Haywood Sees Met Coal Prices Averaging $125 in 2015

Haywood Securities lowered its price forecasts for many commodities in a report released Tuesday, and the story was no different for metallurgical coal.

Citing continued volatility for the base metals sector and slowing demand growth, the firm decreased its 2015 outlook for copper from $3.25 to $2.50 per pound, while lowering its forecast for nickel from $8.25 to $7 and its expectations for zinc from $1.20 to $1.10. Meanwhile, its forecasts for gold and silver stayed constant at $1,250 and $18 per ounce, respectively.

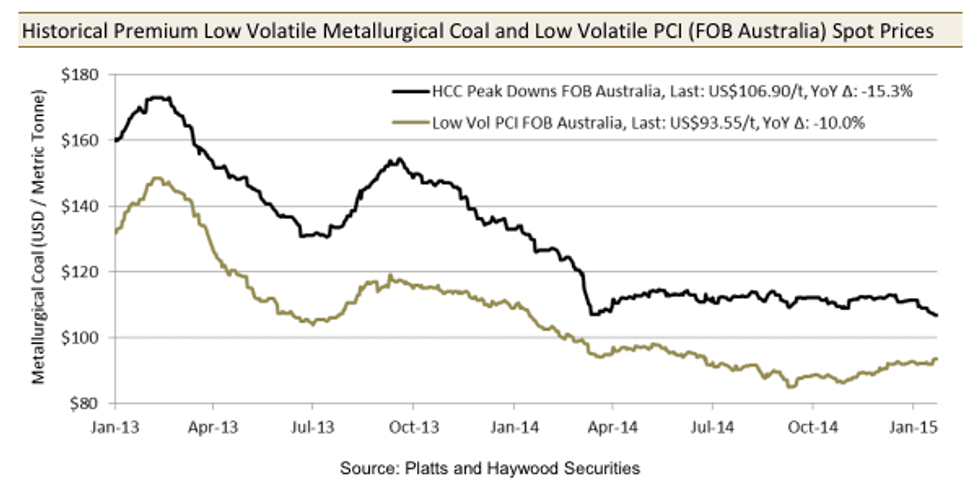

The firm sees met coal prices averaging US$125 per metric ton (MT) this year, down from an earlier call of $130. While Haywood has left its price assumption for 2020 and beyond flat at $175 per MT, it brought its forecast down to $140 from $150 for 2016 and down to $150 from $175 for 2017.

Normally, met coal gets painted with the same brush as thermal coal, and that is sometimes said to be the cause of weaker prices and poor share performance from miners. However, Haywood points out in its report that a stronger US dollar, “tepid demand” and oversupply are to blame in this case. China is the main driver on the demand side, and a more tempered rate of expansion in the country is affecting demand for met coal, a key steelmaking ingredient.

Haywood also suggests that “lacklustre demand” is being mimicked in Europe, which can’t be helping matters. “The broader structural issues with oversupply remain, and thus we do not see pricing strength for metallurgical coal for some time,” the report states, and the firm notes that while some benchmark pricing figures are holding up, others have dipped a bit this quarter. For example, the Q1 benchmark for low-volatility premium hard coking coal has dipped to $117 per MT.

That said, the outlook from Haywood isn’t all negative. In fact, looking at the medium to long term, Haywood is still positive on metallurgical coal.

“On a mid- to long-term basis, we remain more bullish on the outlook for metallurgical coal owing to expectations of growth from selected BRIC (e.g., China) countries and other growth-market nations,” the firm’s report notes.

Of course, it’s worth remembering that there is no substitute for coking coal in the steelmaking process, so similar to copper, there are a number of market watchers who favor the commodity long term. Case in point: BMO Capital Markets is forecasting an average of US$120 per MT for BMA hard coking coal in 2015, but its yearly forecasts gradually increase to $165 through to 2019.

That said, Haywood also notes that a few things need to change in order for met coal prices to see some strength come back. “The prevailing pricing dynamic requires additional operational curtailments to remediate relative oversupply,” the report states. And to be sure, Haywood isn’t the only firm that’s said supply needs to come out of the market to help met coal prices — Joe Aldina of Wood Mackenzie has made similar comments.

For investors “wanting to get exposure to the sector,” Haywood points in its report to “lower cost producers of high-quality metallurgical coal.” Specifically, it has picked out Canada’s Teck Resources (TSX:TCK.B,NYSE:TCK) as an example, although it’s changed its rating from “buy” to “hold” for the company and has reduced its target price from $22.50 to $16.25.

Securities Disclosure: I, Teresa Matich, hold no direct investment interest in any company mentioned in this article.

Related reading:

Coal Outlook 2015: Material Recovery in Pricing Still a Few Years Out