Drill Tracker Weekly: Troy Resources Returns High-grade Gold at West Omai Project

Definition drilling in the central area of the Smarts deposit, located at Troy’s recently acquired West Omai project, intersected high-grade gold over significant widths. The company acquired the project through the acquisition of Azimuth Resources in July 2013 for AU$188 million.

Drill Tracker Weekly is not exclusive to Resource Investing News and is published with permission from Mackie Research Capital Corporation. It highlights drilling results in context with our database of over 10,000 drilling and trenching results. The purpose of this report is to highlight drilling and trenching results that stand out from the pack and compare them to their peer group. This report does not constitute initiation of coverage or a recommendation.

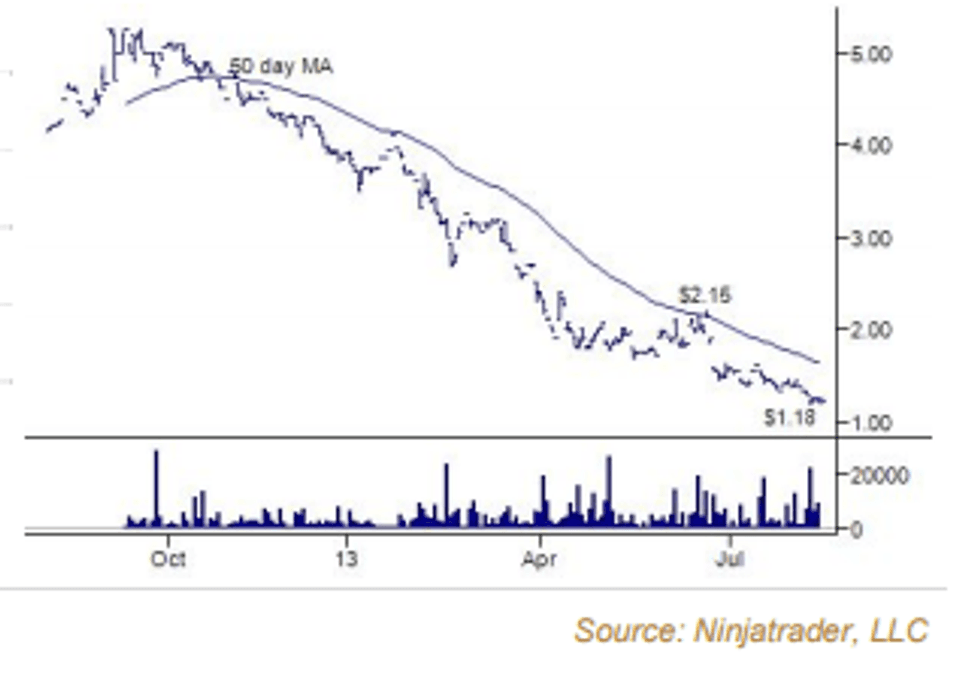

Troy Resources (TSX:TRY)

Price: $1.24

Market cap: $204 million

Cash estimate: $24 million

Project: West Omai

Country: Guyana

Ownership: 100 percent

Resource: 16.7 Mt @ 3.06 g/t Au inferred

Project status: Resource definition

Catalysts: Updated resource — September 2013

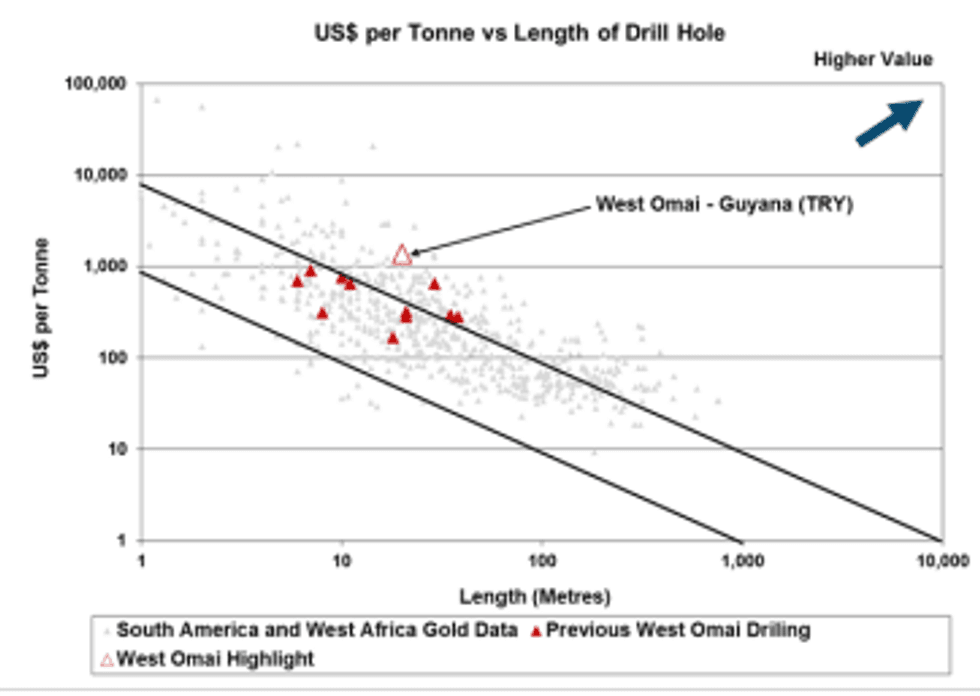

- Definition drilling in the central area of the Smarts deposit, on the Company’s recently acquired West Omai project, intersected high-grade gold over significant widths. The Company acquired the project through the acquisition of Azimuth Resources in July 2013 for A$188 million.

- Highlights from the in-fill drilling on the Smarts Zone include 20 metres grading 30.09 g/t Au, starting at a depth of 66 metres and six metres of 34.24 g/t Au, from 34 metres. The drilling in the Smarts zone is intended to upgrade the drill density, to increase the confidence level of the resource in the central part of the deposit. The current drilling is focused on the Hicks deposit located three kilometres to the southeast.

- The Company has outlined a 43-101 compliant inferred resource for the Smarts and Hicks deposits on the West Omai project, of 16.7 million tonnes grading 3.06 g/t Au using a 1.0 g/t Au cut-off grade. Using a 2.0 g/t Au cut-off returns a 9.0 million tonne resource grading 4.46 g/t Au. The deposit includes both an open pit and an underground component.

- The Company expects to have an updated indicated resource completed by September 2013, with a prefeasibility study by the March quarter, 2014.

DISCLOSURES

This report was prepared by Wayne Hewgill, Analyst. At the date of release of this report Wayne Hewgill owned no shares of the issuers contained in this report.

Tempest Capital Corp. does not have formal coverage on the highlighted issuers in this report and the information within this report is for information purposes only.

Any and all reports or studies by a third-party expert consulted in preparing this report have been cited in this report.

To the extent reasonably practicable, research will be disseminated contemporaneously to all of Tempest Capital Corp. clients and potential clients who have requested and are entitled to receive Tempest Capital Corp.’s research.

The information contained in this report has been drawn from sources believed to be reliable but its accuracy or completeness is not guaranteed, nor in providing it does Tempest Capital Corp. assume any responsibility or liability. Tempest Capital Corp., its directors, officers and other employees may, from time to time, have positions in the securities mentioned herein. Contents of this report cannot be reproduced in whole or in part without the express permission of Tempest Capital Corp.

This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities.