Corporation (NYSE:GOLD, TSX:ABX) (“Barrick”) to jointly explore, develop and mine certain gold mineral properties and mining projects in Japan (the “Barrick Alliance”). The Company is also pleased to announce a further consolidation of its position in the Southern Kyushu Epithermal Gold Province with the acceptance of an additional six new project areas, by the Japan Ministry of Economy, Trade and Industry (“METI”).

Barrick Alliance Highlights:

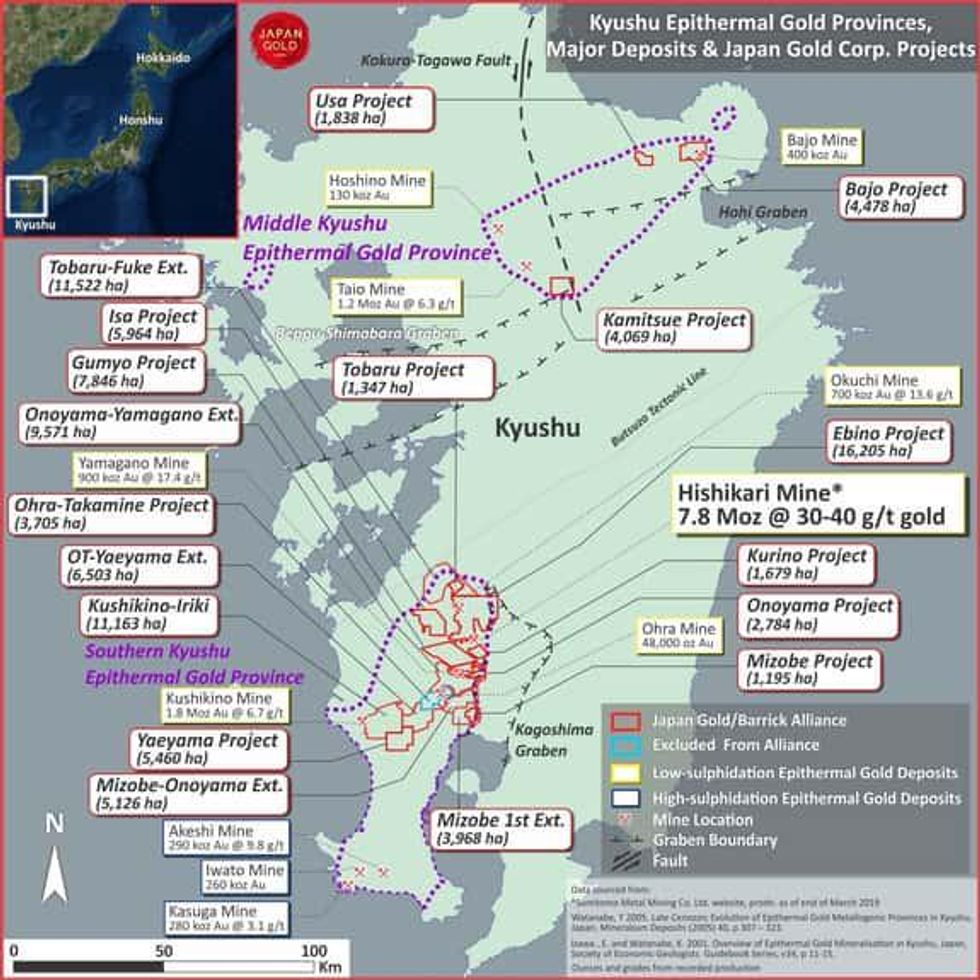

- The Barrick Alliance covers the entire country of Japan including 28 out of 30 projects currently held by Japan Gold (Figure 1).

- The Barrick Alliance does not include the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in Kyushu and Japan Gold will continue to advance these two projects independently.

- Barrick will sole fund a 2-year Initial Evaluation Phase of each project.

- Barrick will sole fund a subsequent 3-year Second Evaluation Phase on projects which meet Barrick criteria.

- Japan Gold will act as the Manager of each project, subject to Barrick’s right at any time to become the Manager of a project.

- Barrick may identify a project as a Designated Project, at any time during the Initial Evaluation Phase or the Second Evaluation Phase, which Barrick may elect to sole fund to completion of a pre-feasibility study (“PFS”). Upon completion of a PFS, Barrick will earn a 51% interest in the Designated Project.

- Barrick may elect to continue to sole fund a Designated Project following the completion of a PFS to a bankable feasibility study (“BFS”). Barrick’s interest in the Designated Project at the completion of the BFS will increase to 75%.

- Where Barrick has elected to sole fund a Designated Project through to completion of a BFS, Japan Gold will be fully carried through completion of the BFS and retain a 25% interest in the Designated Project.

- Barrick and Japan Gold will establish a Technical Committee to, among other matters, provide input in respect of the preparation of programs and budgets for, and the conduct of operations on, projects that are part of the Barrick Alliance. All programs and budgets for projects that are part of the Alliance will be subject to approval by Barrick.

- New gold projects acquired by Japan Gold may be included in the Barrick Alliance, at Barrick’s election and if Barrick wishes to apply for any new gold mineral rights in Japan, or acquire an interest in certain mining rights or projects in Japan, it will be required to offer such opportunity first to the Barrick Alliance.

Barrick’s CEO, Mark Bristow, commented “We are pleased to partner with Japan Gold, who have assembled an impressive portfolio of exploration tenements within the renowned epithermal gold provinces of Japan. We look forward to advancing our partnership by combining Barrick’s technical and financial resources with Japan Gold’s first mover advantage, to deliver new world class gold discoveries.”

Japan Gold’s Chairman and CEO, John Proust commented “Japan Gold is delighted to welcome Barrick Gold to Japan. As Barrick is one of the pre-eminent gold producers in the world we look forward to a very positive partnership. Every great new frontier starts with geology. Japan is an ideal, underexplored, setting to make new large low sulphidation epithermal gold discoveries, building on the great success of the Sumitomo Metal Mining Co. Ltd.’s Hishikari Gold Mine. Barrick’s global experience of operating 15 mines on 4 continents combined with Japan Gold’s in country knowledge and operational expertise make an ideal partnership to advance the gold mining industry in Japan.”

Japan Gold Acquires Six New Projects in the Southern Kyushu Epithermal Gold Province

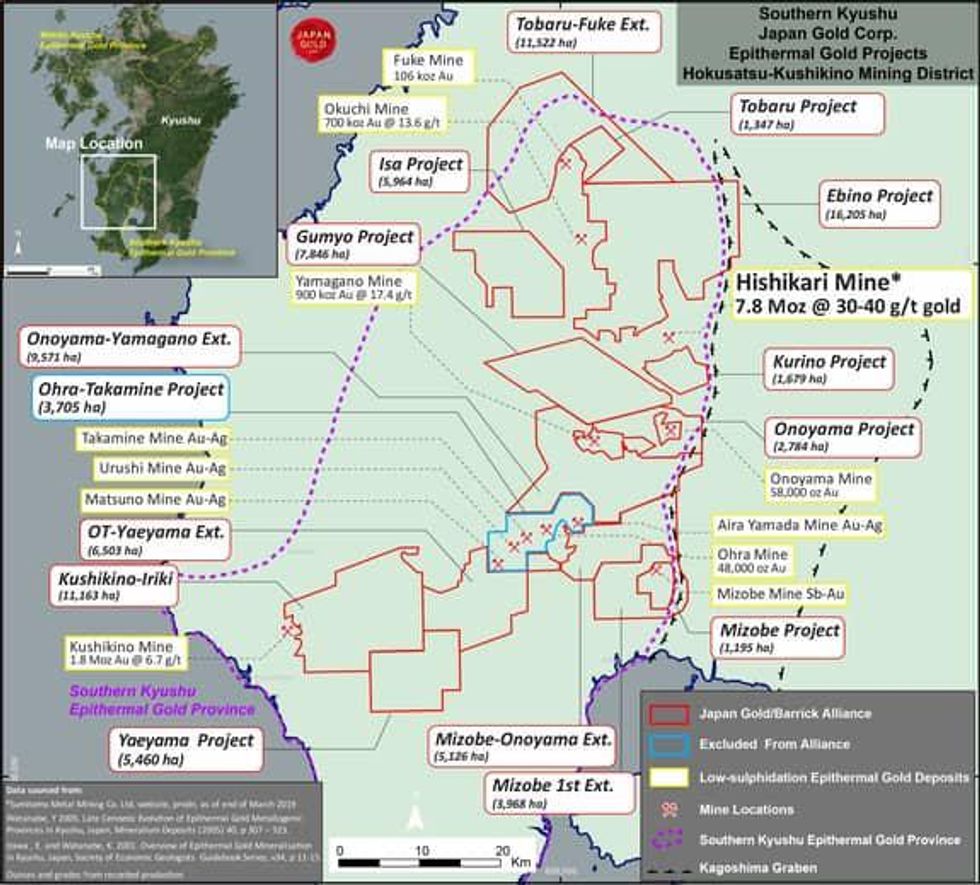

In conjunction with the Barrick Alliance, Japan Gold has acquired six new projects in the northern part of the Southern Kyushu Epithermal Gold Province and now holds a dominant position in a district which hosts most of the low-sulphidation epithermal mineralization in the province. In excess of 11 million ounces of gold have been produced from low-sulphidation epithermal deposits within the province with notable producers including: the Hishikari Mine with 7.8 million ounces produced to date at average grades of 30-40 g/t Au1, the Kushikino Mine which produced 1.8 million ounces at 6.7 g/t Au, the Yamagano Mine which produced 910,000 ounces at 17.4 g/t Au, and the Okuchi Mine which produced 714,000 ounces at 13.6 g/t Au2,3. Low-sulphidation epithermal gold deposits within the district are hosted along a volcanic front which lies west of the Kagoshima graben, (Figure 2). A review of geological and geophysical conditions favourable to hosting the known mineralization of the district has provided the basis for the recent round of applications. The new projects give the Company contiguous cover over the remaining portions of exposed prospective Pliocene and Pleistocene geological sequences between the Kushikino Mine in the southwest and beyond the Fuke Mine in the northeast, (Figure 3).

The six new projects include: Kushikino-Iriki; OT-Yaeyama Extension; Mizobe-Onoyama; Mizobe 1st Extension; Onoyama-Yamagano Extension; and the Tobaru-Fuke Extension and comprise 47,853 hectares. The Company now holds priority over 94,402 hectares comprising 15 projects in southern Kyushu and a total of 30 projects (176,370 hectares) across the 3 main Islands of Japan. With the acceptance of the new applications Japan Gold has priority over these areas and authorization to commence surface exploration.

Barrick Alliance Details

The Barrick Alliance will initially include all of the Company’s projects, excluding the Ikutahara Project in Hokkaido and the Ohra-Takamine Project in southern Kyushu (which are subject to existing agreements with a third party), for a total of 28 projects including 152,152 hectares over Hokkaido, Honshu and Kyushu.

Under the terms of the Barrick Alliance, Barrick will sole fund all expenditures incurred in respect of certain gold mineral properties and mining projects in Japan (“Included Projects”), with programs and budgets for Included Projects providing for minimum aggregate expenditures of: (a) US$3 million for each of the first two years of the Barrick Alliance; and (b) US$4 million for each of the third, fourth and fifth years of the Barrick Alliance, subject to certain limitations and exceptions.

As long as the Barrick Alliance remains in effect, if Japan Gold acquires an interest or an option to acquire an interest in any mineral property in Japan, Barrick will have 90 days to elect to include the new project in the Barrick Alliance. Barrick has also been granted rights of first offer in respect of certain projects. During the term of the Alliance, if Barrick wishes to apply for any new gold mineral rights in Japan, or acquire an interest in certain mining rights or projects in Japan, it will be required to offer such opportunity first to the Barrick Alliance.

Barrick can elect to designate an Included Project as a Designated Project and has the right to earn a 51% interest by sole funding and completing a PFS for the project. Following completion of a PFS in respect of a Designated Project, Japan Gold and Barrick will enter into a joint venture agreement in respect of the Designated Project, the terms of which shall supersede the terms and conditions of the Barrick Alliance agreement in respect of the Designated Project. Barrick may obtain an additional 24% ownership interest in a Designated Project (increasing Barrick’s ownership interest to 75%) by sole funding a Designated Project until completion of a BFS that satisfies certain criteria.

Under the terms of the Barrick Alliance agreement, if Barrick acquires common shares of Japan Gold and Barrick’s ownership interest in Japan Gold is at least 10%, Barrick will have the right, but not the obligation, to appoint a nominee to Japan Gold’s Board of Directors. Such right will terminate in the event that Barrick’s ownership interest in Japan Gold falls below 10%.

Investor Conference Call

Japan Gold Corp. will hold an audio conference call on February 24, 2020 at 11:30am eastern (8:30am pacific) to discuss the Barrick Gold Alliance. A presentation is available on Japan Gold’s website: www.japangold.com.

Participants may dial in using the numbers below (no access code is needed).

Canada/USA Toll Free: 1-800-319-4610

International Toll: +1-604-638-5340

Japan Toll Free: 0053-116-0941

UK Toll Free: 0808-101-2791

Callers should dial in 5 – 10 min prior to the scheduled start time and simply ask to join your call.

The conference call will be available for playback until March 24, 2020 by dialing 1-800-319-6413 (toll free Canada/US) or +1-604-638-9010 (international) and quoting access code 4189.

____________________

1 Sumitomo Metal Mining Co., LTD. website, production as of end of March 2019.

2 Watanabe Y, 2005. Late Cenozoic evolution of epithermal gold metallogenic provinces in Kyushu, Japan. Mineralium Deposita (2005) 40: pp 307-323

3 Garwin, S.G. et al. 2005. Tectonic setting, Geology, and gold and copper mineralization in the Cenozoic magmatic arcs of Southeast Asia and the West Pacific. Economic Geology 100th Anniversary Vol. pp 891-930

Qualified Person

The technical information in this news release has been reviewed and approved by Japan Gold’s Vice President of Exploration and Country Manager, Andrew Rowe, BAppSc, FAusIMM, FSEG, who is a Qualified Person as defined by National Instrument 43-101.

On behalf of the Board of Japan Gold Corp.

“John Proust”

Chairman & CEO

About Japan Gold Corp.

Japan Gold Corp. is a Canadian mineral exploration company focused solely on gold exploration across the three largest islands of Japan: Hokkaido, Honshu and Kyushu. The Company has a country-wide alliance with Barrick Gold Corporation to jointly explore, develop and mine certain gold mineral properties and mining projects. The Company holds a portfolio of 30 gold projects which cover areas with known gold occurrences, a history of mining and are prospective for high-grade epithermal gold mineralization. Japan Gold’s leadership team represent decades of resource industry and business experience, and the Company has recruited geologists, drillers and technical advisors with experience exploring and operating in Japan. More information is available at www.japangold.com or by email at info@japangold.com

For further information, please contact:

John Proust

Chairman & CEO

Phone: 778-725-1491

Email: info@japangold.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release contains forward-looking statements relating to expected or anticipated future events and anticipated results related to future partnerships and the Company’s 2020 gold exploration program. These statements are forward-looking in nature and, as a result, are subject to certain risks and uncertainties that include, but are not limited to, general economic, market and business conditions; competition for qualified staff; the regulatory process and actions; technical issues; new legislation; potential delays or changes in plans; working in a new political jurisdiction; results of exploration; the timing and granting of prospecting rights; the Company’s ability to execute and implement future plans, arrange or conclude a joint-venture or partnership; and the occurrence of unexpected events. Actual results achieved may differ from the information provided herein and, consequently, readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this News Release. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.