Mining Investor Digest: Key Issues in Financial Reporting and Analysis for Mining, Part 3

The cash adequacy ratios of seven of the world’s largest gold miners show that those companies do not make sufficient revenues from their operations to sustain their existing business models. Here’s a breakdown of those numbers and what they mean for investors.

Mining Investor Digest is generated for investors by investors who have spent countless hours researching and analyzing the mining and metals sector and want to share their findings. This article is the third in a series. Read the first and second here.

This series of articles aims to highlight relevant characteristics of accounting for mining in order to help readers with no formal training or background in accounting gain a better understanding of financial reporting in mining and identify key issues in mining operations.

Before we continue with the review of cash flows in mining, let’s take a little step back.

Mining equities are not the easiest to understand when it comes to market valuation. Miners for the most part are price takers operating in a highly cyclical and volatile commodity price and market liquidity environment that they have very little control over. It is no surprise that they keep changing their value proposition to investors — first was focus on optionality, followed by net present value, followed by production growth, followed by low cost measures (all non-GAAP measures).

These repositions are attractive, but they can also be elusive and damaging to both companies and investors. For instance, in a bull market with rising prices and high liquidity in the markets, the aggressive pursuit of growth can lead to unwise acquisitions and reckless borrowing, which typically will not be felt by the market until there is a sharp drop in the commodity price. A drop in price coupled with the highly prohibitive costs of shutting down a mine could pave a pretty quick way to insolvency.

Volatility in commodities prices is a given — studies show that for the last three centuries commodities have shown greater price volatility than manufacturers. In our opinion, this reality makes an even stronger case for maintaining healthy cash flows. Cash adequacy and adequate free cash flow to the company (in most years at least) should be key mantras followed by the market.

Investors should look at cash flow ratios so they can determine the viability of a company. That means whether the company can generate or has generated adequate cash flows over a significant period of time in order to operate or if it has to borrow in order to survive, rewarding investors with dividend payments.

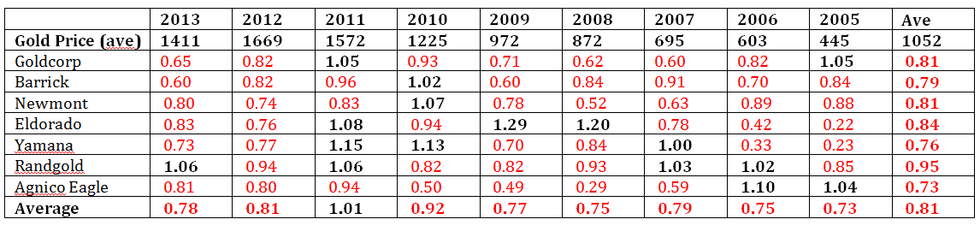

A key cash flow ratio measures inflows over outflows of cash and is referred to as a cash adequacy ratio. In the case of mining companies we use Revenues over Total Operating Costs + IMP + Debt Repayments + Dividends Paid. A ratio greater than 1.0 is healthy, while a ratio below 1.0 over an extended period means that companies must continuously raise money from sources other than operations in order to survive.

The cash adequacy ratios of of seven of the world’s largest gold-mining companies (Agnico Eagle Mines (TSX:AEM,NYSE:AEM), Barrick Gold (TSX:ABX,NYSE:ABX), Eldorado Gold (TSX:ELD,NYSE:EGO), Goldcorp (TSX:G,NYSE:GG), Newmont Mining (NYSE:NEM), Randgold Resources (LSE:RRS) and Yamana Gold (TSX:YRI,NYSE:AUY)) are tabulated here:

Adequacy Ratio — (Revenues / (Operating Costs + IMP + Debt Payments + Dividends Paid))

What we see is that:

- None of the companies has had an adequacy ratio of greater than 1.0 for more than two consecutive year in the past nine years

- Only in 2011 is the collective average greater than 1.0

- None of the companies has a nine-year average greater than 1.0

The table clearly shows that these companies do not make sufficient revenues from their operations to sustain their existing business models. In the next articles we will review some of the causes and effects of these consistently poor cash flow adequacy ratios.

Columnist Elena Tanzola is a partner at Cipher Research. Cipher Research is an independent research and analysis company that covers the mining and metals sector of the commodity markets. For more information on Cipher Research please visit: https://www.cipherresearch.com or contact info@cipherresearch.com.