Gold at Highest Price Since 2013 as US and Iran Clash

The gold price hit its highest level since April 2013 on Monday as fallout from the death of Iran’s Qassem Soleimani continued.

Spot gold rocketed higher on Monday (January 6) to reach its highest price since April 2013.

The yellow metal hit a high of US$1,578.80 per ounce in early morning trading, spurred by increasing tensions between the US and Iran, before sinking to US$1,565.20 as of 5:00 p.m. EST.

The rise for gold followed last week’s news that US President Donald Trump ordered an airstrike that killed Qassem Soleimani, leader of the Quds Force, a unit of Iran’s Revolutionary Guard. The Pentagon has described the airstrike, which took place near Baghdad’s international airport, as a defensive action that was necessary to protect Americans in the area.

Gold began the year at just above US$1,500, but the unexpected action by the US immediately sent the precious metal soaring — it was close to US$1,540 late on Thursday (January 2) after the airstrike happened, and by Friday (January 3) it was able to pass US$1,550.

The metal is now up significantly from below US$1,300, where it was this time last year. Its precipitous rise over the last 12 months has been spurred in large part by the ongoing trade war between the US and China, although other factors and trends have also contributed.

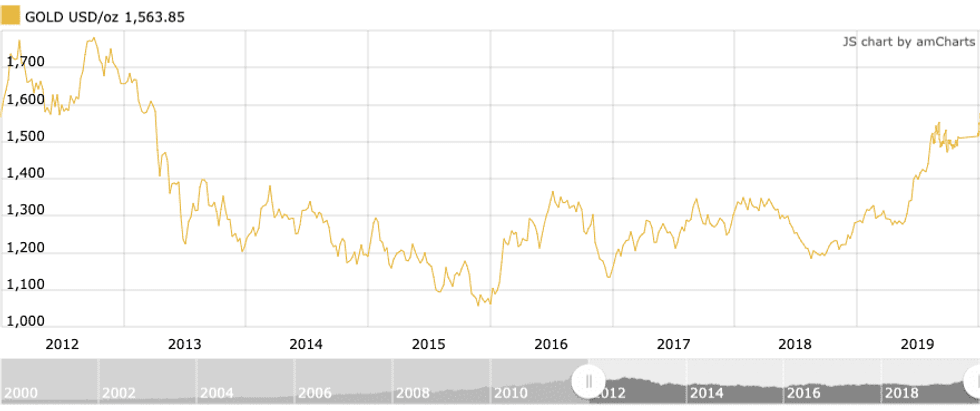

Gold’s performance from January 2012 to January 2020. Chart via Kitco.

Both the US and Iran have continued to make moves since the airstrike last week, and the situation has become increasingly complex as the countries interact.

Among other developments, Iranian President Hassan Rouhani has said the country will enact “tough revenge” for the killing, while the leader of the nation’s Revolutionary Guard has vowed that Iran will work strategically to oust the US from the region.

That process has already begun, with Iraq’s government voting over the weekend to start taking steps to remove American troops from the country.

Iran has also now pulled out of a 2015 nuclear deal that limited uranium enrichment in the country, saying it will not respect the deal unless the US takes away sanctions on the country. Trump removed the US from the nuclear deal in 2018, placing sanctions back on Iran at the same time.

For his part, Trump has said that the US has identified 52 Iranian targets, some of them culturally important, and will hit “very fast and very hard” if Iran retaliates.

As a whole, market watchers agree that continued issues between the US and Iran may move gold even higher than it is now, with Jeffrey Currie of Goldman Sachs (NYSE:GS) writing in a note that the firm is sticking to its three, six and 12 month forecast of US$1,600 gold. According to Currie, there is possible further upside if geopolitical tensions rise.

That said, many believe that investors should not rely on the US and Iran as long-term drivers.

“I remain bullish but caution not to buy it on geopolitical concerns because as stated they are usually temporary. Buy it instead because the dollar continues to weaken and real yields continue to fall,” Peter Boockvar of Bleakley Advisory Group cautioned in a note.

While gold has been the standout precious metal during the recent grappling, silver has also performed well, rising as high as US$18.39 per ounce on Monday. Unlike gold, it has not yet passed its 2019 high point, which was US$19.57 in the first week of September.

Platinum closed at US$962 per ounce on Monday, while palladium finished at US$2,008 per ounce.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.