Mining Investor Digest: Key Issues in Financial Reporting and Analysis for Mining, Part 1

This series of articles aims to highlight relevant characteristics of accounting for mining in order to help readers with no formal training or background in accounting gain a better understanding of financial reporting in mining and identify key issues in mining operations.

Mining Investor Digest is generated for investors by investors who have spent countless hours researching and analyzing the mining and metals sector and want to share their findings. This article is the first in a series.

Mining companies’ share prices have suffered in recent months as a result of massive write-downs and poor earnings reports. The prolonged decrease in the gold price has revealed what appears to be a systemic flaw in their model of operations.

This series of articles aims to highlight relevant characteristics of accounting for mining in order to help readers with no formal training or background in accounting gain a better understanding of financial reporting in mining and identify key issues in mining operations.

We will ultimately review the three financial statements and how they fit together, beginning with: statement of cash flows.

Statement of cash flows shows the amount of cash generated and used by a company in a given period. Statement of cash flows can tell us if a company generates enough cash from operations to sustain itself, to pay off existing debts as it matures and to take advantage of new investment opportunities.

Cash flows are classified in the following way depending on their purpose:

- Cash from operations — cash generated from day-to-day business operations

- Cash from investing activities — cash used for investing in assets, as well as proceeds from the sale of other businesses, equipment or other long-term assets

- Cash from financing activities — cash paid or received from issuing shares, dividends and/or borrowing funds

The main conditions that we want to find over the years in the statement of cash flows of a healthy mining company are:

- The primary source of cash is from operations

- Operating cash flow exceeds net income

- Operating cash flow exceeds capital expenditures, indicating that the company can finance its growth internally (from generated cash vs. borrowed cash)

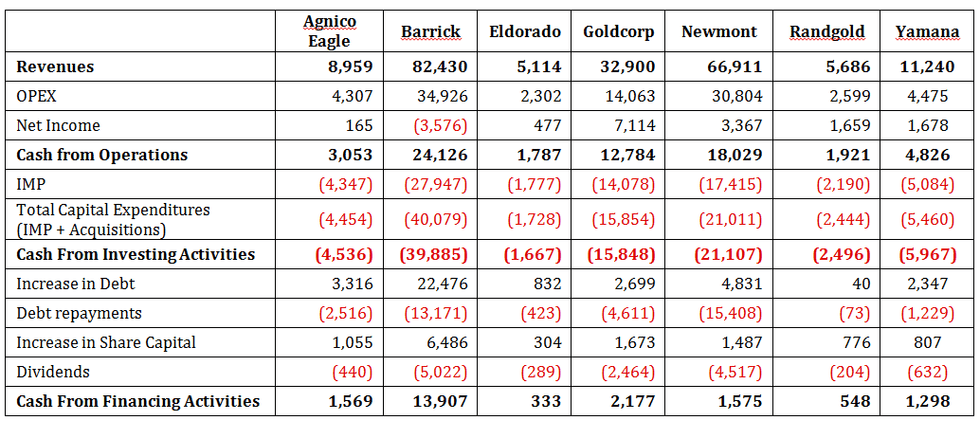

A review of the cash flow statements for seven of the world’s largest gold mining companies (Agnico Eagle Mines (TSX:AEM,NYSE:AEM), Barrick Gold (TSX:ABX,NYSE:ABX), Eldorado Gold (TSX:ELD,NYSE:EGO), Goldcorp (TSX:G,NYSE:GG), Newmont Mining (NYSE:NEM), Randgold Resources (LSE:RRS) and Yamana Gold (TSX:YRI,NYSE:AUY)) shows that they consistently meet the first two criteria, but fail to meet the third.

Capital expenditures have exceeded operating inflows for all the companies except Eldorado (and the difference is minimal) on a cumulative basis from 2005 to 2013. The individual years in which operating inflows exceed capital outflows are the exceptions and the difference is often marginal.

When capital expenditures exceed cash inflows for a period this long, it means that a company is not generating enough cash for its operations to sustain its current business model and must raise funds via debt or equity financings. This practice is dilutive to investors and burdens future cash flows.

Operating expense (OPEX) and investment in mining property (IMP) for the seven companies reviewed here have cumulative totals for the period ranging from 62 to 91 percent and a combined average of 76 percent of revenues. In the next article we will review these very significant uses of cash and their impact on the health of the companies.

Columnist Elena Tanzola is a partner at Cipher Research. Cipher Research is an independent research and analysis company that covers the mining and metals sector of the commodity markets. For more information on Cipher Research please visit: https://www.cipherresearch.com or contact info@cipherresearch.com.