Credit Suisse Pulls Out of Roxgold, Leaves Company Looking for Backers

Credit Suisse has decided not to extend its $37.5-million commitment to Roxgold, leaving the Canadian company searching for a new backer. The company’s Burkina Faso-based Yaramoko project has been in the spotlight since the ousting of Blaise Compaore, the country’s former president, in a military coup.

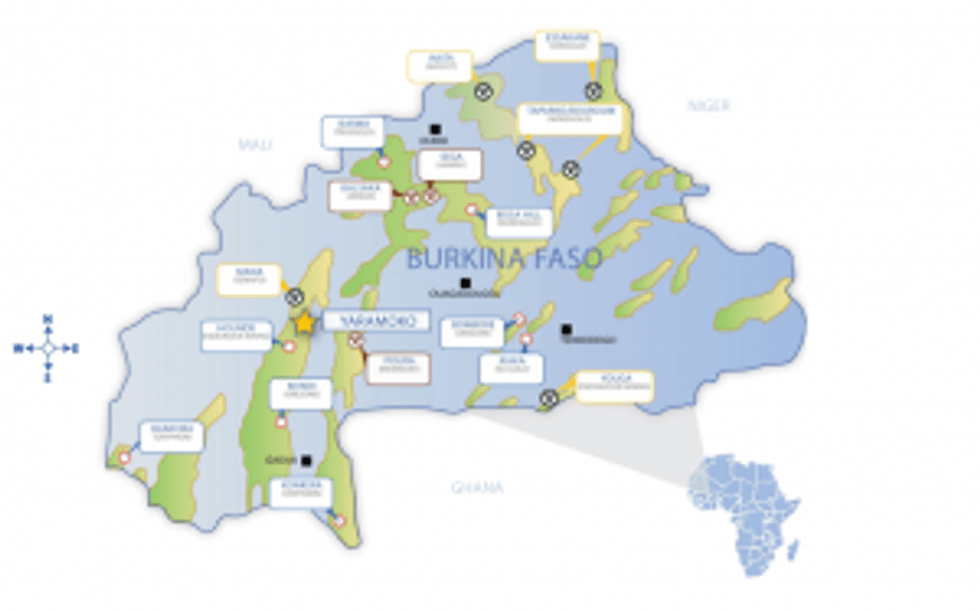

A map detailing Roxgold’s work in Burkina Faso

Credit Suisse (NYSE:CS) has decided to no longer back Roxgold (TSXV:ROG) and its Yaramoko project as fears over political tension within Burkina Faso linger.

Roxgold signed an agreement with Societe Generale (EPA:GLE) and Credit Suisse in September, with each group pledging $37.5 million to fund the project. However, the agreement expired on December 25, and Credit Suisse elected not to continue with the deal.

“I think it’s more of a political risk issue that Credit Suisse saw. Nothing has really changed in the technical aspects of project,” said Joe Mazumdar, a market analyst with Canaccord Genuity who follows the company.

The Yaramoko project has been in the spotlight since the ousting of Blaise Compaore, Burkina Faso’s former president, in a military coup. Compaore had tried to lengthen his presidency to a fifth term, extending his 27-year hold on the country, but in October but was forced to resign as the military stepped in. Michel Kafando was appointed as interim president on November 1, and was given the task of naming a prime minister and helping create a 25-person interim government in time for next year’s elections.

Roxgold’s share price saw a brief dramatic drop after the ouster, but is still up 14.6 percent for the year.

Mazumdar noted that the company’s share price has declined since November and said its liquidity has also fallen since the start of turmoil in Burkina Faso.

A spokesperson for Roxgold wasn’t available at time of publishing, but in a statement, John Dorward, CEO and president, emphasized optimism. ”Despite recent challenges in Burkina Faso, Roxgold is in excellent shape for the commencement of development at Yaramoko,” he said.

The release goes on to highlight that Roxgold has $42 million in cash and the ability to issue up to $15 million in equity. The company is still waiting on a mining receipt from the Burkina Faso government to move ahead.

In a note to clients, Haywood Securities analyst Tara Hassan also expressed optimism, listing the company as a “buy” and noting, “[a]lthough the recent political unrest in Burkina Faso may limit some investors from coming to the table, the project quality, limited investment requirements, and recent positive rhetoric from the Burkina Faso Ministry of Mines is likely to still attract a number of interested parties.”

However, she also states in the note that Roxgold is proposing underground mining at Yaramoko — which isn’t common in the region — and points out that the 2015 election and financial news could be risky for investors.

With Credit Suisse having opted out, Roxgold maintains that it is working with Societe Generale and holding discussions with project finance banks with the aim of closing the updated debt facility in the first quarter of 2015.

Securities Disclosure: I, Nick Wells, hold no direct investment in any of the companies mentioned in this article.