Gold Price Hits Two-month Low on US Rate Expectations

The gold price was under pressure this week as the US dollar climbed following hawkish comments from US Federal Reserve Chair Jerome Powell.

Gold sank to a two-week low on Thursday (March 1) as the US dollar rose following hawkish comments from US Federal Reserve Chair Jerome Powell.

Powell told the Senate Banking Committee that day that “there is no evidence the economy is overheating,” and he expects the Fed to continue its monetary policy tightening at a “gradual” pace.

The US dollar reached a six-week peak as Powell’s comments appeared to confirm expectations for further rate hikes. The next hike is expected to be announced following a policy meeting from March 20 to 21.

Higher interest rates could be bad news for gold, as they curb the investment appeal of holding non-yielding bullion.

“We still expect the Fed to continue to hike interest rates, as economic growth is doing quite well in the United States and fiscal stimulus should help to boost growth further,” said Capital Economics analyst Simona Gambarini.

“As inflationary pressures build, the Fed will hike by more to prevent inflation from getting out of control. That doesn’t bode well for gold prices. We expect real rates to increase, and that should see the gold price pull back a little,” Gambarini added.

Powell’s remarks came as US President Donald Trump announced plans to impose tariffs of 25 percent on imported steel and 10 percent on imported aluminum.

The Dow Jones Industrial Average (INDEXDJX:.DJI) lost more than 580 points following Trump’s announcement, but overall the US economy is building momentum. The economy grew 2.3 percent in 2017, and the number of Americans filing for unemployment benefits is at a 48-year low.

That said, the last few weeks have been volatile for gold, which declined 1.39 percent in February. On February 5, US markets recorded their worst trading day in over six years, putting upward pressure on prices and supporting safe-haven demand for gold, FocusEconomics analysts said in their latest report.

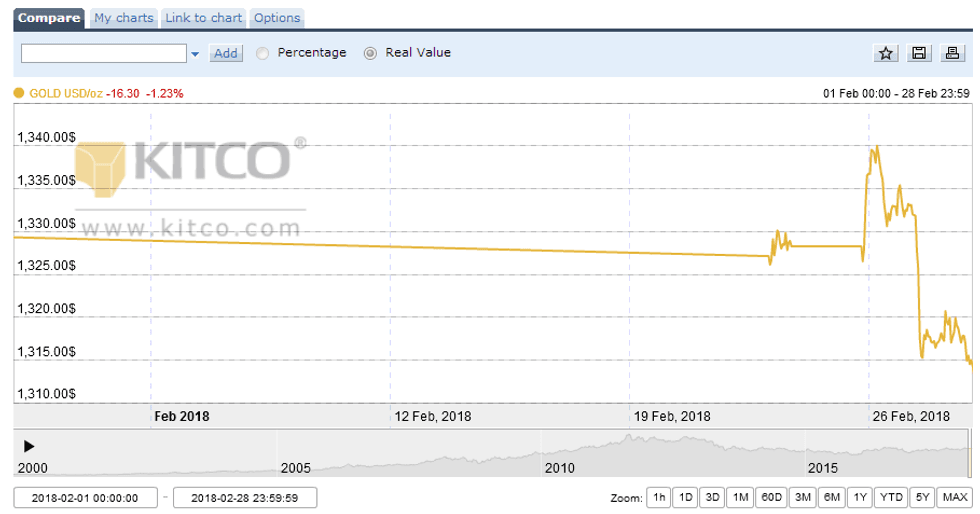

As the chart below shows, the precious metal closed at $1,313 per ounce on February 9 before rising sharply to $1,355.50 on February 14 and falling to 1,328.80 on February 20. The gold price rose ahead of the release of the Federal Open Market Comittee meeting minutes on February 21, and then ended the week down slightly at $1,328.20.

Chart via Kitco.

The last week of February has not been good for gold, as its price had fallen from $1,330.70 on Monday (February 26) to $1,309.76 as of 1:30 p.m. EST on Thursday (March 1).

Looking ahead, FocusEconomics analysts see strong jewelry demand from India supporting the gold price, with recent data revealing that mine production fell in the first nine months of 2017 on output cuts in China due to environmental concerns.

However, the analysts said an expected tightening in global interest rates will limit gold’s gains. In February, Bank of England Deputy Governor Ben Broadbent said interest rates could be raised sooner than previously expected and at a quicker pace.

In terms of prices, FocusEconomics analysts see gold decreasing in 2018 before strengthening in 2019 on a supportive geopolitical climate. The analysts noted that monetary policy tightening will weigh on the asset’s appeal, but added that they see gold averaging $1,284 in Q4 2018 and $1,334 in Q4 2019.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Shaw, hold no direct investment interest in any company mentioned in this article.