Fidelity Minerals Acquires Two Highly Prospective Gold Projects in Northern Peru

Fidelity Minerals Corp. (TSXV:FMN,FSE:S5GM) (“Fidelity Minerals” or “the Company”) is pleased to announce the acquisition of a 100% interest in the Las Brujas and Cerro El Bronce projects.

- Fidelity Minerals has acquired a 100% interest in the:

- Las Brujas Project (1,900Ha) in the province of Cajamarca, and

- Cerro El Bronce Project (600Ha) in the province of Ancash, where historical sampling has identified peak copper grades of up to 6.8% Cu and gold grades of up to 20.3g/t Au.

- Both projects host significant mineralization and are located in prolific Au-Cu districts that are the subject of active exploration by major mining companies.

- Acquisitions represent further expansion of Fidelity Minerals project portfolio.

- Fidelity Minerals is in the process of further consolidating the footprint of key projects in the portfolio to further strengthen strategic position.

Fidelity Minerals Corp. (TSXV:FMN,FSE:S5GM) (“Fidelity Minerals” or “the Company”) is pleased to announce the acquisition of a 100% interest in the Las Brujas and Cerro El Bronce projects. These two highly prospective projects (“the Projects”) are located in the provinces of Cajamarca and Ancash, Northern Peru, respectively.

Historical exploration at both the Projects has identified substantial resource prospectivity with exposed gold mineralization at surface and in soils, highlighting the potential of the Projects. Given the Projects are located in prolific gold districts, with further exploration success, the Projects may host potentially economic gold mineralization.

Las Brujas Project

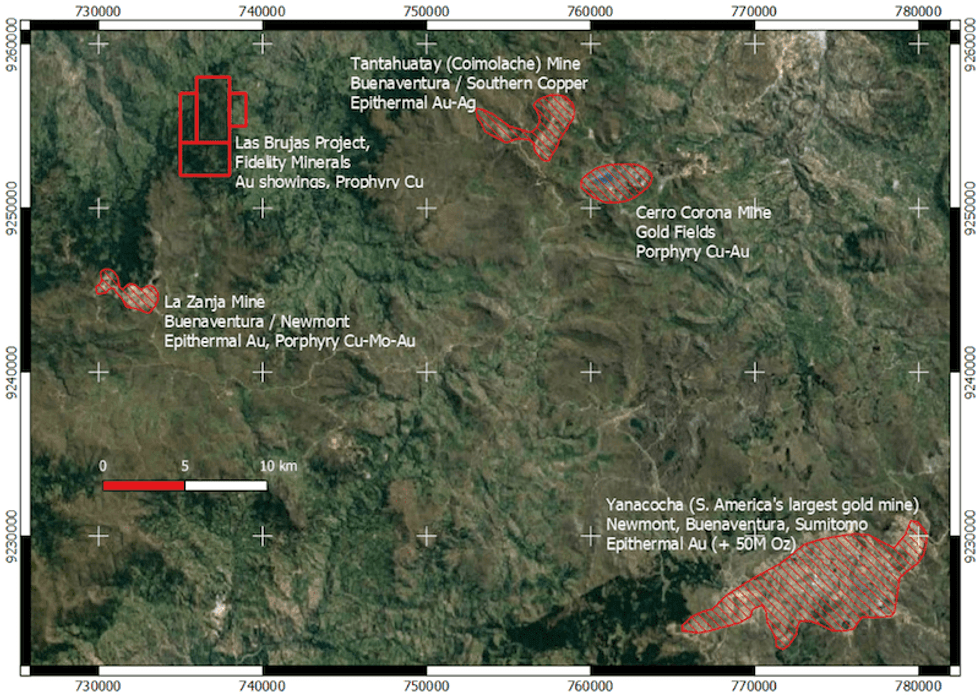

The Las Brujas project consists of 4 concessions totalling 1,900Ha located in the Cajamarca province of Peru. The project is accessible by road and is located within 10km of the La Zanja high sulphidation gold mine, and 20km and 23km from the Tantahuatay epithermal (Au/Ag) and Cerro Corona porphyry (Cu/Au) mines, respectively. The project features extensive argillic, advanced argillic, and quartz-sericite alteration over a 3 x 6 km area, where gold mineralization occurs in silicified volcanic rocks and hydrothermal breccias. Anomalous gold values have been reported from more than three extensive zones (including surface chip samples over 10 metres grading 1.5 g/t Au). Previous exploration at the project identified an apparent geochemical signature that appears typical of an epithermal precious metal system. The Project is hosted in the Calipuy Formation, which also hosts the world-class Yanacocha and Pierina gold deposits, and is situated within the “Yanacocha External Caldera”, which hosts several economic deposits within 50 kilometres of Yanacocha, in the Western Andes of Peru. Yanacocha is one of the largest heap leachable gold mines in the world, mining an occurrence of over 50M Oz.

Cerro El Bronce Project

The Cerro El Bronce project consists of 2 concessions totalling 600Ha located in the Ancash province of Peru. Historical exploration at the project has identified a number of important copper minerals including malachite, pyrite and chalcopyrite with peak copper values of up to 6.8% Cu. In addition to the copper mineralization, at least 8 mesothermal gold veins have been identified at the project. Historical sampling of the Bronce Vein returned peak values of 20.3 g/t Au and 41.0 g/t Ag, with the seven-sample average of 8.29 g/t Au and 7.78 g/t Ag. The general project area has previously undergone small-scale artisanal working, with historical reports delineating relatively shallow high-grade gold resources.

The Cerro El Bronce project is entirely surrounded by concessions controlled by major gold mining companies including Newmont, which are actively exploring adjacent concessions.

Acquisition Rationale

Due to the increased corporate activity targeting high-quality gold and copper projects in the North Andean mineral provinces, Fidelity Minerals recently outlined plans to leverage its in-country expertise and access to proprietary deal-flow, to strategically expand the existing project portfolio, with a particular focus on Norther Peru. The Company believes these projects provide material opportunities to rapidly advance these projects towards value-accretive milestones in the near term.

For more information, refer to the Map of the North Andean World-Class Mineral Provinces, available at:

https://www.fidelityminerals.com/north-andean-mine-map

Acquisition Consideration – Key Terms

Through the continued implementation of the previously announced Strategic Project Generator model, the Company has once again been able to identify highly prospective gold opportunities and to make two project acquisitions in regions dominated by major mining companies.

- The Company will now proceed to complete the acquisition of a 100% interest in each of the Las Brujas and Cerro El Bronce Projects through the transfer of title into its Peruvian subsidiary.

- As partial consideration for the project acquisitions, the Company has agreed to assume responsibility for maintenance and renewal of the Concessions, once transferred to the Company, and will be responsible for advancing the projects as deemed appropriate by Fidelity Minerals.

- In the event the Company sells the Concessions to an unrelated third party in the future, the vendors will receive 10% of the cash profits generated from the sale. The determination of cash profits essentially consists of the sale proceeds minus total expenditures made by the Company on the project up to the time of the sale, including transaction costs and taxes and duties related to the sale transaction.

- In the event the Company makes a decision to mine at the Las Brujas project, the Company will establish a 75:25 unincorporated JV with the vendors, where the majority interest in the JV is owned by Fidelity Minerals.

Management Commentary

Director & CEO of Fidelity Minerals, Mr. Ian Graham commented:

“The acquisition of two compelling gold projects located adjacent to major mining and exploration operations being aggressively advanced by major Companies such as Newmont presents Fidelity Minerals with an attractive opportunity to advance these projects in the near-term. Extensive shallow high-grade gold projects are becoming increasingly difficult to find, and in a resurgent gold price environment, will provide Fidelity Minerals with abundant optionality. Whilst it is still early days, we are also very excited by copper prospectivity of these projects, with indications of porphyritic copper mineralization at the Las Brujas project and high-grade surface sample at the Cerro El Bronce. As we continue to review these projects, we will provide further details, commencing with an updated corporate presentation, shortly.”

About Fidelity Minerals Corp.

Fidelity Minerals Corp. is assembling a portfolio of high-quality mining assets in Peru through the implementation of our Strategic Project Generator (SPG) model. The project generator model involves the identification and acquisition of appraisal stage opportunities with near-term valuation catalysts, including potential for high-impact M&A. The company is backed by an experienced management team with diverse technical, market, and commercial expertise and is supported by committed and sophisticated investors focused on building long term value.

On behalf of the Board of Fidelity Minerals;

Ian Graham

CEO and Director

Tel: +1.604.671.1353

Email: igraham@fidelityminerals.com

Investor Contact:

Bahay Ozcakmak

Executive Chairman

Tel: +61.3.9236.2800

Email: bahay@fidelityminerals.com

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Disclaimer & Forward-Looking Statements: This news release contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this news release. This news release may also contain inferences to future oriented financial information (“FOFI”) within the meaning of applicable securities laws. The information in this news release has been prepared by our management to provide a context for the project acquisition and to provide the reader with an outlook for our future activities and anticipated key projects and may not be appropriate for other purposes. Forward-looking statements in this announcement include, (but are not limited to) the possibility that a resurgent gold price environment will provide Fidelity Minerals with abundant optionality, that there exists copper and gold prospectivity at the Las Brujas and Cerro El Bronce, and the expectation that through the Strategic Project Generator model Fidelity Minerals is positioning itself to identify and acquire appraisal stage projects, and that there exists potential for high-impact M&A.

Source: www.juniorminingnetwork.com